2021-2-4 11:19 |

Offering users a suite of automated money management tools, the platform aims to unlock DeFi for a wider audience.

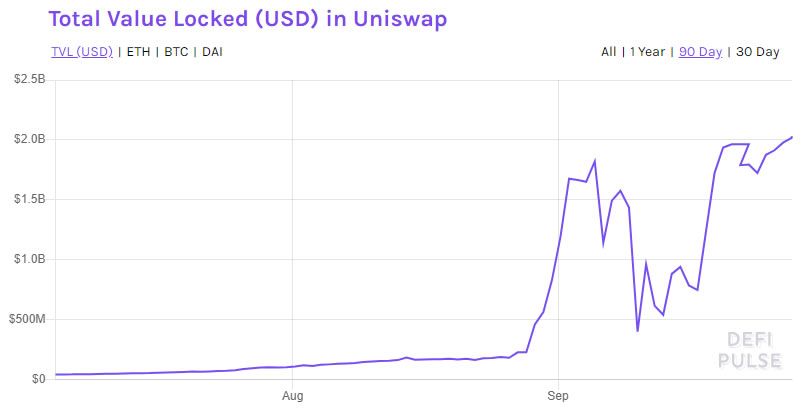

We have all seen the meteoric rise of decentralized finance over previous months and with the DeFi marketcap now sitting at around $47 billion, decentralized borrowing and lending protocols have well and truly made their marks as one of many innovations of blockchain technology in recent years. The total value locked in DeFi protocols according to CoinGecko is currently over $34 billion, and with more platforms emerging every day aiming to offer alternatives to outdated and centralised financial products there is no shortage of options for consumers.

But this being said, many of the DeFi protocols on the market are still, to the uninitiated, hard to understand, and difficult to use. The complex mechanics behind decentralised borrowing, lending and yield farming can put many off even attempting to get involved in the decentralized finance space and is considered a major bottleneck when it comes to mainstream adoption.

DAOventures is a platform that looks to make the power of DeFi products available to the mainstream market and traditional investors worldwide by offering a suite of automated and easy to understand tools and services, all residing inside a user-friendly interface. Having recently closed a successful private sale, the team behind DAOventures looks to bridge the gap between DeFi services and the real world.

DeFi made easyMany traditional and regular cryptocurrency investors struggle to get to grips with mechanics that underpin DeFi protocols. Yield farming, impermanent loss, and clunky decentralized exchange interfaces are amongst the several confusing hurdles that can stop the everyday investor from adopting decentralized finance, and DAOventures aims to make both the technology and the strategy behind DeFi easier to access with its comprehensive suite of tools and services.

With products including an automated DeFi money manager that leverages robo-advisory, yield-farming aggregation and structured DeFi products, the DAOventures platform takes the lion’s share of work out of the hands of the investor and puts it into tried and tested automated tools that run themselves. With innovative options for yield farming, users can choose from the best strategies all in one place, picking from a range of different yield farming strategies from low-risk low reward to high-risk high reward.

“Our core team research, analyze and backtest the latest DeFi protocols to filter the best from the rest. It has never been simpler to explore and assess according to your suitable investment appetite. Benchmarking with the best performance algo.” – Victor Lee, DAOventures Product Lead

One dashboard to rule them allBy utilising the DAOventures DeFi dashboard, users have unrivalled access to the DeFi markets and can browse curated products, check historical returns, and choose preferred strategies according to risk profile. One of the main issues with yield farming and liquidity mining is the need for constant monitoring of performance in order to maximise profitability and avoid impermanent loss – the DAOventures platform makes investments and liquidity provision transparent, accessible and visible at all times, with self-custody meaning that the user is always in charge of their funds.

Private Sale successDAOventures recently announced that they had successfully closed their private sale round, having been 20x oversubscribed. The project raised a total of $1.3 million in the private sale round and gained interest from various notable investors from a range of industries including Moonrock Capital and Black Edge Capital, a firm with an impressive investment portfolio that includes projects such as Tomochain, Hypernet and Fantom.

With experience coming from impressive backgrounds that include positions at Google and Standard Chartered Bank, the DAOventures team is composed of professionals from the traditional finance, digital marketing, software development and smart contract development sectors. Advisors include Aaron Choi, Vice President of Kava Labs and Aniket Jindal, Co-Founder of Biconomy.

The DAOventures public sale is expected to be announced in the coming weeks and with an overwhelming interest in the private sale, the public counterpart is expected to be just as popular.

Image by StockSnap from Pixabay origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|