2026-2-1 17:48 |

Demand for US-listed spot Bitcoin exchange-traded funds (ETFs) has reversed, with the 12 products recording $1.6 billion in net withdrawals this month.

Data from SoSoValue shows that this marks a third consecutive month of negative flows for the ETF products. During this period, the funds lost around $6 billion in flows.

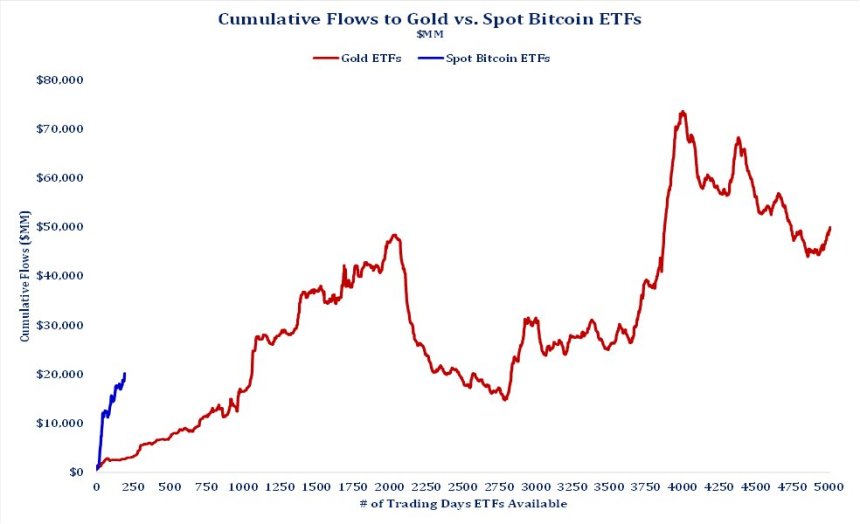

Bitcoin ETF Demand Reverses Course After Three Months of Sustained SellingMeanwhile, these monthly outflows represent the longest streak of losses since the US SEC authorized the products in January 2024.

US Bitcoin ETF Monthly Flows. Source: SoSo ValueMarket observers noted that persistent outflows indicate that demand for Bitcoin products has entered a sustained decline.

Notably, data from CryptoQuant further corroborates the downtrend. The 12 Bitcoin funds have collectively experienced an exodus of approximately 4,595 BTC since the start of 2026.

This year-to-date figure highlights a significant shift in investor sentiment compared to the record-breaking inflows of previous years. Indeed, the BTC products had pulled in nearly 40,000 BTC during the same period last year.

Demand for the Bitcoin ETF is reversing, compared to previous years.

Bitcoin ETF YTD Flows:

2024: +17,155 BTC

2025: +39,769 BTC

2026: -4,595 BTC pic.twitter.com/TT0cOdzxqR

Market observers attribute the exodus to a “narrative exhaustion” that has coincided with Bitcoin’s lackluster price performance.

Since reaching an all-time high of more than $126,000 in October 2025, BTC’s price has declined by more than 37%.

In light of this, Jim Bianco, founder of Bianco Research, suggested that the period of rapid institutional adoption has reached its logical conclusion.

“Markets are discounting mechanisms. They price the narrative long before the event occurs,” Bianco stated.

He noted that BTC’s transition into traditional finance fueled a 400% rally from the initial 2023 filings to the political shifts of late 2024.

However, he characterized the climb to $126,000 in late 2025 as a “zombie rally” driven by residual momentum rather than fresh capital.

Bitcoin Price Performance Since 2023. Source: Bianco ResearchAccording to him, the current market apathy is further evidenced by a lack of responsiveness to traditionally bullish headlines.

Thus, even positive developments such as the appointment of crypto-friendly officials to economic posts have failed to spark a recovery.

Consequently, Bianco suggests the “adoption story” is now fully priced into the market, returning Bitcoin to its status as a high-volatility risk asset.

This shift leaves ETF investors to grapple with the reality of a maturing market that is currently in retreat.

The post Bitcoin ETFs See $6 Billion Exit as Institutional Demand Cools appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|