2020-9-29 15:48 |

Coinspeaker

Uniswap Is First DeFi Protocol to Hit TVL of $2 Billion

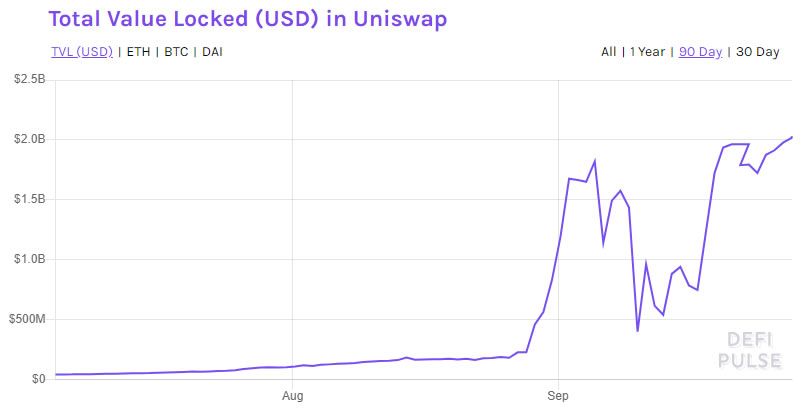

At the time of writing, data from DeFi Pulse showed Uniswap total value locked (TVL) stood at $2.03 billion. The trend shows how the decentralized finance (DeFi) market is continuously growing at a fast rate. Meanwhile, the TVL across all DeFi protocols is nearing to an all-time high, now at $11 billion. TVL is a term that represents the total amount of various DeFi protocols’ users have “locked-in” or committed.

‘Yield farming’ Propelling Surge of Uniswap TVLUniswap is currently considered one of the best performing DeFi protocols this year as its TVL surged by 780% over the last one month. The protocol also managed to reclaim all of the liquidity that SushiSwap had taken. By liquidity, the top three tokens of Uniswap are Ether (ETH), Wrapped Bitcoin (WBTC), and Tether (USDT).

UNI Farming is the main agent that supposedly propelled Uniswap to the milestone. Users’ affinity to get the highest possible yield from UNI token – a phenomenon known as the “yield farming” craze – is the main reason for the surge.

Amongst the DeFi protocols, Uniswap’s dominance is just around 18%. MakerDAO, a decentralized lending protocol, became the first DeFi protocol to hit the TVL market of $1 billion earlier in the year- and is not too far from reaching the $2 billion milestone also. The total deposits of DAI stablecoin’s builder Maker is now at $1.95 billion, while Aave follows closely at $1.54 billion.

UNI’s Trading Pairs Increase ‘Yields’Earlier this month, Uniswap launched its own governance token UNI and Coinbase Pro and Binance quickly – in a matter of hours – listed it.

Uniswap’s creator Hayden Adams awarded 400 free UNI tokens to users who first utilized the trading platform as part of its celebratory introduction. Reportedly, nearly 13,000 Uniswap traders claimed the free ERC-20 tokens. The action made the price of the token to surge by almost 90%.

Uniswap’s vast majority of liquidity is locked across four liquidity pools that earn UNI. They form almost 80% of the protocol’s total amount. ETH/WBTC pool is the most popular, as it currently holds nearly 30% of the whole. While the rest of the three pools (ETH/DAI, ETH/USDC, ETH/USDT) have an even share. If these pools were nonexistent, rewards on this DeFi platforms would be lower as yield farmers would just manage to earn a 0.3% trading fee share.

As far as UNI’s prices are concerned, it remained flat over this weekend and later dropped below $5, and it currently trades in the $4.75 range. Unlike its rival SushiSwap, which has experienced a loss in value of nearly 80%, UNI has managed to hold on to most of its gains since it was first incepted.

Uniswap Is First DeFi Protocol to Hit TVL of $2 Billion

origin »Defi (DEFI) на Currencies.ru

|

|