2020-9-29 17:34 |

Decentralized Finance (DeFi) is back to recovering, currently at over $11 billion, reaching an all-time high of nearly $12 billion from last week, as per DeFi Pulse.

On this climb up, the amount of BTC on Ethereum is already at an all-time of 130.8k BTC. When it comes to Ether, at 8.2 million ETH, it still has some way to go before it hits a peak of 10.67 million ETH.

Interestingly, the third-largest DeFi project Aave with $1.63 billion in TVL, has added over 370 million ETH in just the last three days.

Since Friday, ETH locked in the lending protocol has jumped by more than 190% and a whopping 792% since the beginning of this month. Aave is the fifth largest ETH holder in the DeFi space.

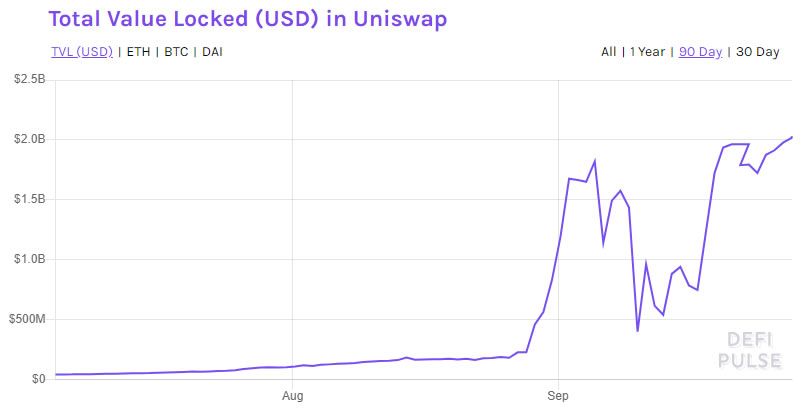

The most amount of ETH is locked in Uniswap at 2.9 million, doubled in the past ten days. While Maker’s ETH balance stayed steady over 2 million throughout this month, both Compound and SushiSwap recorded a drastic drop.

Both are among the top five ETH holders, but the amount of Ether locked in Compound has been on a constant decline since the middle of this month, down 30%. Uniswap clone SushuSwap registered a whopping 72% fall in ETH deposit on its protocol, which is no surprise given its overall sliding value.

The price of Ether meanwhile, is also on the rise, up 3.24% trading at $364, a jump from last week’s low of $320.

These gains are in line with the rest of the crypto market, which is moving in tandem with Bitcoin, approaching $11,000. But while bitcoin’s options market is sending mixed messages, “front-end skew bid and 3-month largely flat,” Ethereum’s is much more bullish.

“This can point to hedging flow, especially given the rising trend of locking Bitcoin on the Ethereum network, as well as lend/borrow flow,” noted Dennis Vinoourov of Bequant.

At the same time, Ethereum bulls are also waiting for an update on the much-needed Proof of Stake (PoS) transition for which the Spadina testnet, dress rehearsal for the most important parts of the Eth 2.0, will go live this week.

However, the best thing happened with the Ethereum transaction fees, which have declined sharply since skyrocketing on Uniswap’s governance token UNI’s launch — another factor acting in support of the DeFi world.

The average cost of processing an Ethereum transaction has fallen to a 49-day lull, at $2.34 compared to early Sept. cost of $14.6, as per Bitinfocharts.

The post ETH Locked on Aave & Uniswap Records a Sharp Rise first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|