2020-9-28 09:27 |

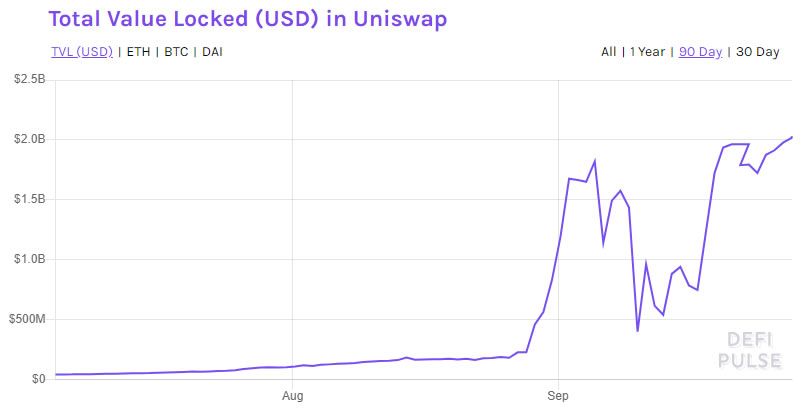

Collateral locked on the Uniswap decentralized exchange has surpassed $2 billion, making it the first decentralized finance (DeFi) platform to reach this milestone.

The crypto bears have been held at bay over the weekend, providing some relief for the cryptocurrency markets, while the total value locked across all DeFi protocols is close to its all-time high at $11 billion.

The TVL chart continues its steep ascent despite crypto markets cooling off over the past month. Uniswap has retaken the top spot, becoming the first to climb over the $2 billion mark.

The platform itself is reporting that liquidity is slightly higher, around $2.24 billion, with a daily volume of $276 million.

Uniswap TVL – DeFi PulseUniswap has managed to reclaim all of the liquidity that SushiSwap took from it earlier this month. Since the same time last month, Uniswap TVL has surged 780% making it one of the best performing DeFi protocols of the year.

80% Locked in Liquidity PoolsThe vast majority of that liquidity is locked across the four liquidity pools that are earning UNI.

Around 80% of the total amount on the protocol is split between the four pools with the ETH/WBTC pool being the most popular, holding around 30% of the total. The remaining three pools are split almost evenly earning a share of the 83,333 UNI dished out daily:

Uniswap Liquidity Pools – UniswapUNI farming will continue until Nov 17 and it is likely that this liquidity will be moved to more lucrative pools on other platforms unless Uniswap has more offerings up its sleeves.

Without these pools, yield farmers would only get a share of the 0.3% trading fee, which is on the low end of the spectrum as far as rewards on DeFi platforms are concerned.

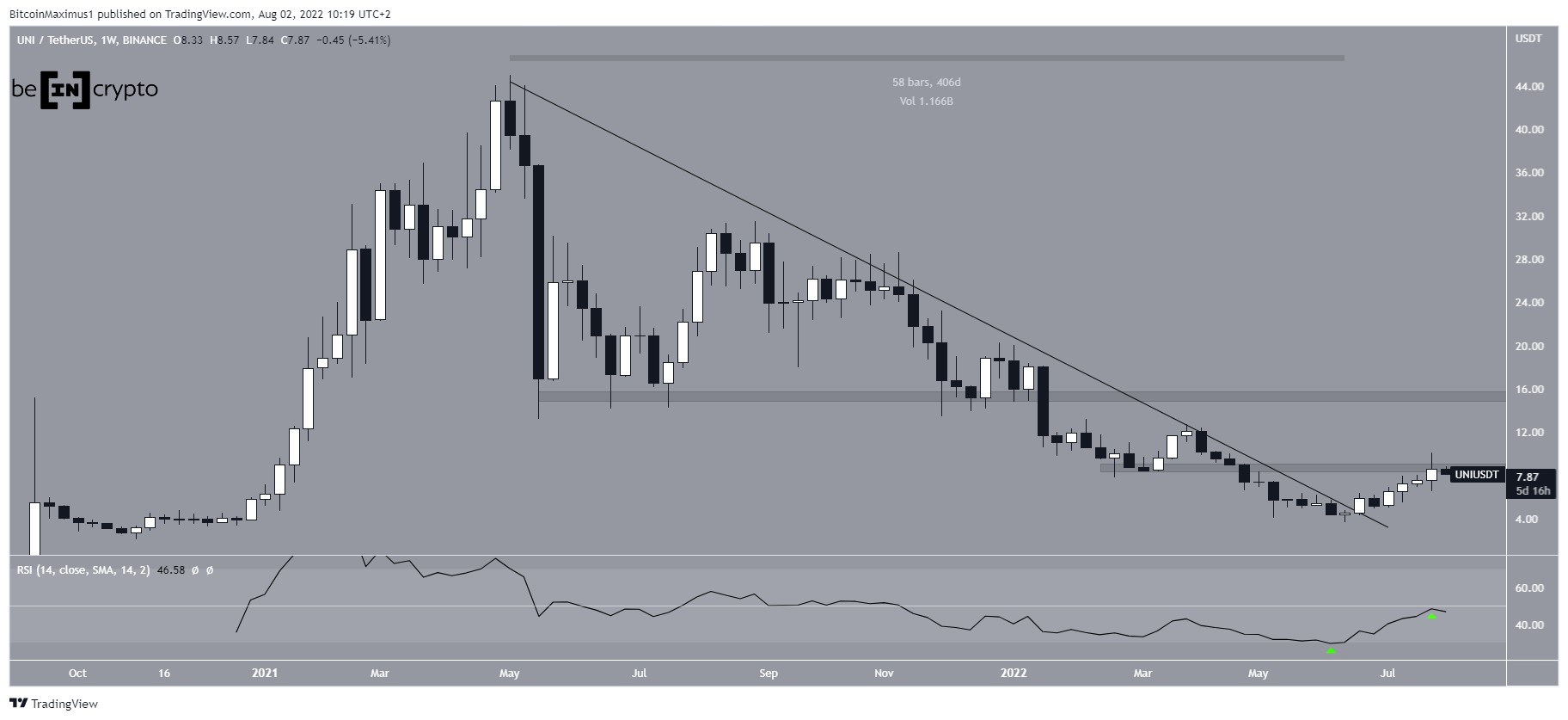

UNI Price UpdateUNI prices have remained relatively flat over the weekend, dropping below $5 and trading in the $4.75 range at the time of press. On the positive side, UNI has held on to most of its gains since inception, unlike its rival SushiSwap which has lost around 80% of its value.

There was a rather scathing report by Glassnode last week which inferred that Uniswap governance is centralized and that one of the largest holders of the token, which can be used for voting, is Binance. It added that around 40% of the supply is allocated to the team and investors which has eroded its decentralization.

The post UNI Farming Propels Uniswap to First $2 Billion DeFi Platform appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|