2025-6-27 11:00 |

Bitcoin has been trading near its all-time high (ATH), holding above $100,000 for the past two months. However, spot trading volume has not followed suit. Unlike previous bull runs, this price level has not triggered a surge in trading activity.

This divergence has raised concerns among investors. Recent analyses from CryptoQuant, Glassnode, and other market data sources provide key insights into this unusual trend.

Bitcoin Price Decouples from Spot Volume — What Does It Mean?According to Dan from CryptoQuant, the market is currently in a “cooling” phase without signs of overheating.

Bitcoin Spot Volume Bubble Map. Source: CryptoQuant.The chart illustrates that the size of each circle represents trading volume, while color indicates the growth rate of that volume. A drop in volume signals a cooling market. A neutral market shows no sharp changes, and rapid increases in volume may indicate overheating.

At present, green circles — which represent cooling — dominate the chart, even as Bitcoin nears its ATH. This suggests the absence of speculative frenzy. Dan emphasized that this phase calls for patience.

“Currently, Bitcoin is near its all-time high, but the market shows a cooling trend without signs of overheating. To break past its all-time high, macroeconomic catalysts like interest rate cuts or regulatory easing may be needed. However, the market has already established a stable foundation. Thus, a strategy of patience, keeping an eye on major market events, and waiting for opportunities seems promising,” Dan noted.

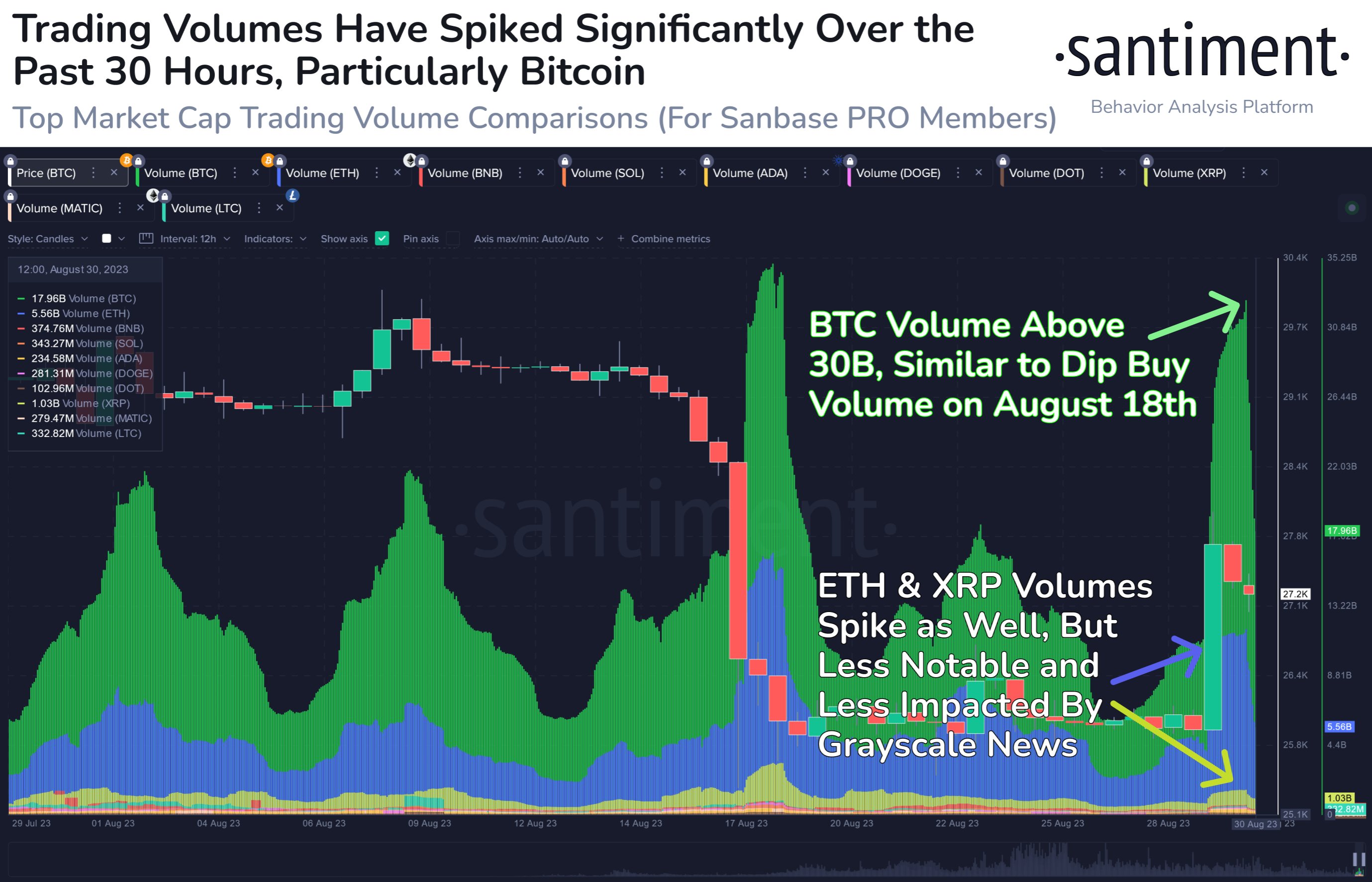

Additionally, Glassnode’s Week 25 report echoes CryptoQuant’s assessment. It pointed out that, unlike the ATH rallies in Q2 and Q4 of 2024, the recent climb to over $100,000 has not been accompanied by a corresponding rise in spot volume.

This reflects a lack of speculative intensity — a key characteristic often seen in earlier bull runs.

Bitcoin Spot Volume on All Exchanges. Source: Glassnode.Instead, Glassnode suggests that accumulation strategies likely drive the current price rise. Long-term investors appear to be holding their Bitcoin rather than selling for profit.

“Current spot volume sits at $7.7 billion, significantly lower than the cyclical peaks observed earlier in this bull market. This divergence further underscores the lack of speculative intensity, highlighting the market’s hesitancy and reinforcing the consolidation narrative,” the report stated.

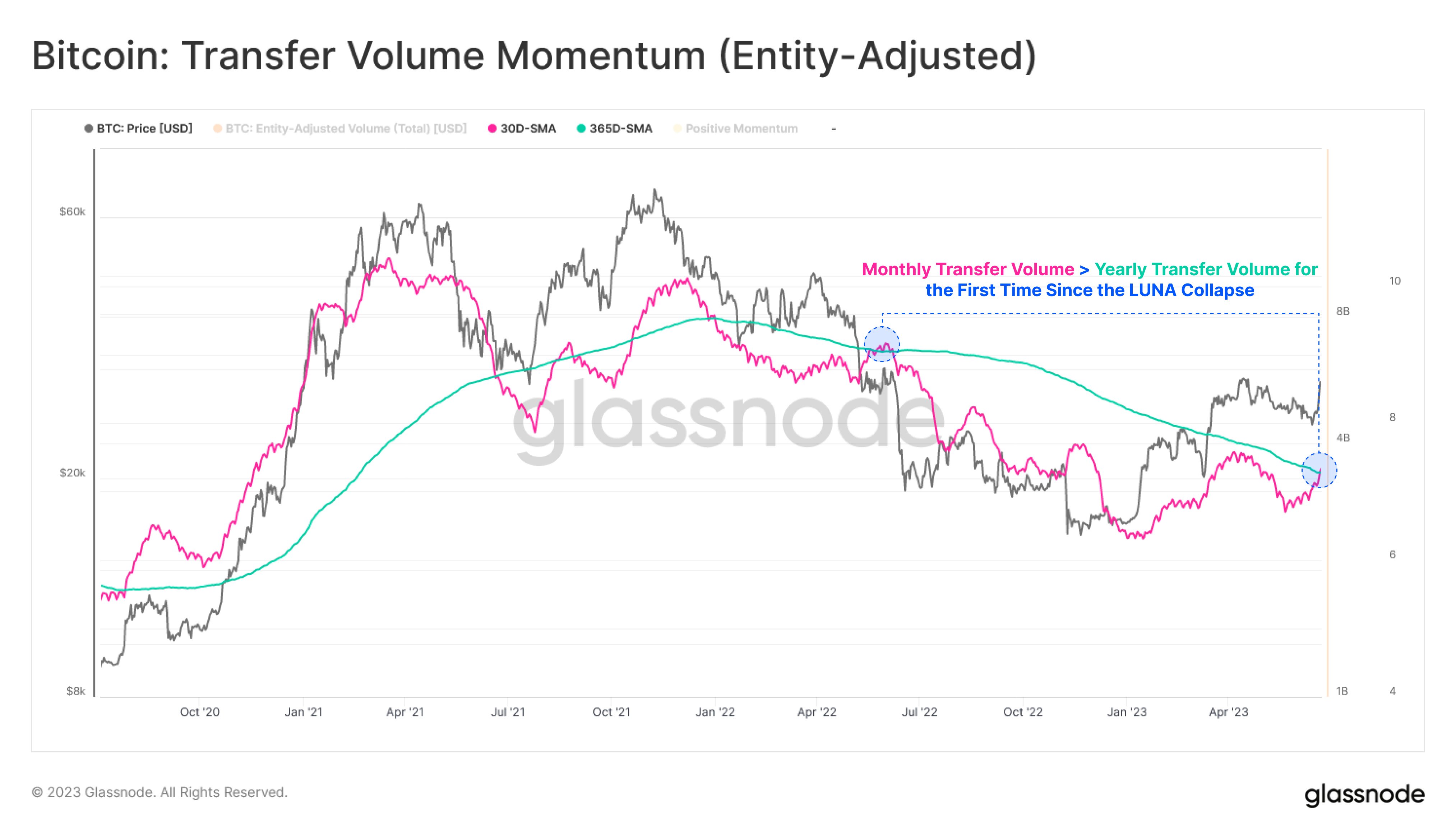

Shrinking Liquid Supply Adds to the PuzzleAnother critical factor is the declining liquid supply of Bitcoin.

According to data from Glassnode and other sources, only about 25% of the total Bitcoin supply remains liquid. The remaining 75% is held by illiquid entities — typically long-term holders or institutions with no intent to sell.

Bitcoin Illiquid Supply. Source: Glassnode.“Bitcoin illiquid supply keeps climbing & is at all-time-highs. Only 25% of Bitcoin’s supply remains ‘liquid.’ The supply shock will be brutal!” Nic, co-founder of Coin Bureau, said.

This creates a potential supply crisis. With fewer coins available on the market, even moderate demand can drive prices higher. This helps explain why Bitcoin remains near ATH levels without a spike in spot trading volume.

The drop in spot volume may signal a lack of retail investor FOMO, which fueled previous bull cycles. Instead, it could indicate a shift toward long-term value investing over short-term speculation.

Still, without macroeconomic catalysts like interest rate cuts or technical breakthroughs to boost market confidence, Bitcoin’s price could stagnate.

The post Why is Spot Volume Declining Despite Bitcoin Hovering Near All-Time Highs? appeared first on BeInCrypto.

origin »Volume Network (VOL) на Currencies.ru

|

|