2020-10-8 18:00 |

DeFi tokens like Chainlink and Yearn.Finance dominated the crypto market all throughout the summer months. But a recent shift in sentiment has prompted investors to derisk and these same coins have been crashing deeply.

And while there’s no certainty that a reversal is near, a buy setup has triggered on these two once top-performing tokens that could at least provide a dead cat bounce it the short term.

Chainlink Readies Rebound Following 50% Fall From All-Time HighChainlink’s rise to the top of the crypto world began a lot earlier than most of the DeFi space, but the oracle feeding price data to platforms helped further fuel this year’s parabolic rally.

RELATED READING | AFTER 50% DROP, CHAINLINK (LINK) IS REACHING A DO OR DIE TECHNICAL LEVEL

The cryptocurrency was already the best performing asset for almost two full years running, then this year went on to rise from around a $1 on Black Thursday, to $20 per LINK token at the peak.

The incredible rally was reminiscent of Bitcoin’s in 2017, and so far the fall hasn’t been as sharp from top to bottom. Chainlink dropped 60% from the peak, while Bitcoin fell a total of 84% in the end. That could be a similar target for Chainlink in the long-term.

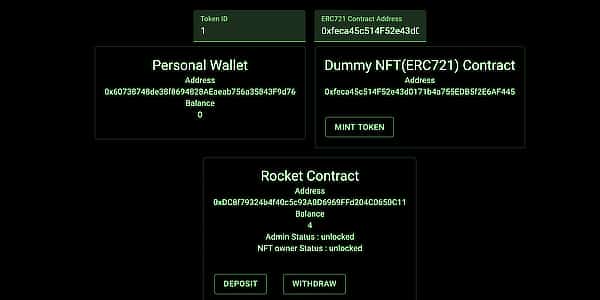

LINKUSDT & LINKBTC Daily TD Sequential Indicator TD9 Buy Setup | Source: TradingViewBut in the short term, its already recovered 10% back. And now a buy setup triggered on the TD Sequential indicator – on both the LINKUSD and LINKBTC trading pairs – pointing to a potential near-term recovery rally.

DeFi Token Yearn.Finance Cuts Valuation Down By Two-Thirds In Under 30 DaysYearn.Finance is also showing a similar signal, suggesting that DeFi tokens, in general, could make a comeback in terms of USD and in their ratio against Bitcoin. YFI has been hit even harder than Chainlink and remains down by 60% on both pairs.

RELATED READING | TOP DEFI COIN YEARN.FINANCE (YFI) JUST SLIPPED BY ANOTHER 10%

Yearn.Finance was once more valuable than four Bitcoins, according to the YFIBTC trading pair, but is now trading at barely over 1. The TD Sequential indicator showing a TD 9 buy setup on daily timeframes also suggests that Yearn.Finance could recover some of its lost gains.

YFIUSDT & YFIBTC Daily TD Sequential Indicator TD9 Buy Setup | Source: TradingViewWith the election heading into the fourth quarter of the year, and the recent news that stimulus money may be over until after then, the market is hazy on where it wants to turn next. After DeFi tokens have been so deflated, it is difficult to imagine more downside so soon. But considering how fast these assets climbed to the top, the fall to the bottom could be equally as hasty.

A decision should be made about the future of these DeFi tokens soon enough, according to the TD Sequential indicator.

Featured image from Deposit Photos, Charts from TradingView origin »Bitcoin price in Telegram @btc_price_every_hour

VIP Tokens (VIP) на Currencies.ru

|

|