2019-6-17 14:26 |

Coinspeaker

Bitcoin Futures Volume is Just 33% of the Spot Volume in May, Reports JPMorgan Chase

It is evident that the Bitcoin industry has changed considerably since 2017. According to JPMorgan Chase (JPM), there is an increase in institutional interest as reported by Bloomberg on June 15. That publication quoted a report that was led by Nikolaos Panigirtzoglou, the managing director of global market strategy of the United States’ biggest bank.

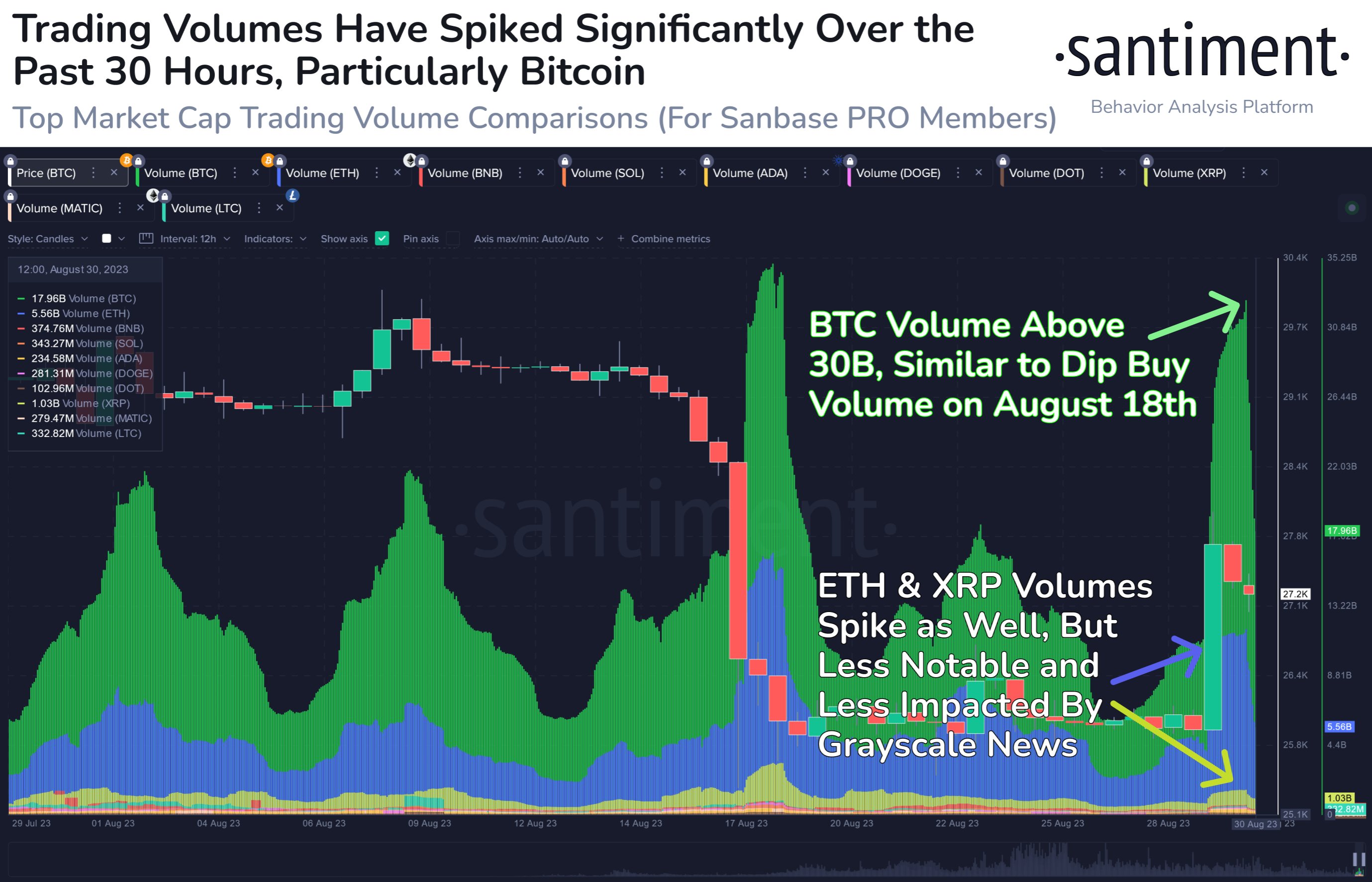

Researchers and experts examined recent phenomena surrounding crypto exchanges. Although the industry is growing, challenges have also come up. Bitcoin futures volumes have surged to record highs of around $12 billion in May. That represents a growth of 118% from the volumes recorded in April.

JPMorgan estimated that after eliminating the faked volume, the actual spot Bitcoin volume on crypto exchanges was almost $36 billion in May. That means the futures share of spot volumes was just around 33%.

JPMorgan explained that due to the surge in fake volume, the importance of Bitcoin futures has been understated. This understatement means that the market structure has most likely changed significantly since the last spike in Bitcoin prices in December 2017. According to JPM:

“The overstatement of trading volumes by cryptocurrency exchanges, and by implication the understatement of the importance of listed futures, suggests that market structure has likely changed considerably since the previous spike in Bitcoin prices in end-2017 with a greater influence from institutional investors”

The InvestigationAs we published earlier, an investigation by asset manager Bitwise in March showed that 95% of reported Bitcoin trading volume is likely non-existent. CoinMarketCap reports almost $19 billion per day in Bitcoin trading volume. However, the real figure could be less than 33% of the reported amount, according to Bitwise.

Bitwise analyzed many regulated exchanges in May using Coinbase Pro as its case study. The study aimed to reveal the nature of the trading patterns that appear trustworthy. Citing JPMorgan, Bloomberg notes that if just 5% of May’s $725 billion number is accurate, then the real volume of BTC trading last month was approximately $36 billion.

On the other hand, the month of May became the best performing month on record for CME Group. The Bitcoin futures provider achieved an implied USD value surpassing $500 million. There exists a volume difference between trading on exchanges and volumes in bitcoin futures. The difference means that institutional investors are honest about crypto.

Additionally, the end of June will see CBOE, the pioneer in futures provision, shut down its final contracts. These contracts are set for shutdown in line with a resolution made in March. Bakkt meanwhile said that it plans to start testing its futures offering in July.

Bitcoin Futures Volume is Just 33% of the Spot Volume in May, Reports JPMorgan Chase

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|