2020-9-20 20:55 |

If you’ve been following decentralized finance at all over recent weeks, you likely know of the so-called “food coins.”

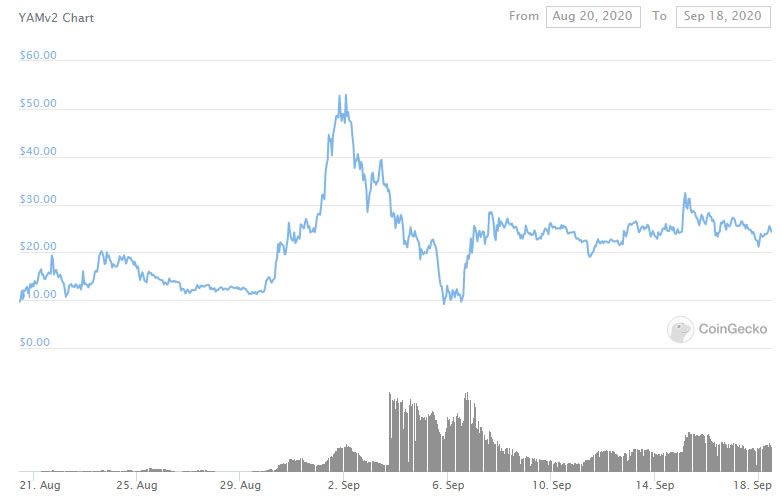

It ostensibly began with Yam Finance, an Ethereum-based coin that introduced the idea of “fair farming” or “stakedrops” to DeFi, along with the concept of having cryptocurrencies branded by emojis of food items. After Yam quickly became DeFi’s biggest trend, it was unsurprising that there were copycats.

Remember Kimchi? It’s gone, worth $0.003. Remember Pizza? Reduced to ashes.

Most food coins followed similar paths, launching to much hype, then crashing in the hours and days that followed as crypto collectively became sick of these copy-and-paste projects that had no intrinsic value.

There have been at least three exceptions to this rule, though: Yam, which still has a market capitalization above $100 million, SushiSwap, and Pickle.

What is Pickle Finance?As reported by CryptoSlate, Pickle Finance (or just Pickle) is a unique food coin project focused on normalizing the U.S. dollar stablecoin market.

Two of the most popular stablecoins in DeFi, MakerDAO’s DAI and Synthetix USD, often trade over the value of one U.S. dollar. As of the time of this article’s writing, both trade around 1.5 percent above one U.S. dollar.

“More rewards are given to below-peg stablecoin pools and fewer rewards are given to above-peg stablecoin pools. This gets people to sell above-peg stablecoins and buy below-peg stablecoins,” Pickle’s “PicoPaper” reads.

As esoteric as this may seem, the project has continued to hold its traction despite it being around a week since its launch. As aforementioned, a food coin lasting for a week is rather impressive, especially considering that as of this article’s writing, there is over $100 million worth of cryptocurrency locked in the project.

This comes after the project launched a new product called Pickle Jars or pJars, which allow users to earn capital on their deposits of certain assets, similar to Yearn.finance’s Vault product.

Product garners tractionDue to it being a unique offering in DeFi and in food coins, the product has continued to garner traction amongst users of Ethereum who see value in more stable stablecoins.

Co-founder of Delphi Digital Anil Lulla posted the tweet below on Sep. 17, expressing his support for two new DeFi projects: Pickle and Safe/Cover.

$PICKLE and $SAFE (rip) are interesting farms to me b/c they both had value-add intentions behind the actions they were incentivizing:

– @picklefinance : help maintain stablecoin pegs

– @chefinsurance : get people to buy covers

— Anil Lulla (@anildelphi) September 18, 2020

Google engineer Tyler Reynolds has also confirmed his support for the project.

He shared an extensive thread on Sep. 17, analyzing the fundamentals of Pickle’s project and trying to extrapolate a potenital long-term price target for the coin, which now trades at $28 as per CoinGecko.

Per Reynolds’ thread, PICKLE is the “best assymetric bet” in the DeFi market, discussing how the fees collected by the platform, along with the unique offerings that Pickle has, could drive the coin above $400 with time:

“@picklefinance has the opportunity to be the next big DeFi money management dApp, and it’s only a few days old. If it weren’t a food coin, it’d be the talk of DeFi. I, too, thought it was a joke when I first heard of it. Nonetheless, I’m impressed now.”

The post The reason why Ethereum’s Pickle Finance still holds over $100m in tokens appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|