2022-5-25 05:48 |

MakerDAO (MKR) total value locked (TVL) fell sharply to new lows in the last week of May due to decreased investor interest in decentralized finance (DeFi).

Maker was the third-ranked decentralized application (dApp) with the most value locked throughout April, behind Curve and Lido.

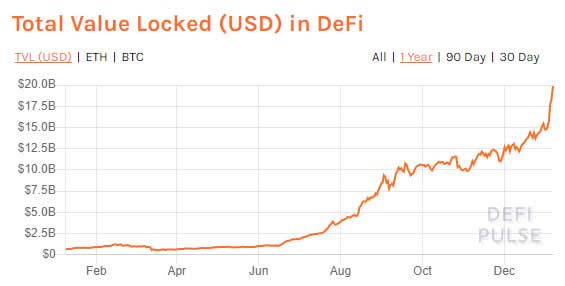

According to Be[In]Crypto research, Maker lost 45% of its year-high TVL on Feb. 10, 2022. On that day, its TVL was in the region of $18.12 billion, and this dropped to approximately $9.82 billion by May 24.

Source: MakerDAO TVL Chart by DeFiLlamaMakerDAO enables the generation of DAI. As a growing ecosystem, there are more than 400 services and applications such as games and decentralized finance platforms that have integrated DAI.

Its TVL fell substantially due to an overall market crypto market crash. Maker TVL was $17.5 billion on the first day of the year and this figure declined by 43% to more than $9 billion in the last week of May.

Overall, Ethereum TVL sunk by 50% from $146.78 billion on Jan. 1 to $72.93 billion on May 24, 2022.

Despite shedding more than $8 billion in total value locked, MakerDAO has become the dApp in terms of most value locked.

Source: TVL Rankings by DeFiLlamaMakerDAO now commands a relatively higher TVL than other popular dApps such as Curve, Aave, Lido, Uniswap, Convex Finance, PancakeSwap, Compound, JustLend, Instadapp, and SushiSwap.

MKR price reactionMKR opened on Feb. 10 with a trading price of $2,247.69 and reached a low price of $984.81 on May 12. It has moved up slightly since then and was exchanging hands for $1,311 at the time of press.

Overall, this equates to a 44% loss in the price of MKR in the past 15 weeks.

Source: MKR/USD Chart by TradingViewThe post MakerDAO Back on Top Despite Dropping $8 Billion in Total Value Locked (TVL) appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Circuits of Value (COVAL) на Currencies.ru

|

|