2021-2-16 20:09 |

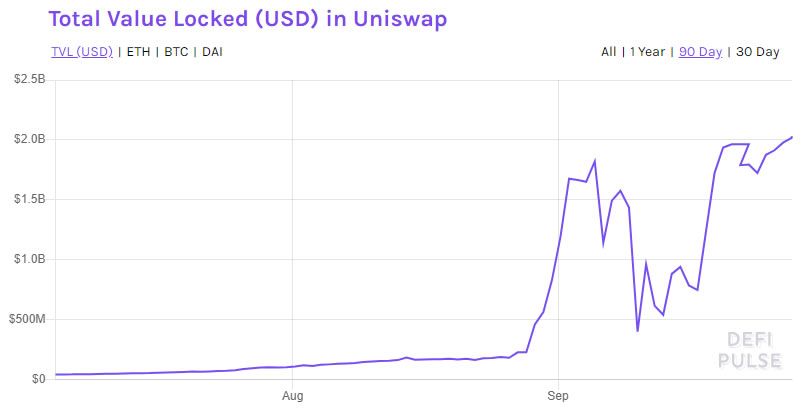

The popular decentralized exchange Uniswap has hit a milestone of processing more than $100 billion in trading volume in its entire life. Ever since the beginning of 2021, the DEX has been doing more than $5. origin »

Bitcoin price in Telegram @btc_price_every_hour

Uniswap (UNI) на Currencies.ru

|

|