2026-2-10 10:04 |

Bitcoin’s (BTC) latest price correction is reinforcing, rather than undermining, the long-standing 4-year halving cycle that has historically shaped the asset’s market behavior, according to a new report from Kaiko Research.

The debate carries significant implications for traders and investors navigating Bitcoin’s volatility in early 2026.

Bitcoin Is Following Its 4-Year Cycle Amid Sharp CorrectionBitcoin fell from its cycle peak near $126,000 to the $60,000–$70,000 range in early February. This marked a drawdown of roughly 52%.

While the move rattled market sentiment, Kaiko argues the decline is fully consistent with previous post-halving bear markets and does not signal a structural break from historical patterns.

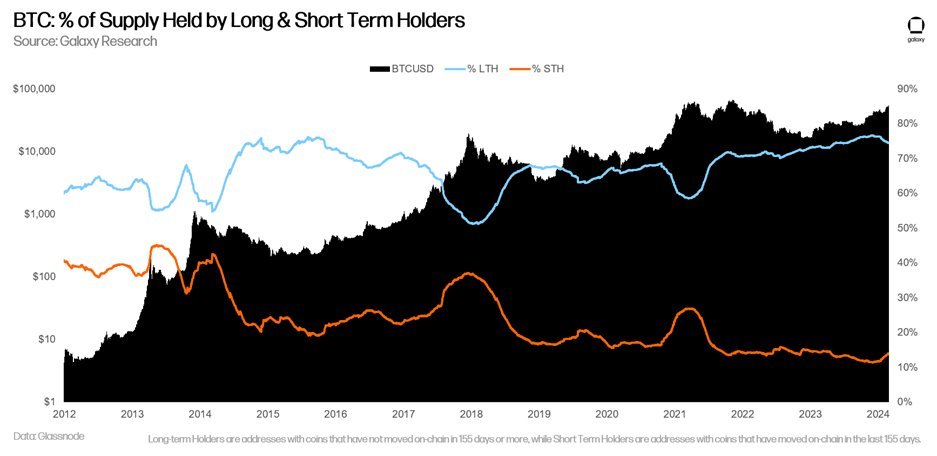

“Bitcoin’s decline from $126,000 to $60,000 confirms rather than contradicts the four-year halving cycle, which has consistently delivered 50-80% drawdowns following cycle peaks,” Kaiko’s data debrief read.

The report notes that the 2024 halving took place in April. Bitcoin topped out roughly 12–18 months later, aligning closely with prior cycles. In past instances, such peaks have typically been followed by extended bear markets lasting around a year before the next accumulation phase begins.

Bitcoin’s 4-Year Halving Cycle. Source: KaikoKaiko says the current price action suggests Bitcoin has transitioned out of the euphoric post-halving phase and into that expected corrective period.

It is worth noting that many experts have previously challenged Bitcoin’s 4-year cycle. They argue that it no longer holds in today’s market. In October, Arthur Hayes said the 4-year Bitcoin cycle was over. He pointed instead to global liquidity as the dominant driver of price movements.

Others have argued that Bitcoin now follows a 5-year cycle rather than a 4-year one. They cite the growing influence of global liquidity conditions, institutional participation, and broader macroeconomic policy shifts.

Kaiko acknowledged that structural changes, including spot Bitcoin exchange-traded fund (ETF) adoption, greater regulatory clarity, and a more mature DeFi ecosystem, have distinguished 2024-2025 from previous cycles. Nonetheless, it said these developments have not prevented the expected post-peak retracement.

Instead, they have changed how volatility manifests. Spot Bitcoin ETFs recorded more than $2.1 billion in outflows during the recent sell-off.

This amplified downside pressure and demonstrated that institutional access increases liquidity in both directions, not just on the way up. According to Kaiko,

“While DeFi infrastructure has shown relative resilience compared to 2022, TVL declines and slowing staking flows indicate no sector is immune to bear market dynamics. Regulatory clarity has proven insufficient to decouple crypto from broader macro risk factors, with Fed uncertainty and risk-asset weakness dominating market direction.”

Kaiko also raised the key question now dominating market discussions: where is the bottom? The report explained that Bitcoin’s intraday rebound from $60,000 to $70,000 suggests initial support may be forming.

However, historical precedent shows that bear markets typically take six to 12 months and involve multiple failed rallies before a sustainable bottom is established.

Kaiko noted that stablecoin dominance stands at 10.3%, while funding rates have fallen close to zero and futures open interest has dropped by about 55%, signaling significant deleveraging across the market. Still, the firm cautioned that it remains unclear whether current conditions represent early, mid, or late-stage capitulation.

“The four-year cycle framework predicts we should be at the 30% mark. Bitcoin is doing exactly what it has done in every previous cycle, but it seems many market participants convinced themselves this time would be different,” Kaiko wrote.

As February 2026 progresses, market participants must weigh both sides of this argument. Bitcoin’s next moves will reveal whether history continues to repeat or a new market regime is taking shape.

The post Bitcoin’s Four-Year Cycle Is Intact, and the Latest Sell-Off Shows Why appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|