2020-10-1 11:19 |

Decentralized finance stalwart MakerDAO has been slowly strengthening in terms of collateral locked. This is starting to reflect in MKR token prices which are up 17% on the week.

While the recent fervor and focus has been on all the new DeFi offerings that have been appearing on an almost daily basis, Maker has been quietly evolving and growing. The decentralized credit platform has been knocked off the top spot in the DeFi TVL charts, but it’s racing to close the gap.

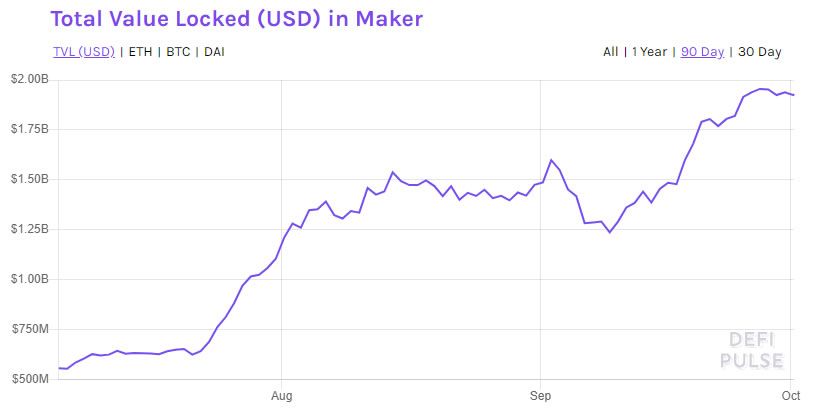

Over the past three months, total value locked on Maker has increased by almost 250% to reach a record high of $1.93 billion according to DeFi Pulse.

Maker TVL – DeFi Pulse USDC Driving LiquidityRecent research by Messari’s Jack Purdy (@jpurd17) has revealed that the Coinbase and Circle USD Coin (USDC) is largely responsible for this increase.

While new governance tokens and sky-high APYs stealing all the attention during the latest DeFi Summer

Maker has quietly grown to almost $2 billion in value locked pic.twitter.com/DId9JP443X

— Jack Purdy (@jpurd17) September 30, 2020

He added that $400 million in USDC has been added by Maker governance in order to restore the Dai dollar peg as its demand has increased in recent months.

With new yield farms appearing and a surge in interest for non-fungible tokens, Dai has been the stablecoin of choice for many. The Dai Savings Rate is still zero, so most of it is being used as collateral in higher-yielding liquidity pools.

Purdy added that this increased demand has led to debt outstanding increasing from $200 million to over $900 million in the past few months. The Dai supply currently stands at around $900 million, an increase of over 1,000% over the past six months.

The researcher concluded that Maker could regain lost ground over newer DeFi platforms as interest rates rise.

The latest announcement from Maker is the addition of Chainlink, Loopring, and Compound tokens for use as collateral in its vaults:

Loopring ($LRC) @loopringorg

Compound ($COMP) @compoundfinance

and Chainlink ($LINK) @chainlink are now available to use as collateral in Maker Vaults. pic.twitter.com/V8mmJiXwLS

— Maker (@MakerDAO) September 30, 2020

MKR Climbs 17%Maker’s native token, MKR, has also been progressing in terms of price action recently. MKR has added 17% on the week in a move from just over $500 to the current price of $590.

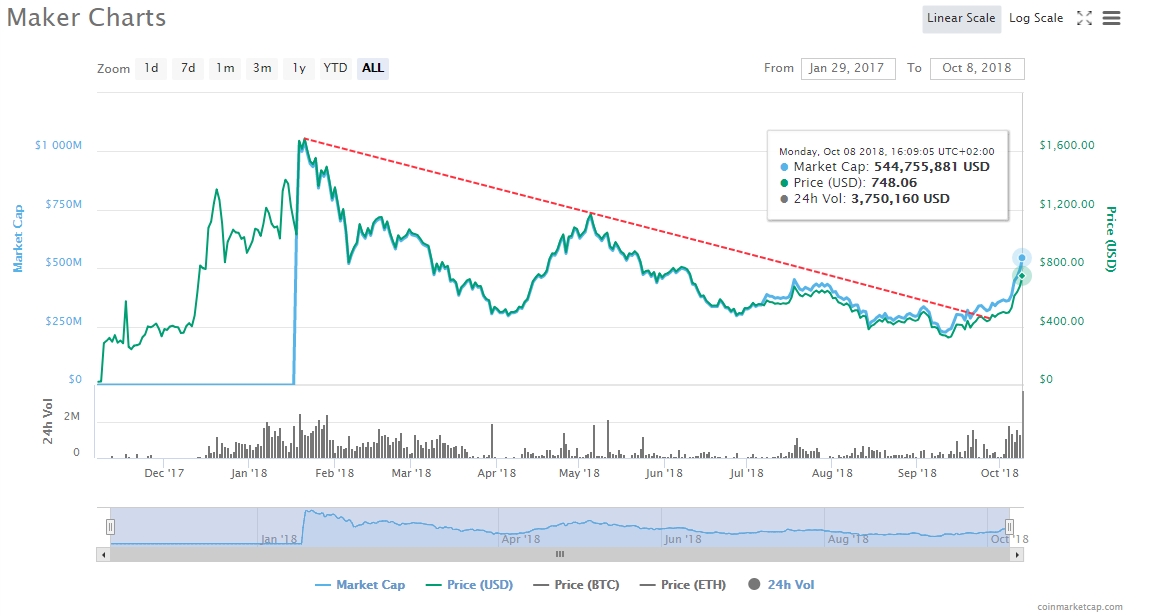

MKR/USD – TradingViewMaker prices have been relatively stable for the past two years, oscillating around the $500 zone. It’s high for the year came in mid-August when MKR briefly touched $800.

The post Maker Closes in on $2 Billion Collateral, MKR Pumps 17% appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Maker (MKR) на Currencies.ru

|

|