2025-12-27 02:00 |

Bitcoin is struggling to regain momentum below the $90,000 level, yet it continues to hold above $86,000, reflecting a market gripped by indecision. Price action has narrowed into a tight range, with neither buyers nor sellers able to assert clear control.

As volatility compresses, apathy has become a defining feature of the current environment, and an increasing number of analysts are openly discussing the possibility that the market is transitioning toward a broader bear phase.

While price levels dominate headlines, on-chain data suggests the more important battle is unfolding beneath the surface. According to CryptoQuant analyst Burak Kesmeci, Bitcoin’s current positioning cannot be understood by price alone.

Instead, attention is shifting toward the cost bases of key market participants, particularly whales and Binance spot users. Even with Bitcoin trading around $87,000, the most consequential level sits significantly higher.

Data shows that the average cost basis of new whales, defined as holders with coins younger than 155 days, is clustered around $100,500. This zone represents a critical break-even threshold for large players who entered the market recently.

As a result, every approach toward $100,000 carries heightened significance. That level may either trigger distribution, as whales seek to protect capital, or mark the start of renewed accumulation if confidence returns.

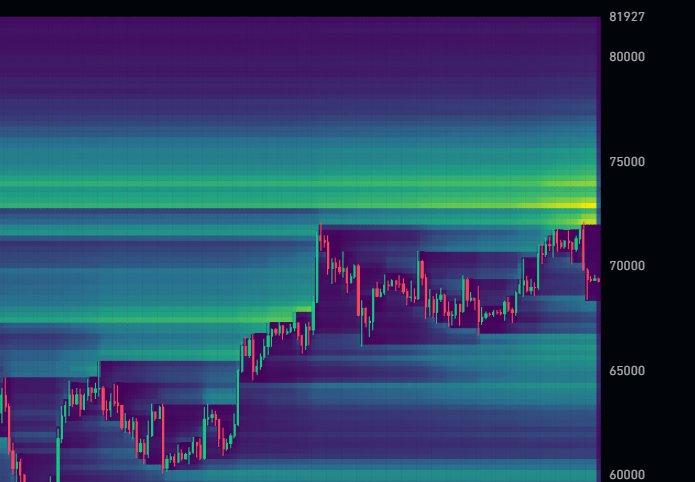

Cost Basis Data Maps Bitcoin Real Support and ResistanceThe report highlights that beneath Bitcoin’s current price action, cost basis data offers a clearer framework for understanding market risk. For Binance spot users, the average cost basis sits near $56,000. This level represents the largest concentration of spot volume in the market and effectively defines the “deep water” zone if conditions deteriorate.

In a prolonged bearish phase, $56K is where the bulk of spot holders would be tested, making it a critical long-term support area rather than a short-term trading level.

Long-term whale positioning adds another important layer. The cost basis for whales holding Bitcoin longer than 155 days is clustered around $40,000. This means these participants are still sitting on profits of more than 2x, even after the recent correction.

That profit cushion helps explain the rise in realized gains seen over recent weeks. For many long-term holders, current prices already represent a satisfactory exit, increasing the incentive to distribute into strength rather than aggressively accumulate.

Taken together, the data reframes Bitcoin’s market structure. The key short-term ceiling remains near $100,000, where newer whales approach breakeven and supply tends to emerge. On the downside, $56,000 stands out as the level where spot market conviction would be most severely tested.

Bitcoin Consolidates Above Key Weekly Support as Momentum CoolsBitcoin is trading near the $88,700 level on the weekly chart, stabilizing after a sharp pullback from the $120,000–$125,000 highs reached earlier this cycle. While the broader uptrend from 2024 remains intact, recent price action signals a clear slowdown in momentum. The market has shifted from an impulsive expansion phase into a corrective and consolidative structure, with volatility compressing around a critical support zone.

Technically, Bitcoin is holding just above its rising medium-term moving average, which has acted as dynamic support throughout this bull cycle. The rejection above $110,000 marked a decisive loss of upside control, and the failure to quickly reclaim that zone suggests distribution rather than a brief pause. At the same time, price remains well above the long-term moving average, reinforcing that this move is still corrective within a larger trend, not yet a confirmed trend reversal.

Volume dynamics support this interpretation. Selling pressure expanded during the initial breakdown, but recent weeks show declining volume as price stabilizes between roughly $86,000 and $90,000. This points to seller exhaustion, though buyers have yet to step in with conviction.

Structurally, the $86,000–$88,000 range is pivotal. Holding this zone keeps the higher-timeframe bullish structure alive. A clean breakdown would expose deeper downside. While a recovery above $95,000 would be needed to reassert bullish momentum and reopen the path toward prior highs.

Featured image from ChatGPT, chart from TradingView.com

origin »Bitcoin price in Telegram @btc_price_every_hour

Level Up Coin (LUC) на Currencies.ru

|

|