2023-4-21 09:30 |

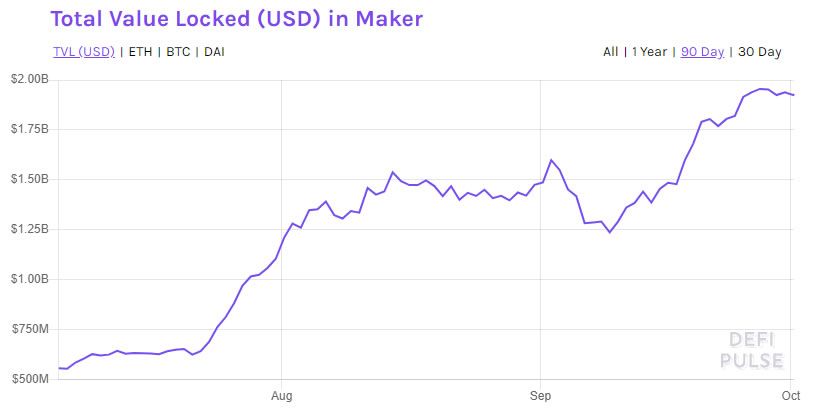

MakerDAO made plans to increase stability fees for various versions of wrapped BTC. A new vote was also announced to add Coinbase Custody as a type of collateral asset to the MakerDAO protocol. origin »

Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|