2026-2-14 12:00 |

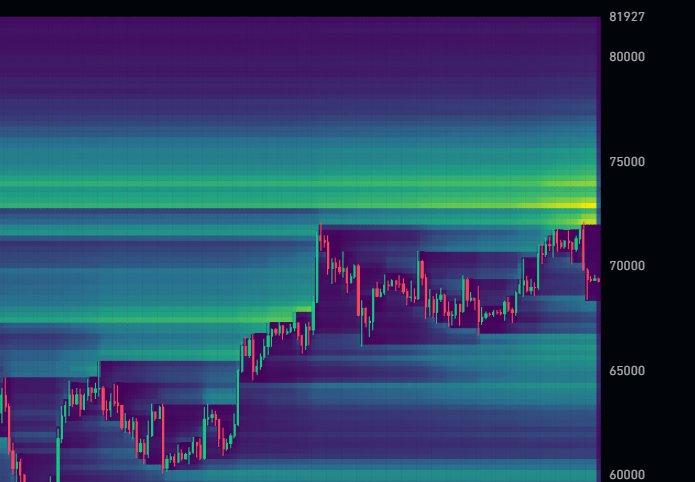

After a dour performance throughout the week, the price of Bitcoin experienced a fair amount of bullish impetus on Friday, February 13th. Going into the weekend, the premier cryptocurrency seemed on its way to reclaim the psychologically relevant $70,000 level. Interestingly, recent on-chain data shows that this latest bullish spurt might be the start of, at least, a short-term rally for the Bitcoin price.

Is Bitcoin On The Verge Of A Short Squeeze?In a Quicktake post on the CryptoQuant platform, market analyst CryptoOnchain revealed that the Bitcoin Funding Rate on Binance, the world’s largest cryptocurrency exchange by trading volume, has dropped to a critically low level — one not seen in over a year. The relevant indicator here is the 14-day Simple Moving Average (SMA-14) of BTC Funding Rate.

Typically, the Funding Rate metric estimates the periodic fee paid by traders in a derivatives market for a particular cryptocurrency (Bitcoin, in this case). When the funding rate is in the positive territory, it usually implies that the long traders (investors with buy positions) are paying a fee to short traders (investors with sell positions) in the derivatives market.

On the flip side, a negative funding rate metric, as is the case currently, suggests that the payment is going from the short traders to the long traders. Data from CryptoQuant shows that the 14-day SMA of the Bitcoin Funding Rate on Binance has fallen to -0.002, its lowest level since September 2024.

As CryptoOnchain rightly noted, a deeply negative funding rate, especially one that lasts over a 14-day average, indicates that bears (short traders) are increasingly betting against the premier cryptocurrency. The market analyst noted that these extremely negative values often correlate with the bottom of severe downward trends.

CryptoOnchain wrote in the post:

From an on-chain and market psychology perspective, deeply negative funding rates often serve as a strong Contrarian Signal. The market currently appears to be heavily “overcrowded” on the short side.

From a historical perspective, this on-chain trend has often set the stage for a potent short squeeze, where a minor price rebound could trigger a cascade of liquidations of the mounting short positions. This cascade of short liquidations often serves as jet fuel, further propelling the Bitcoin price to the upside.

Bitcoin Price At A GlanceAs of this writing, the price of Bitcoin stands at around $69,000, reflecting an over 5% jump in the past 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

Level Up Coin (LUC) на Currencies.ru

|

|