2020-8-6 06:00 |

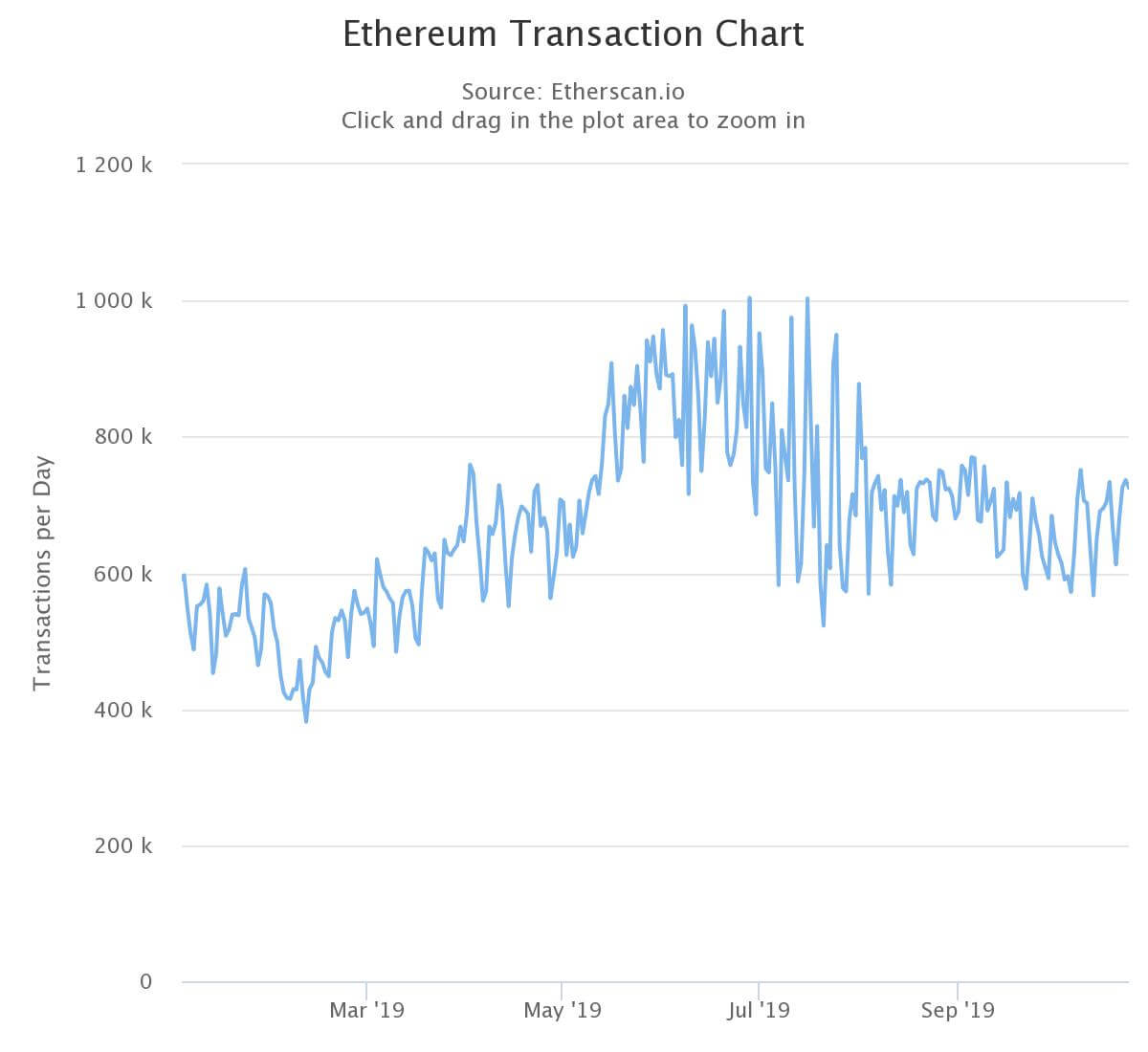

It’s no secret that Ethereum has benefited the most from the ongoing decentralized finance (DeFi) craze. After all, nearly all DeFi protocols and coins are based on the blockchain, the second-largest by market capitalization.

ETH’s dominance is not really unexpected: it has the most active developers, the most brand recognition, and most importantly, has the largest array of assets and infrastructure. A vast majority of stablecoins, which are pivotal to the DeFi experience, are based on Ethereum, for instance.

Yet new data shows that not all DeFi power users are committed to using Ethereum. That’s to say, they would even use a new blockchain if it offered a better user experience.

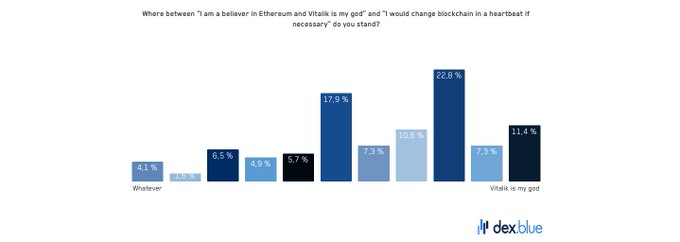

Related Reading: Crypto Tidbits: Ethereum Surges 20%, US Banks Can Hold BTC, ETH’s DeFi Space Still in Vogue DeFi Users Aren’t “Emotionally Attached to Ethereum”A new survey by decentralized exchange aggregator dex.blue found in a survey that DeFi traders are not committed to using Ethereum. After getting 134 responses from DeFI power users, the company analyzed:

“Crypto traders are not as emotionally attached to Ethereum as many might think. What’s your stance? “I am a believer in Ethereum and Vitalik is my god” or “I would change blockchain in a heartbeat if necessary”? On a 1-10 scale, the avg. score only 5.5 towards Ethereum.”

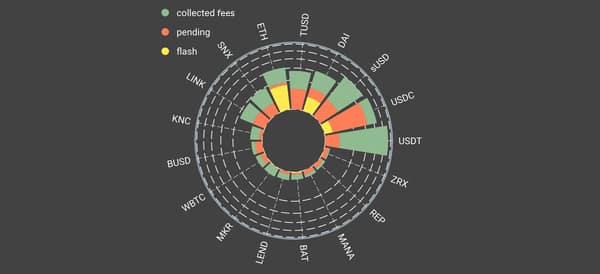

Responses to the aforementioned question from dex.blue.There are signs that Ethereum could lose its dominance in the future, with fees driving this narrative.

Qiao Wang, a former head of product at crypto research firm Messari, wrote on Twitter in June:

“I’ve changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

I've changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there's an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX. https://t.co/vXAAFET3YK

— Qiao Wang (@QWQiao) June 28, 2020

We saw the issue with fees epitomized on Saturday, during the infamous flash crash. As ETH shot lower, gas costs shot up to 180 Gwei as investors sought to manage their DeFi positions and send coins to and from exchanges. At 180 Gwei, it can cost upwards of $10 for each interaction with a DeFi contract, and even more if you are dealing with complex protocols.

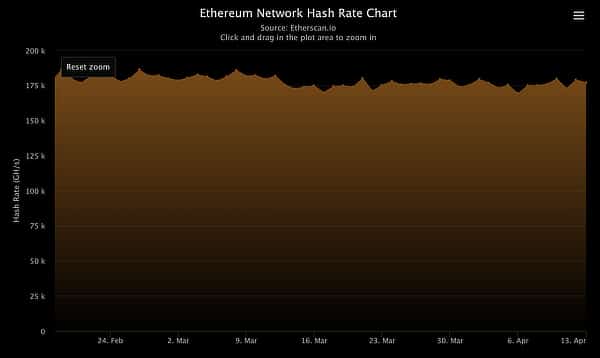

For Now, ETH Is WinningAlthough there are these concerns about scalability, Ethereum is still winning by leaps and bounds.

Case in point: 19 out of 20 of the top 20 DeFi protocols, as per data site DeFi Pulse, are based on Ethereum. DeFi protocols based on the blockchain continue to get a brunt of the investment entering DeFi, with investors opting in for the tried-and-true blockchain over more nascent competitors.

Spencer Noon, head of DTC Capital, commented on this trend in a recent Twitter post:

“My read on #DeFi after speaking with instl investors, fund mgrs, OTC desks, and FOs over the last few wks: The herd is coming. They’re excited about DeFi but new to it, so they’re buying $ETH first.”

Data also indicates that there has been more than 800,000 ETH deposited in DeFi contracts over the past month alone. There is now nearly 4% of all of the cryptocurrency in circulation currently deposited in these contracts.

Related Reading: Coinbase Takes DeFi Focus as it Looks to List 19 New Crypto Assets Featured Image from Shutterstock Price tags Charts from TradingView.com Not All DeFi Users Are Committed To Using Ethereum: New Survey origin »Defi (DEFI) на Currencies.ru

|

|