2024-5-7 20:00 |

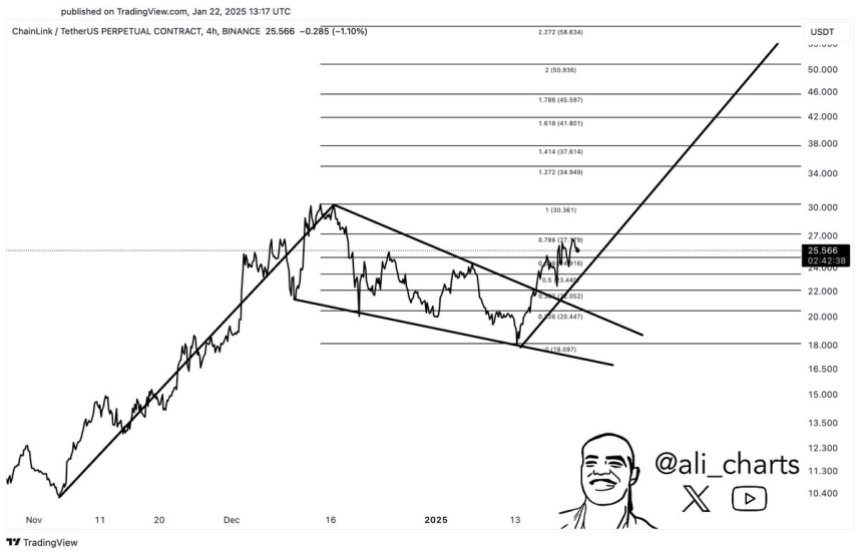

Popular cryptocurrency analyst, Michael van de Poppe has predicted a major bullish breakout for Chainlink (LINK), urging investors to hold on to their cryptocurrencies despite market volatility.

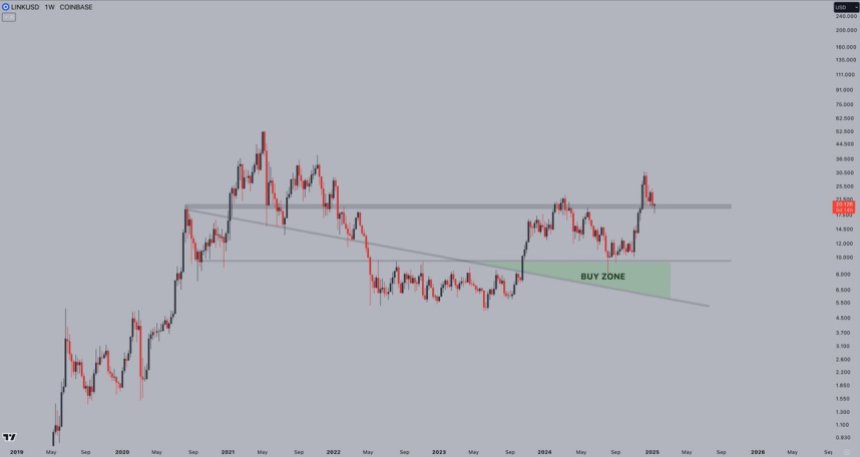

Analyst Cautions Against Premature Sell-OffIn an X (formerly Twitter) post on Monday, May 5, Poppe shared a LINK/BTC price chart, depicting historical price movements from 2018 to 2025. Based on the technical analysis of the cryptocurrency’s price action across previous market cycles, the crypto analyst noted that Chainlink was presently undergoing a retest at its low point.

This suggests that the cryptocurrency is experiencing a phase of reassessment and potential stabilization, followed by a possible price rebound. Poppe has disclosed that initiating sell-offs during Chainlink’s current price stage may not be a strategic move, as doing so could result in investors missing out on potential gains when the market rebounds from the temporary weakness.

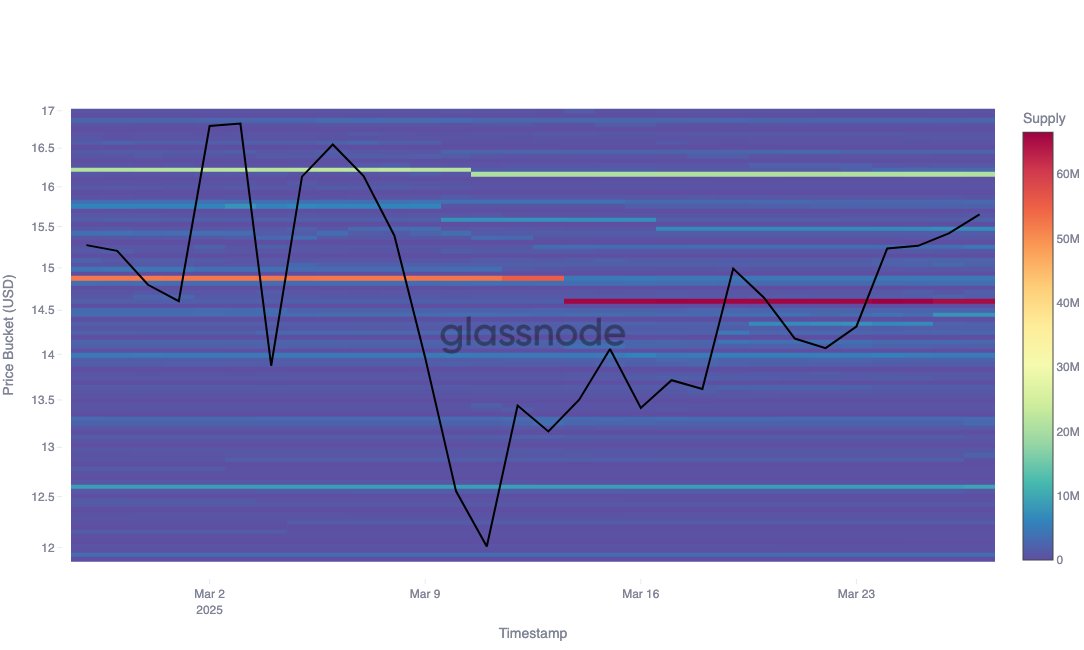

Highlighted in the price chart, the analyst disclosed that $0.0004480 was a crucial resistance level for a potentially strong breakout upwards. Additionally, the LINK/BTC ratio could undergo a trend switch at $0.0006721, as it begins to make “higher lows and higher highs.”

In addition to the optimistic outlook, the crypto analyst previously disclosed that Chainlink was getting close to its “bottom,” potentially testing new lows around 2,000 Satoshis (SATs) before surging upwards. He revealed that this phase was a prime buying period, acknowledging in an earlier post that he was already investing in Chainlink.

At the time of writing, Chainlink is down by 3.54% in the last 24 hours and trading at a price of $14.5%, according to CoinMarketCap. While the present market condition may have contributed to the price decline, the cryptocurrency has remained relatively stable, witnessing a price increase of 6.28% over the past seven days, and a massive 75.15% surge in its 24-hour trading volume.

Chainlink Becomes Top RWA By DevelopmentChainlink has ranked number one among the top Real World Assets (RWA) by development activities. According to market intelligence platform Santiment, Chainlink emerged as the leading project in the RWA sector, witnessing activities 2.49 times greater than that of the next most active project, Synthetix (SNX).

The blockchain platform disclosed that the top list was compiled by GitHub, an online software development platform. The criteria for evaluating the top RWA project in terms of development was based on counting non-redundant GitHub activities and averaging this daily activity over the past 30 days.

The result of the evaluation revealed Chainlink’s high level of developer engagement and activities, underscoring the ongoing progress and innovative processes within the crypto project.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|