2020-7-24 19:23 |

Leading spot cryptocurrency exchange Binance is listing MakerDAO’s governance token Maker (MKR) and stablecoin DAI.

The exchange is adding support for eight trading pairs viz. MKR/BNB, MKR/BTC, MKR/BUSD, MKR/USDT, DAI/BNB, DAI/BTC, DAI/BUSD, and DAI/USDT.

This is no surprise given the ongoing DeFi crazy. Binance has been increasingly adding support for these projects, and as we reported, Binance CEO Changepeng “CZ” Zhao is a “very strong proponent” of this sector. However, he did warn that they are “very inherent high risk” and doesn’t see an “overwhelmingly large proportion” of them succeeding.

The DeFi sector actually surpassed $3 billion in total value locked this week, after reaching $2 billion earlier this month only. The hot trend in the DeFi market is yield farming, which is trying to get the highest yield from DeFi products.

The decentralized credit platform built on Ethereum, Maker, is back to dominating the DeFi space at 20.90%, a substantial loss from over 50% up until the launch of COMP token, which momentarily even took Maker’s place.

Also, the majority of ETH, 2.7 million ETH, out of the total 3.9 million ETH locked in DeFi, are in Maker protocol. However, when it comes to DAI, it’s the third biggest protocol with the highest amount of DAI locked at 21 million after Uniswap and InstaDapp.

The 27th largest cryptocurrency by market cap is also enjoying gains today, up 22.50% trading at $572.

Binance’s MKR listing came after Coinbase listed the digital asset last month and DAI a month before that. Both the tokens are also supported on DEXs like Balancer and Uniswap.

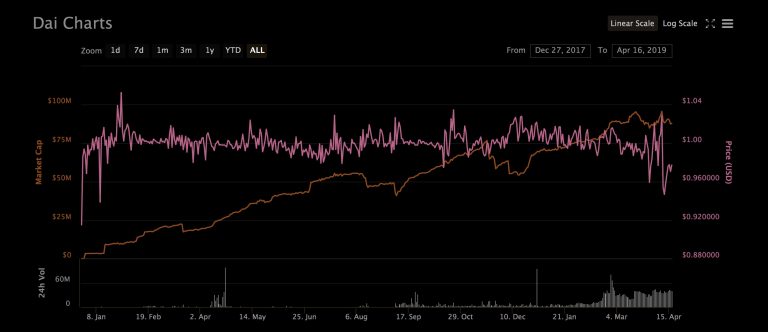

The USD pegged stablecoin DAI has been seeing an increase in supply by over 40 million since July 17th, which again is likely due to high demand for it in the DeFi ecosystem. Currently, DAI has a 7.47% supply APY on Compound, 4% to 6% higher than either USDT or USDC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Multi collateral Dai (DAI) на Currencies.ru

|

|