2026-1-11 21:30 |

According to CryptoWzrd’s daily technical outlook, Chainlink closed the session without a clear directional bias, keeping the focus on the intraday structure. Price is currently confined to a tight range. A controlled dip toward the $12.80 support, followed by a bullish reaction, could present a long opportunity, while holding above $13.50 would open the door for further upside.

Indecisive Daily And Weekly Closes Signal Market UncertaintyMoving forward, CryptoWzrd noted that the daily candles for both Chainlink and LINK/BTC closed without conviction, reflecting ongoing indecision in the market. This lack of directional clarity suggests that neither buyers nor sellers are currently in full control, reinforcing the need for patience as prices continue to consolidate.

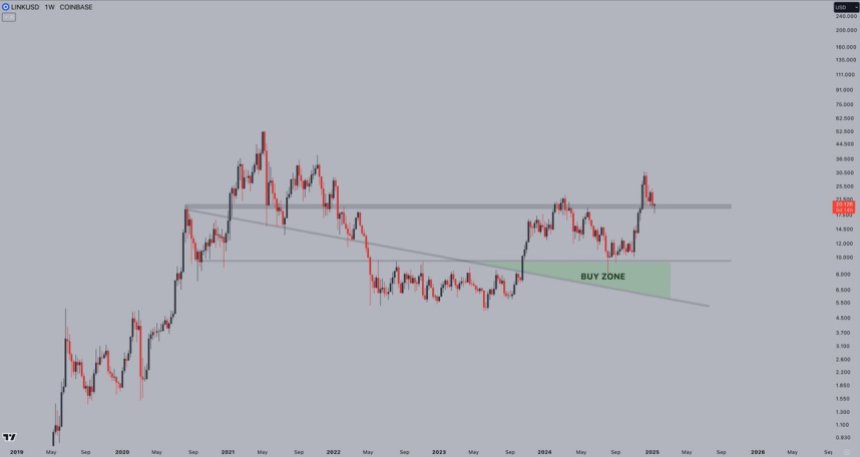

The indecision extends to the weekly timeframe as well, where candles also failed to deliver a decisive close. Currently, the chart still lacks maturity; therefore, healthier price action is needed before a clearer structural bias can be established.

From a relative strength perspective, LINK/BTC must push higher to confirm broader upside potential. That shift is likely to coincide with a decline in Bitcoin dominance, particularly if it breaks down and holds below the 59% support level. Until then, Chainlink may struggle to outperform on a sustained basis.

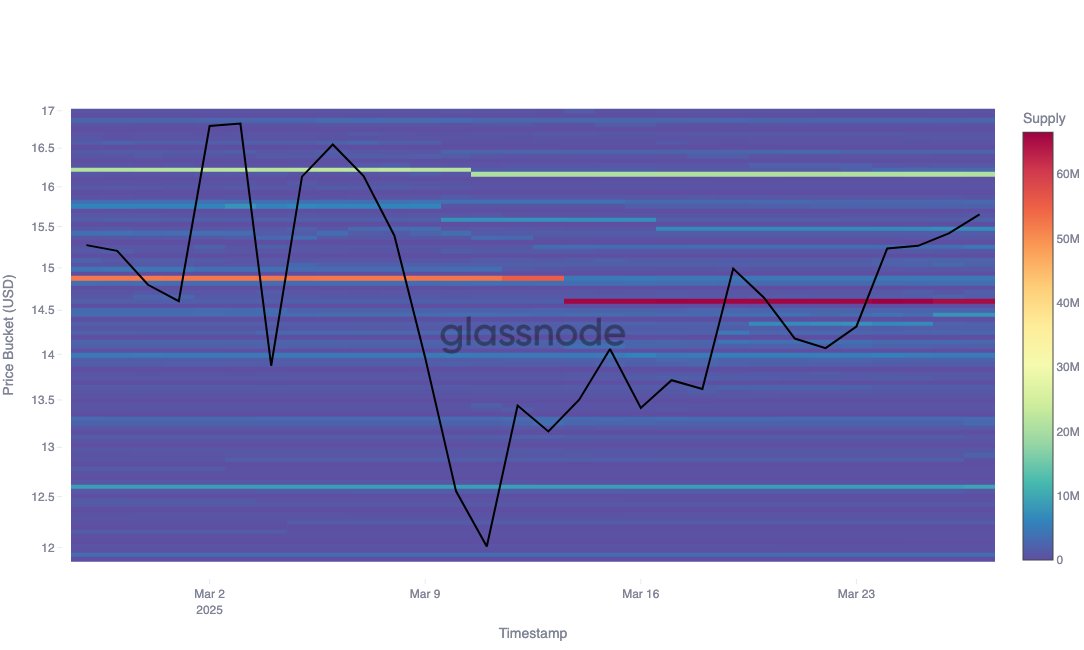

In the near term, LINK is expected to remain range-bound. On the upside, a clean break above the $16 resistance zone would significantly improve the bullish outlook and open the door to higher targets and stronger long setups.

Meanwhile, on the downside, the $12 area stands out as the primary support zone to watch. As long as price trades between these boundaries, focus remains on lower timeframes, where short-term structure and momentum shifts can offer scalp opportunities while the broader market waits for direction.

Choppy Intraday Action Signals Compression Before ExpansionThe analyst went on to conclude that intraday price action was notably choppy and slow, reflecting ongoing indecision and a lack of strong participation from either side of the market. Such conditions often act as a compression phase, where price builds energy before a larger move, increasing the likelihood of heightened volatility in the sessions ahead.

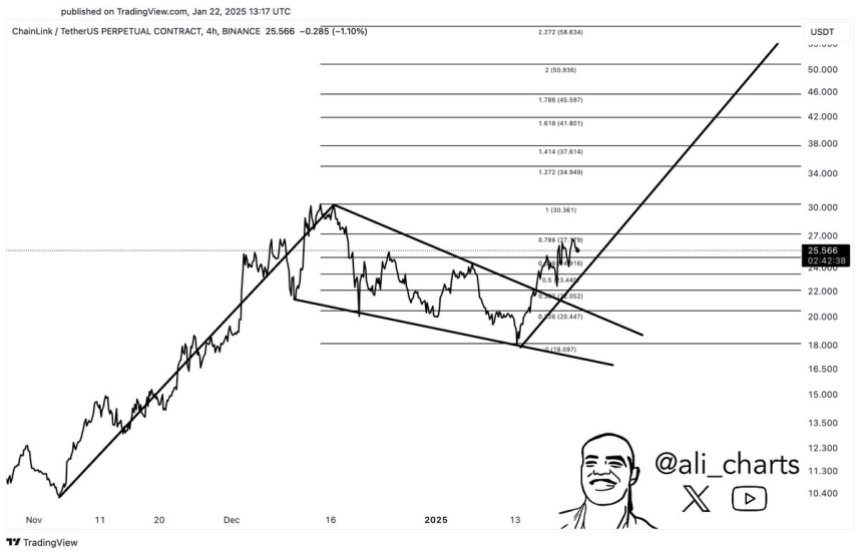

From a trading perspective, a clean bullish breakout above the $13.50 resistance level would serve as a clear long trigger, signaling renewed momentum and improved structure. An alternative scenario involves a bearish pullback toward the $12.80 support zone, which would also favor long positions following a convincing bullish reversal.

That said, Bitcoin’s direction remains a key driver and will likely dictate how Chainlink ultimately resolves its range. Until stronger confirmation appears, the emphasis remains on patience and discipline, waiting for the market to present a well-defined and healthy trading opportunity rather than forcing trades in low-quality conditions.

origin »Bitcoin price in Telegram @btc_price_every_hour

Crystal Clear (CCT) на Currencies.ru

|

|