2024-12-22 22:30 |

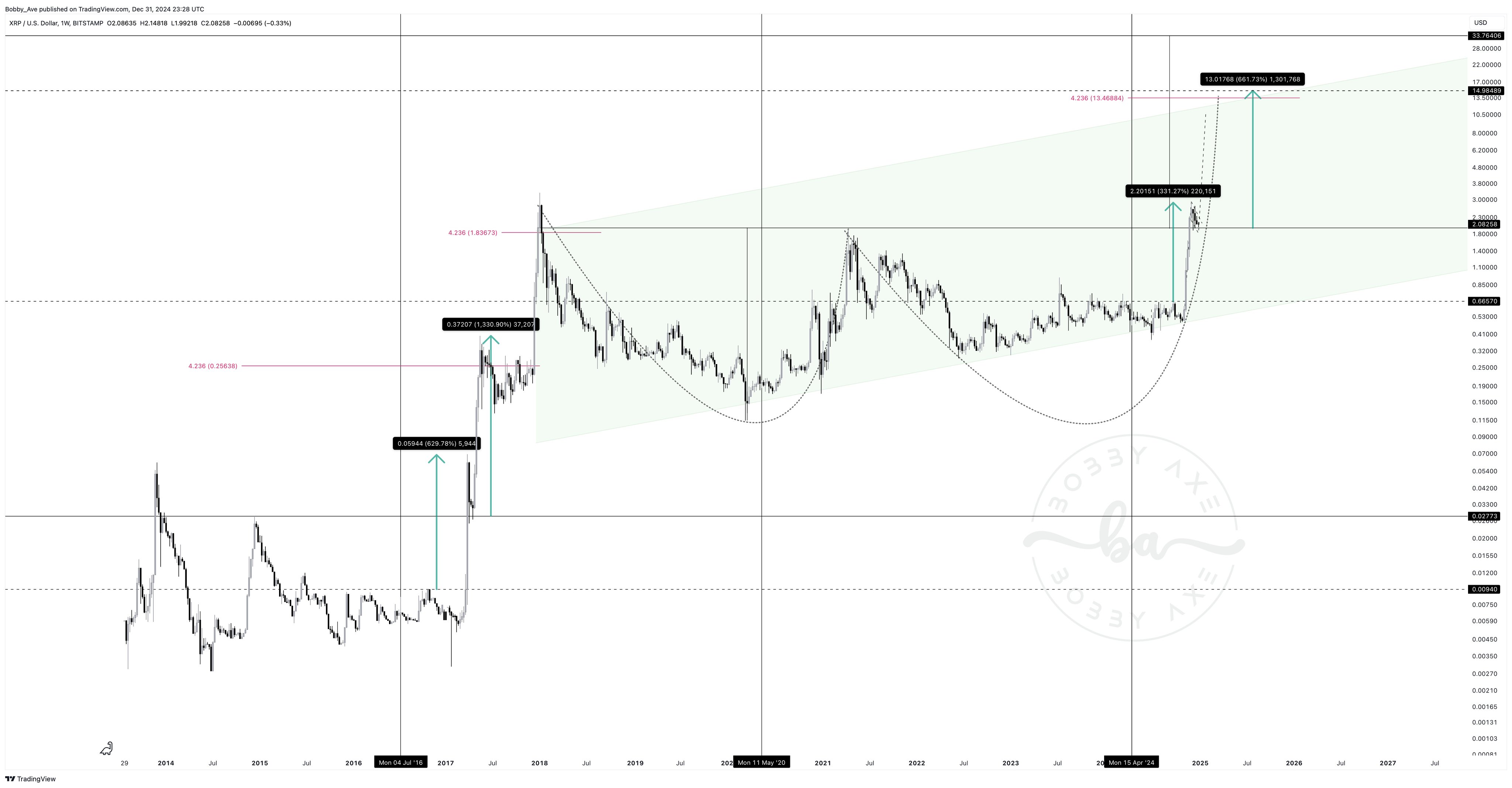

Crypto analyst Dark Defender has shared a detailed XRP price analysis on X, outlining parallel patterns between 4-hour and daily timeframes that could forecast future price movements. The analyst points to specific Fibonacci levels at $5.85 and $8.76 as potential targets if XRP breaks above $2.90.

Historical Pattern AnalysisDark Defender’s analysis reveals XRP’s previous surge from $1.2680 to $2.9070 following a 4-hour correction phase.

The price action demonstrated a clear ascending channel formation with defined support and resistance levels. The pattern showed a 21% retracement before launching into an upward trajectory.

XRP imitates the 4-hour (4-H) correction structure on the daily time frame.

After the 4-hour correction at that time, XRP ran from $1.2680 to $2.9070.

With a daily break above $2.90, the Frog Leap first to the upper Fibonacci Level sits at $5.85 and $8.76 in the short term.… pic.twitter.com/iOeEz17drG

The current daily timeframe exhibits similar characteristics to the previous 4-hour setup. A 34% correction from $2.9070 to $1.9010 mirrors the earlier percentage drops, suggesting a possible repeat of the bullish breakout scenario.

Technical Indicators and Price LevelsThe RSI data supports the observed price patterns across both timeframes.

On the 4-hour chart, the RSI peaked at the $1.2680 mark before showing bearish divergence. The subsequent recovery aligned with price increases, establishing a consistent technical narrative.

The analysis identifies key price levels for traders to monitor. The $2.90 mark serves as a primary resistance level, while support zones rest at $1.0033 and $1.9010. These levels form part of the broader ascending channel structure present in both timeframes.

Read also: Can VeChain (VET) Price Spike to $1 During This Bull Run?

Future Price ProjectionsDark Defender’s analysis suggests two major Fibonacci extension targets above the $2.90 resistance level. The first target sits at $5.85, with a secondary target at $8.76. The analyst estimates this potential breakout could materialize around December 24.

The analyst emphasizes these projections stem from technical analysis of chart patterns and Fibonacci levels, noting that the information does not constitute financial advice. The analysis focuses on historical price data and technical indicators to form these conclusions.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post XRP Price Analysis: Technical Patterns Signal Potential Targets Above $5 appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|