2021-3-2 10:00 |

2020 was the year of DeFi, not just in terms of the explosive price increases – but the technological advances and support from public figures.

From the growth of UniSwap, Chainlink, AAVE, and BNB into the top 20 tokens by market cap to tech billionaire Mark Cuban revealing his positions in the aforementioned tokens, one must wonder what comes next.

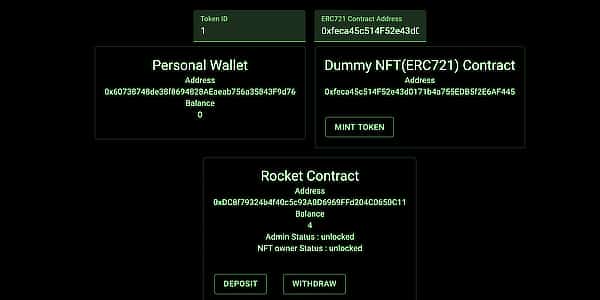

Improved security and auditing of contracts.Exploits performed by hackers on vulnerable DeFi smart contracts resulted in the loss of tens of millions of funds throughout 2020 and early 2021.

Flash loan attacks, where hackers can borrow large uncollateralized quantities of ETH and extract funds from exchange through complex arbitrage opportunities between stablecoins or manipulation of price oracles (the price providing part of a smart contract that interacts with market data outside the chain).

Auditing smart contracts before they go live as part of yield farming or lending strategies by third-party firms such as Nexus Mutual is necessary – and becoming the accepted norm for DeFi platforms. Users becoming acquainted with the basics of DeFi development processes and community-led initiatives to ensure complete auditing of contracts are also vital to its long-term resiliency.

ETH 2.0DeFi has grown from the Ethereum ecosystem but has reached a point where it is almost impossible to continue in the current Ethereum paradigm. ETH 2.0 promises lower fees – lending itself to the higher scalability that is needed for the financial products of the future. But more than lower fees, ETH 2.0 will hopefully address the first point raised.

As a proof-of-stake chain, Ethereum miners will be unable to modify blocks that have already been validated – ensuring the robustness needed for a secure financial ecosystem. Projects like Binance token (BNB) and Cardano (ADA) plan to capture the DeFi market through their blockchains, but with the overwhelming majority of initial development done on Ethereum, ETH 2.0 would likely place the chain in a dominant position over DeFi.

Regulatory PressuresRegulatory focus on crypto has primarily been placed on tax evasion and other fraudulent activity. DeFi. The regulatory framework for DeFi by the governments of the US, China, Russia is nearly non-existent.

Minimizing exit scams, implementing KYC on DEXs (decentralized-exchanges), and preventing money laundering remain pressing concerns.

Overbearing regulation, including policy, targeted explicitly at obstructing DeFi is a critical macro risk that users and project CEOs must be aware of and account for. Government Policy could ultimately end up much favoring centralized exchanges such as Coinbase – which filed to go public on the 25th.

Featured Image from Unsplash

origin »Bitcoin price in Telegram @btc_price_every_hour

VIP Tokens (VIP) на Currencies.ru

|

|