2024-5-20 12:06 |

Bitcoin has enjoyed a week of gains as the asset rose by `~8% pushing past the key US$66,000 price level. Wednesday last week was the deadline for institutional investors to file their quarterly 13F report with the US Securities and Exchange Commission. Filings revealed the positions of some of America’s biggest investors.

Hedge Fund Millennium Management, which has a total AUM of US$64 billion, disclosed that it held almost US$2 billion across a number of BTC spot ETFs during the filing period. The hedge fund, led by groundbreaking investor Israel Englander, holds US$844 million within BlackRock’s iShares Bitcoin Trust (IBIT). It also holds $800 million of the Fidelity Wise Origin Bitcoin Fund (FBTC).

Millennium Management’s US$2 billion position is followed by the Susquehanna International Group which has US$1 billion in spot BTC ETFs. Other major holders revealed include Bracebridge Capital (US$404 million), Boothbay Fund Management (US$303 million), and Morgan Stanley (US$269.9 million). The day earlier it was publicized that the State of Wisconsin had invested US$161 million into Bitcoin spot ETFs.

The disclosures reveal that battle-tested, successful institutional investors have backed BTC over the last quarter, pushing Bitcoin above the US$60,000 price level.

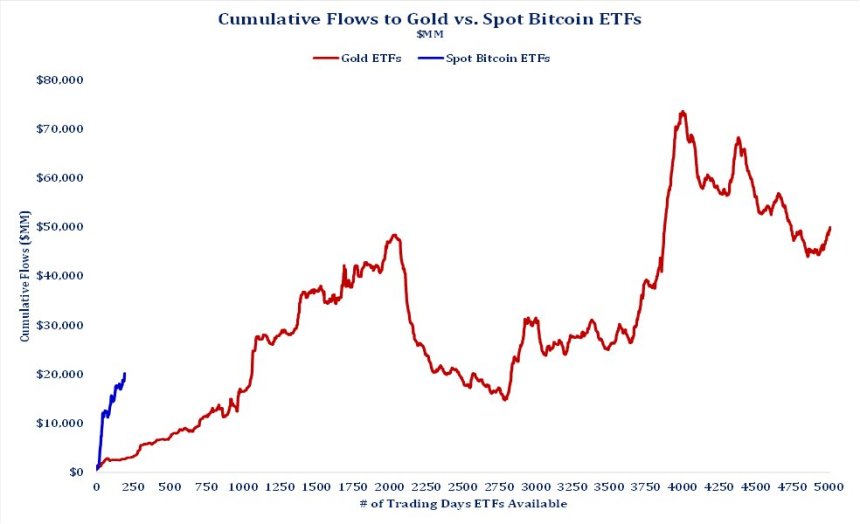

Matt Hougan, Chief Investment Officer evaluated the historic day of 13F filings and outlined in a blog post why he was so bullish. He explained — “This scale of ownership is off the charts for a new ETF. Most ETFs attract very few 13F filers in their first few months on the market.” This opinion was shared by Bloomberg’s ETF analyst Eric Balchunas who called the number of large-scale investors involved in Bitcoin “bonkers”.

Other bullish factors considered by Hougan include the quick due diligence for Bitcoin exposure conducted by the institutions and numerous platform-wide allocations conducted by investors where the entire client book was given a spot BTC ETF allocation.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|