2023-5-4 17:30 |

Historical data of an on-chain indicator may suggest that the $24,400 level could be a major level of support for Bitcoin right now.

Bitcoin STH MVRV Would Hit 1.0 If Price Declines To $24,400According to this week’s edition of the Glassnode report, the 1.0 level of the Bitcoin STH MVRV has been a point of support for the market during uptrends in the past. The “STH” here refers to the “short-term holder group,” which is a Bitcoin cohort that includes all investors who have been holding onto their coins since less than 155 days ago.

The “market value to realized value” (MVRV) is an indicator that measures the ratio between the Bitcoin market cap and its realized cap. The “realized cap” here is a BTC capitalization model that aims to find the “real” value of the asset by assuming that the value of each coin in circulation is not the current price, but the price at which it was last moved on the blockchain.

Since the realized cap accounts for the price at which the investors bought (which is the price at which their coins last moved), its comparison with the market cap (that is, the current price) can tell us about the degree of profitability or loss among the overall market.

When the MVRV is greater than 1, it means the average investor is holding an unrealized profit with their BTC right now. On the other hand, values below this threshold imply the market as a whole is holding some amount of unrealized loss currently.

Now, the “STH MVRV,” the actual indicator of interest in the current discussion, naturally measures the value of the ratio specifically for the coins owned by the Bitcoin short-term holders.

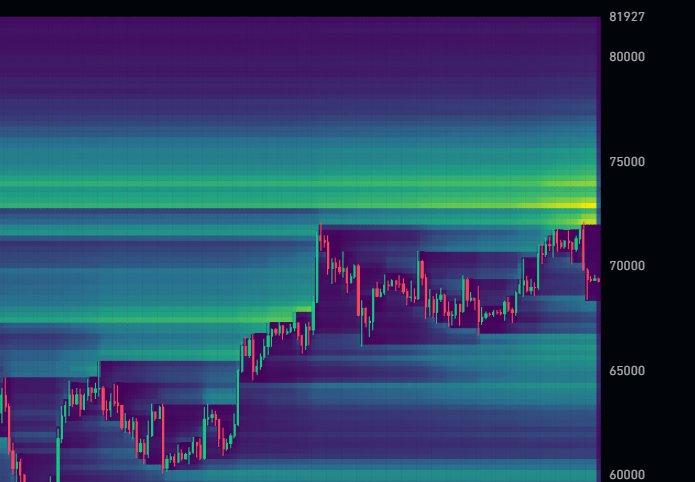

The below chart shows the trend in the 7-day average value of this metric over the last few years:

In the graph, Glassnode has marked the lines of the 7-day average Bitcoin STH MVRV that have been relevant to the price of the cryptocurrency during the last few years.

It looks like short-term corrections for the asset have generally become more probable when this indicator has crossed a value of 1.2. At this level, the STHs hold unrealized profits of 20%.

The recent drawdown in the cryptocurrency’s price from the $30,000 mark also took place when the metric was above this level. To be more specific, the indicator had a value of 1.33 when the asset was rejected, implying that the STHs had 33% profits.

The reason that high MVRV values of this cohort have usually made a decline more probable for the price is that the higher the amount of profits that the STHs hold, the more likely they become to sell and harvest their gains.

From the chart, it’s visible that the on-chain analytics firm has also marked the relevance of the 1.0 level (that is, the threshold line between profit and loss) to the cryptocurrency. Interestingly, this level has generally provided support to the price during periods of uptrend.

The likely explanation behind this trend is that the 1.0 level serves as the cost basis of the majority of the STHs in the market, so when the price hits this mark, these investors look at this point as a profitable zone to accumulate more of the asset. Obviously, this behavior is only seen during rallies, as holders would only find it worthful to buy more if they think the price has the potential to grow.

As the market is right now, the price would need to decline to $24,400 in order to hit this 1.0 level. This implies that if Bitcoin observes a deep decline in the near future, $24,400 could be the level that can provide support to it, considering the pattern that has held during the last few years.

BTC PriceAt the time of writing, Bitcoin is trading around $28,500, down 1% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Level Up Coin (LUC) на Currencies.ru

|

|