2020-10-25 01:14 |

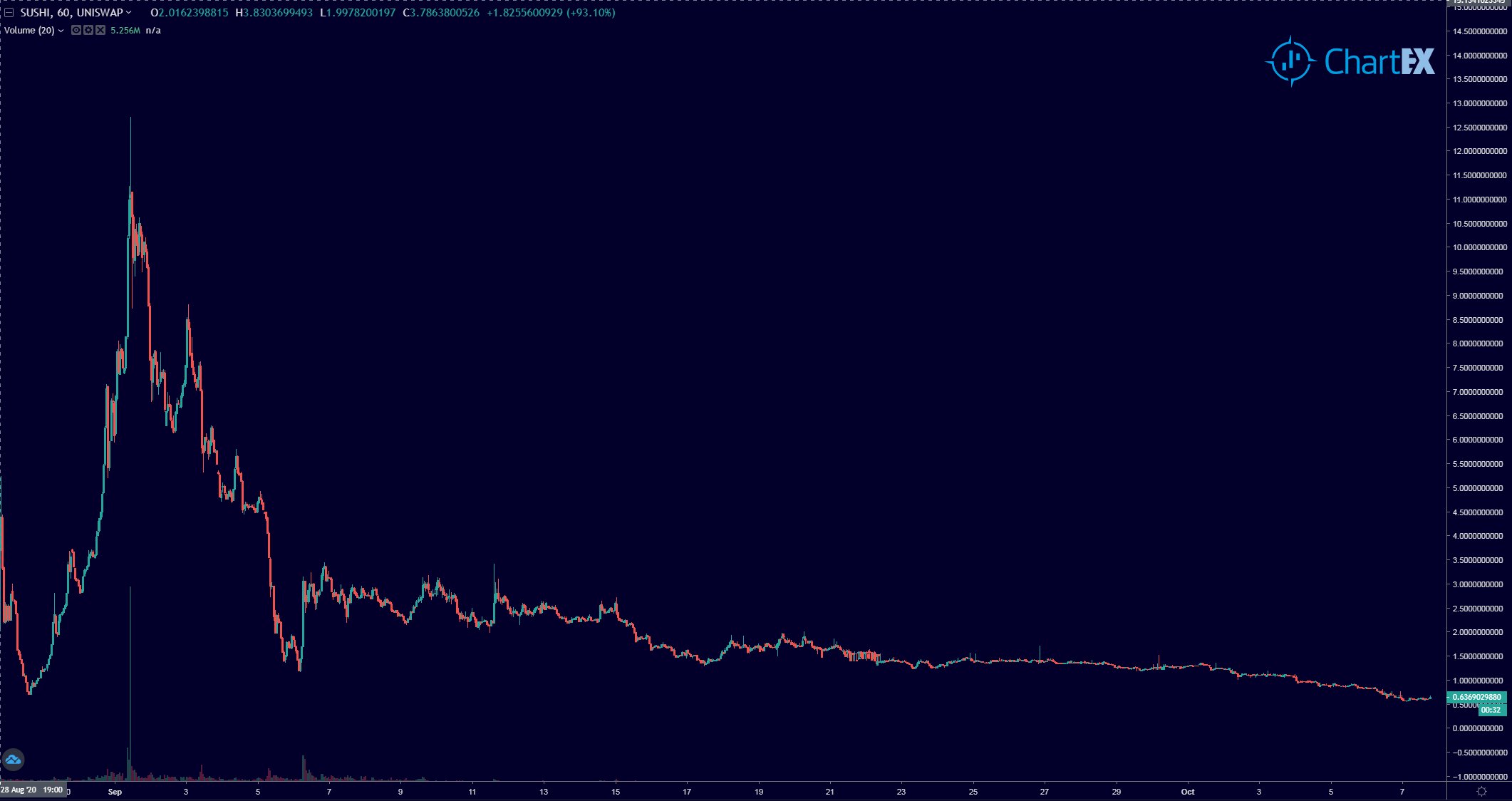

The past seven days have actually been quite mediocre for top coins in the decentralized finance (DeFi) space.

Compared to Bitcoin and Ethereum, which both have gained around 15 percent in the past seven days, many DeFi coins have oscillated around a zero percent weekly performance. That’s to say, some DeFi coins are flat over the past seven days, even as BTC has set new year-to-date highs.

But two coins are starting to break higher after a mediocre week, boosted by investments by multiple venture capital investors in the space. The two coins are AAVE and Yearn.finance’s YFI, both of which have gained 10 percent in the past 24 hours as Bitcoin holds the $13,000 region.

Chart of AAVE’s price action over the past four days. Source: AAVEUSD from TradingView.comCryptoSlate market data indicates that these two coins are some of the best performers in the top 50 coins over the past 24 hours.

YFI and AAVE bump higherA reason why YFI and AAVE are outperforming many of their DeFi peers may come down to venture capital investment in these coins.

As reported by CryptoSlate previously, Polychain Capital, a large crypto fund headed by Coinbase‘s first employee, was reported to have received 329 YFI, valued at around $4,600,000, from Binance.

This was reported by Alex Svanevik, CEO of Nansen, a data firm that uses proprietary methods and heuristics to figure out funds, firms, and investors and how they interact with different ERC-20 tokens.

In terms of AAVE, Arthur Cheong, founder of DeFIance Capital, deployed some capital into AAVE this past week right at the bottom at $32.

That moment you can't get your bid 100% filled because it's the exact bottom…. pic.twitter.com/SmCH0BkaHl

— Arthur (@Arthur_0x) October 22, 2020

Kelvin Koh, a partner at The Spartan Group and a former partner at Goldman Sachs, also announced that he was accumulating the leading Ethereum-based coin.

DeFi stronger than everUnderscoring the rallies in the prices of YFI and AAVE, DeFi is fundamentally stronger than ever.

Head of DTC Capital Spencer Noon noted that while most top coins have dropped from their highs, the “most important indicators” for the health of this space continue to push all-time highs. Namely, the total value locked in DeFi contracts is now at $12.4 billion while the number of ERC-20 stablecoins has breached $14 billion. He explained:

“Despite a month that saw most tokens fall 50% or more, #DeFi is *still* at ATHs with its most important indicators… Don’t listen to the degens who burned out. Phase 2 of this #DeFi bull market will make this summer look like nothing.”

Despite a month that saw most tokens fall 50% or more, #DeFi is *still* at ATHs with its most important indicators:

– TVL: $12.41B

– ERC20 Stablecoins: $14B

Don't listen to the degens who burned out. Phase 2 of this #DeFi bull market will make this summer look like nothing.

— Spencer Noon (@spencernoon) October 22, 2020

The post Top DeFi coins Yearn.finance (YFI) and AAVE rip 10% higher as Bitcoin holds $13k appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|