2021-2-23 08:16 |

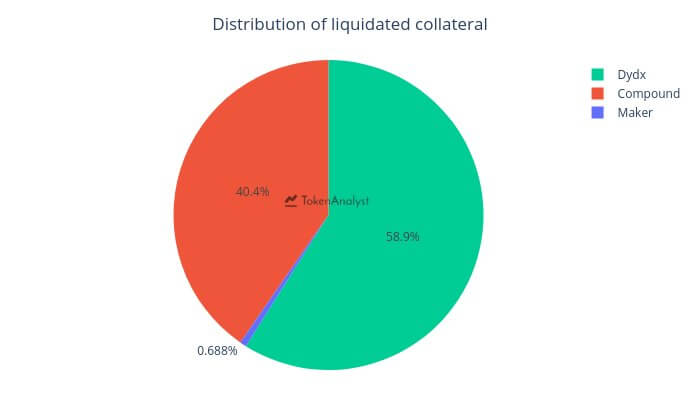

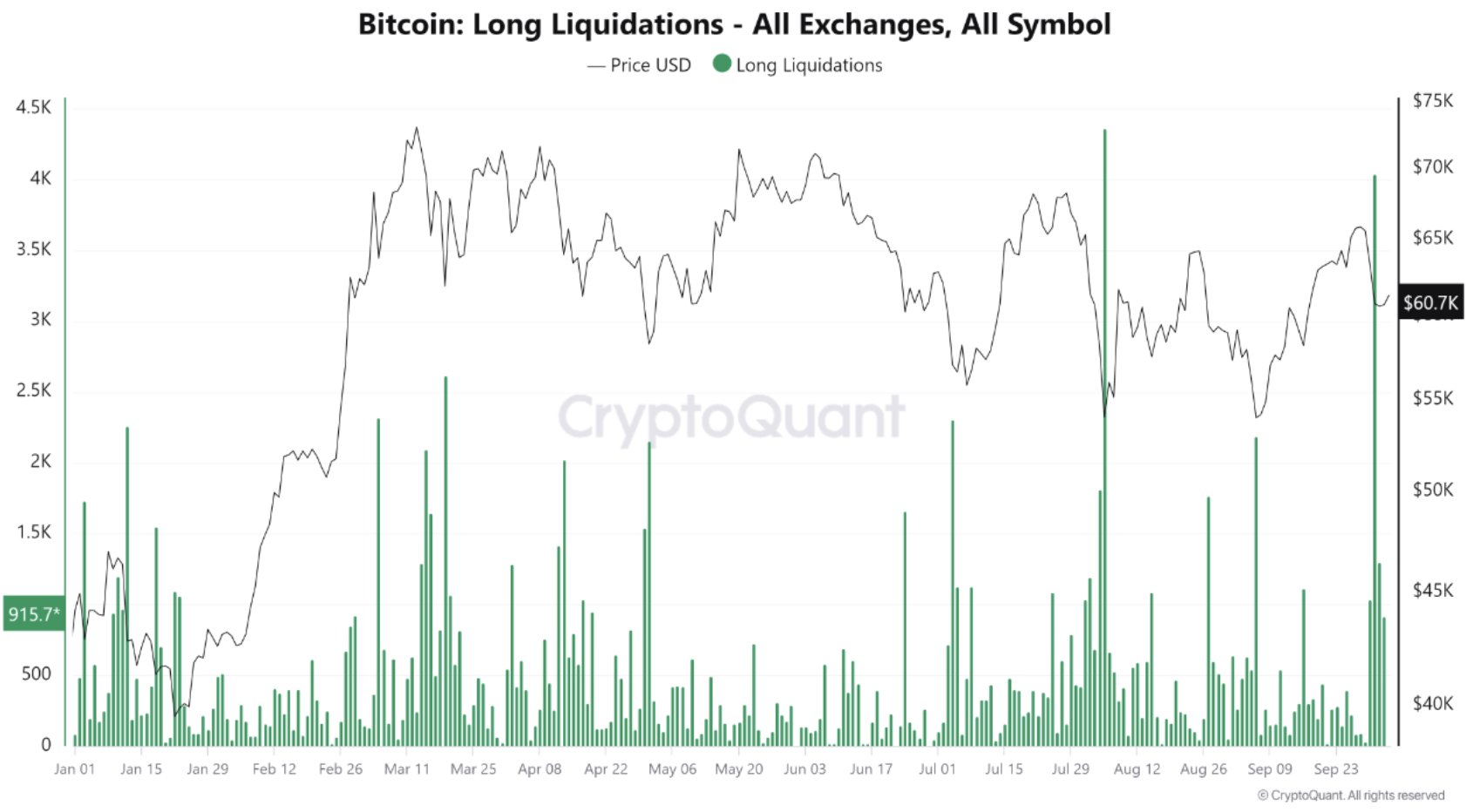

The Feb. 22 crypto market flash-crash liquidated more than $24 million worth of DeFi loans. with Compound users representing more than half of the margin calls. origin »

Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|