2022-10-16 03:20 |

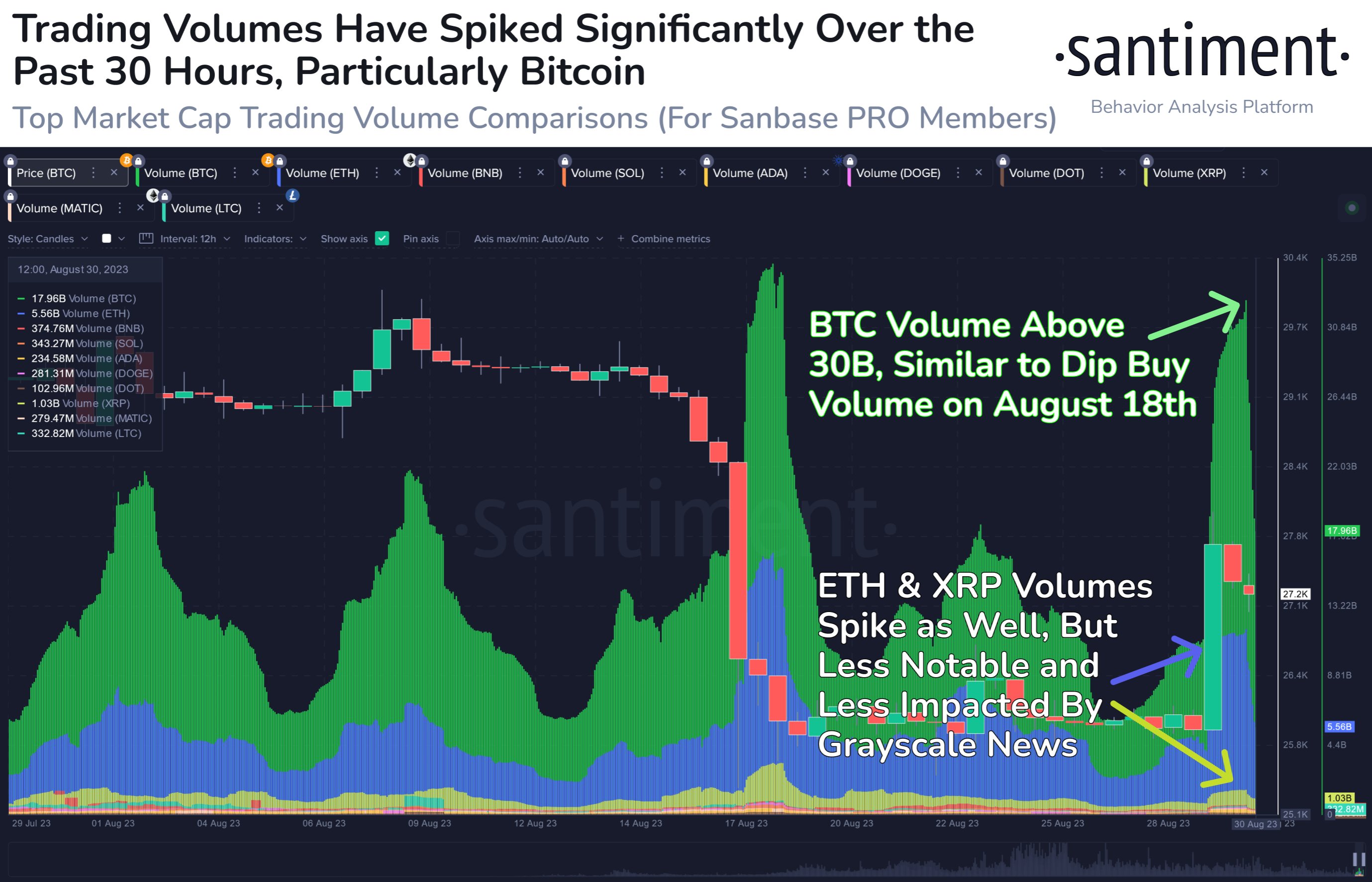

Cryptocurrency markets are again in the red, and this Saturday’s trading volume has drastically decreased. Prices for Bitcoin and Ethereum are lower today due to the market’s break after showing little movement on Friday. Ethereum is still trading below the $1,300 support zone, while Bitcoin is trading in the low $19,000 level.

Crypto Market News UpdateBTCUSD’s 24-hour trading volume is down 54%, while ETHUSD’s 24-hour trading volume is down 49%. The trading volume is anticipated to decline over the weekend.

As a review, some noteworthy news from this week is as follows:

There are claims that North Korea is covertly amassing millions of dollars worth of bitcoin through dubious techniques, including hacking and exploiting smart contracts. The Fed’s aggressive monetary policy is the reason why the stock market is underperforming. The SEC launched an investigation into Yuga Labs, ApeCoin, and their NFTs. Through Coinbase, Google Cloud started to accept Bitcoin, Ethereum, and Dogecoin. Following the merge, Ethereum’s network is becoming deflationary as more Ether is burned during transaction validation than is created through staking. By providing SBCs (Sustainable Bitcoin Certificates) to interested investors wishing to fulfill their sustainability quota, a new protocol attempts to encourage the environmentally friendly mining of Bitcoin. General Thoughts On The Crypto Economic MarketIn terms of the cryptocurrency market’s economics, the total valuation is still at the $900 billion level. We can reasonably conclude that the short-term market mood is bearish as long as it remains below $1 trillion.

The fear and greed index is currently at 24 points, which is lower than last month’s 28 points but still better than the 20 points earlier in the week. This level of extreme fear on the market has been constant over the previous few months.

The lessened volatility for Bitcoin and Ethereum is good news despite the bear market and may indicate that the bottom of the market is getting close. While a trend reversal this year is unlikely, things may change in the following year.

Dollar-cost averaging long-term positions now could be a good strategy if you’re still willing to purchase the drop and have cash on hand to position yourself for enormous gains when the bull market begins. Patience is the game, as it might not be until Q2 or Q3 of 2023 till we actually have another bull run.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: DrawKit Illustrations on Unsplash // Image Effects by Colorcinch

The post Trading Volume Significantly Declines As Bearish Downtrend Sets In for Bitcoin and Ethereum appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|