2023-1-2 18:00 |

Data shows the bear market has also hit Ethereum decentralized finance (DeFi) hard, as the total value locked in the sector has declined by 76%.

Total Value Locked In Ethereum DeFi Now Only Around $23.1 BillionDecentralized Finance (or DeFi as it’s most commonly known) includes all types of financial services that are done on the blockchain. Like other entities on the blockchain, DeFi is public and doesn’t involve any centralized party to get things done (as transactions are peer-to-peer).

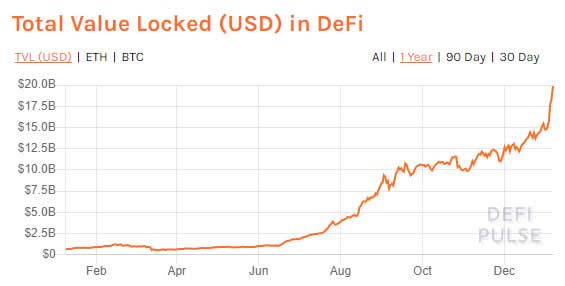

The “total value locked” (TVL) is a metric that measures the total amount of capital that has currently been deposited by users in DeFi protocols. The below chart shows how the TVL of DeFi built on the Ethereum blockchain has changed over the course of the year 2022:

As the above graph displays, the Ethereum DeFi TVL was more than $95 billion at the start of this year. However, capital has exited the sector as the bear market has grown deeper, much like in the rest of the crypto market. Now, the metric has a value of just $23 billion, meaning that ETH DeFi has seen a drawdown of around 76% over the year, according to the year-end report from Arcane Research.

The dominance of Ethereum DeFi (the percentage share of the total DeFi TVL across all blockchains) itself has, however, actually observed a rise of more than 2% this year. From the chart, it’s apparent that this increase coincided with the Terra LUNA collapse, suggesting that the dominance gain was because of capital exiting the Terra DeFi apps.

The report notes that while the year has been bad for DeFi, the sector has “withstood chaotic and turbulent times in crypto credit markets and offered well-needed transparency and reliability in contrast to the centralized crypto lenders in the last year.”

However, it’s also true that DeFi has faced chaos of its own this year as well. In 2022, there were many DeFi and bridge-related hacks amounting to a total of $3 billion, as the below chart shows.

The report believes that proper revenue sharing among DeFi token holders would gain momentum next year, as currently, no token provides any meaningful value to the investors (besides acting as a governance token), and so revenue rights for holders could be one thing that helps revitalize DeFi usage in the coming year.

ETH PriceAt the time of writing, Ethereum is trading around $1,200, down 2% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|