2024-9-15 17:00 |

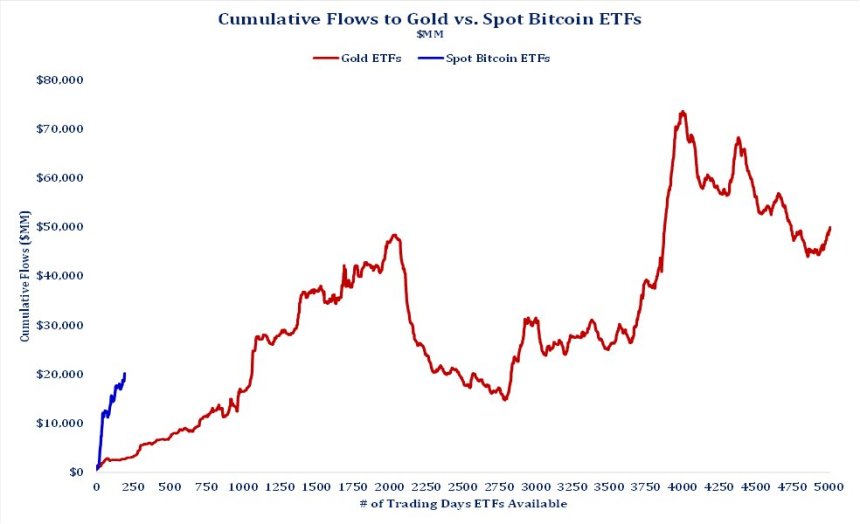

After the hype that greeted the US Securities and Exchange Commission’s approval of spot Bitcoin ETFs in January 2024 and the initial rush of inflows, assets held in Bitcoin ETFs have significantly reduced.

However, there is a new crypto coin that could help investors cope with the losses from the Bitcoin ETFs. Which token is this? And what do investors stand to benefit from investing in it? Stay tuned to find out!

Assets in Spot Bitcoin ETFs Fall To $46 Billion, Raising Concerns Over Immediate ImpactThe approval of the spot Bitcoin ETFs in early 2024 caused a burst of optimism in the crypto industry. Experts had long talked up the immediate impact of this approval, claiming that it would accelerate crypto adoption among traditional investors.

However, eight months later, the Bitcoin ETFs have failed to live up to the hype. The total number of assets in the various products has dropped to $46 billion, down from a peak of $62.55 billion early in June. This figure is also the lowest recorded since February.

Jim Bianco, founder of the financial markets research firm Bianco Research, has said that the current situation shows that ETFs might just be a “small tourist tool” instead of the means of mass adoption they were touted to be.

He also put the timeline for ETFs to become a major adoption tool around the next Bitcoin Halving in 2028. However, he claims cryptocurrencies must significantly develop decentralized finance (DeFi), non-fungible tokens (NFTs), and on-chain payments to drive this approval.

However, some other analysts disagree with him, claiming his conclusions about the Bitcoin ETFs are premature.

FXGuys Provides Respite to Frustrated InvestorsThe decline of Bitcoin ETFs has coincided with poor capital market performances, seriously limiting investors’ choices of outlets. However, FXGuys could be that outlet that lets investors regain some of their losses. How will this happen?

FXGuys is an innovative, first-of-its-kind Forex Trader Development Ecosystem. Its decentralized trading platform allows traders to access various asset classes, such as FX, equities, commodities, indices, and crypto.

Most importantly, FXGuys has a Funding Program that supports promising traders with up to $500,000 in trading capital. However, traders need to pass a challenge stage that shows they can handle the demands of trading. After this, they will get a $200,000 trading account.

With FXGuys, every trader is an earner. All traders will get $FXG tokens whether they earn profit or not. However, profitable traders will receive 80% of their profits, with FXGuys taking 20%. Traders’ profit margins can increase as their profits scale, giving them a fair reward for their efforts.

The private sale phase is another aspect of FXGuys that investors can find joy in. $FXG is currently sold for $0.015 in the private sale phase. It could potentially rise by 100% by the start of the public presale and 566% by its end, turning massive profits for early investors.

>>> JOIN FXGuys PRESALE <<<

Purchase $FXG to Regain Losses and Enjoy Exciting Privileges$FXG is FXGuy’s ERC-20 utility token with a total supply of 835 billion. 35% of this supply is earmarked for public sale, 17% for staking and rewards pool, 11% for marketing, and 10% for listing and liquidity. The remaining 27% is allocated to the private round, funding program, the team, legal, and seed.

The private sale round is ongoing, and $FXG is priced at $0.015. Investors who buy now will earn a 100% profit when the token rises to $0.030 at the beginning of the public presale. They will also benefit from a predicted 566% surge by launch.

What’s more, $FXG holders will enjoy a share of the platform’s revenues. They will also receive trading discounts. Additionally, token holders can stake their tokens and earn up to 30% APY.

These features and benefits show that FXGuys can rekindle hope for struggling investors amid the panic created by falling Bitcoin ETFs!

Visit FXGuysPresale

Join The $FXG Community

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Spot Bitcoin ETFs Plummet To Seven-Month Low, Is There Hope For Crypto Investors With This $0.015 Token? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|