2024-9-24 16:01 |

United States spot Ether exchange-traded funds (ETFs) have posted their largest daily outflows since late July, with more than $79 million being withdrawn on Monday in a sign of faltering institutional demand for the industry’s second-biggest crypto.

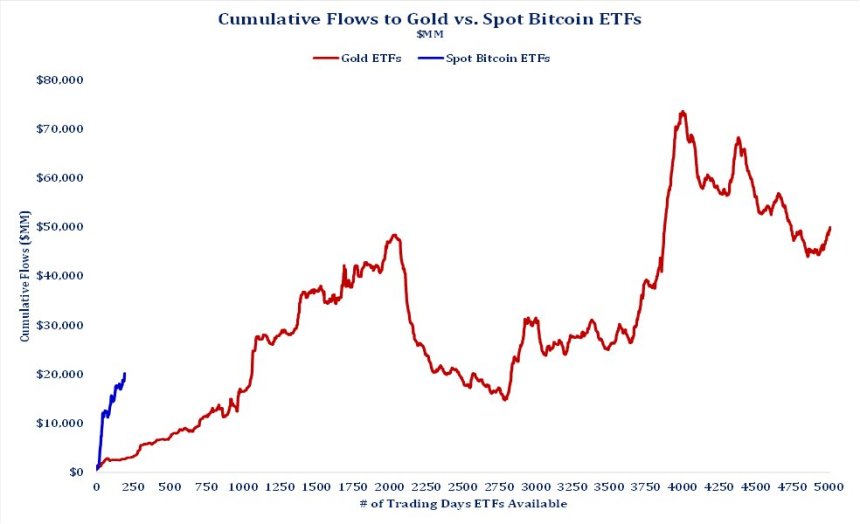

Conversely, spot Bitcoin ETFs saw positive inflows during the same period.

Ether ETFs Bleed While Bitcoin ETFs Cash InIs Ethereum (ETH) losing steam with mainstream investors and institutions? Data on how much money flows into and out of the newly-launched nine spot Ether exchange-traded funds (ETFs) seems to show just that.

The ETH ETFs bled $79.21 million on Monday, marking their largest single-day outflow since July 29, according to Farside Investors data.

The Grayscale Ethereum Trust (ETHE) led the losses, with investors withdrawing $80.55 million from the fund. Since its conversion to a spot ETF, ETHE has faced massive outflows of roughly $2.8 billion in Ether, amounting to 32% of its initial $9 billion ETH holdings. Monday’s outflows broke a brief two-day inflow streak for these products.

Bitwise’s ETHW was the only gainer, with investors purchasing $1.3 million worth of shares in the fund. Other ETFs reported zero flows.

The lackluster demand for spot ETH ETFs has continued since they first went live on U.S. exchanges on July 23. BlackRock’s iShares Ethereum Trust (ETHA) currently leads the pack in terms of total inflows and was the first to hit $1 billion in net capital. Fidelity’s Ethereum Fund (FETH) comes in second spot, followed by Bitwise’s ETHW.

The outflows on Monday came despite a wider crypto market rally spurred by the recent Federal Reserve rate cut, which helped propel the ether price by over 15% in the last seven days. Nonetheless, the dissociation between ETH’s price movement and ETF outflows signals that traditional investors remain skeptical about the asset’s growth potential in the long term.

Ethereum Spot ETFs keep seeing outflows even when the price of ETH rises. This is why.

In the last week, the price of ETH has climbed nearly 15%, as the sentiment in the crypto market has turned more positive.

It is interesting that Ethereum Spot ETFs continue to see a net… pic.twitter.com/Pb9itT9pJZ

While Ethereum ETFs suffered, their spot Bitcoin counterparts saw net inflows of $4.56 million on Monday, marking their third straight day of gains.

Data shows that Fidelity’s FBTC showed robust performance with a single-day net inflow of $24.93 million. BlackRock’s IBIT, the biggest spot BTC fund by net assets, drew in $11.6 million in investor money, while Grayscale’s GBTC recorded inflows of $8.4 million.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|