2021-2-10 17:30 |

The frenzy in Bitcoin prices that was started this week by Elon Musk’s Tesla by announcing that the company purchased $1.5 billion worth of Bitcoin, 8% of the company's cash reserves, took a small hit after actress Lindsey Lohan tweeted “bitcoin to the moon.”

This might have triggered some January 2018 top vibes for CT when singer Katy Perry painted her nails with cryptocurrencies’ logos during the last bull run.

Soon after Lohan’s tweet, the price of Bitcoin dumped about $2k to $44,575. But BTC/USD is back above $45,600, so all seems fine, for now.

The bigger theme in the market right now is who and which company will be the ones to buy Bitcoin Bitcoin next after Tesla, Square, and MicroStrategy.

“One by one, corporations will add Bitcoin to their balance sheets and it couldn’t get bigger than Tesla,” said Vijay Ayyar, head of Asia Pacific at cryptocurrency exchange Luno in Singapore.

While the crypto market is as bullish as ever and given they correctly predicted such a move, they are confident that more high-profile names, major companies, and even municipalities are going to announce their BTC allocation. The traditional market continues to be bearish and extremely conservative, still stuck at speculative mania and its daily usage, and missing the train.

Not only increased interest in the digital asset was evident from MicroStrategy’s Bitcoin Summit conference attended by over a thousand companies it is also reflected on the largest network.

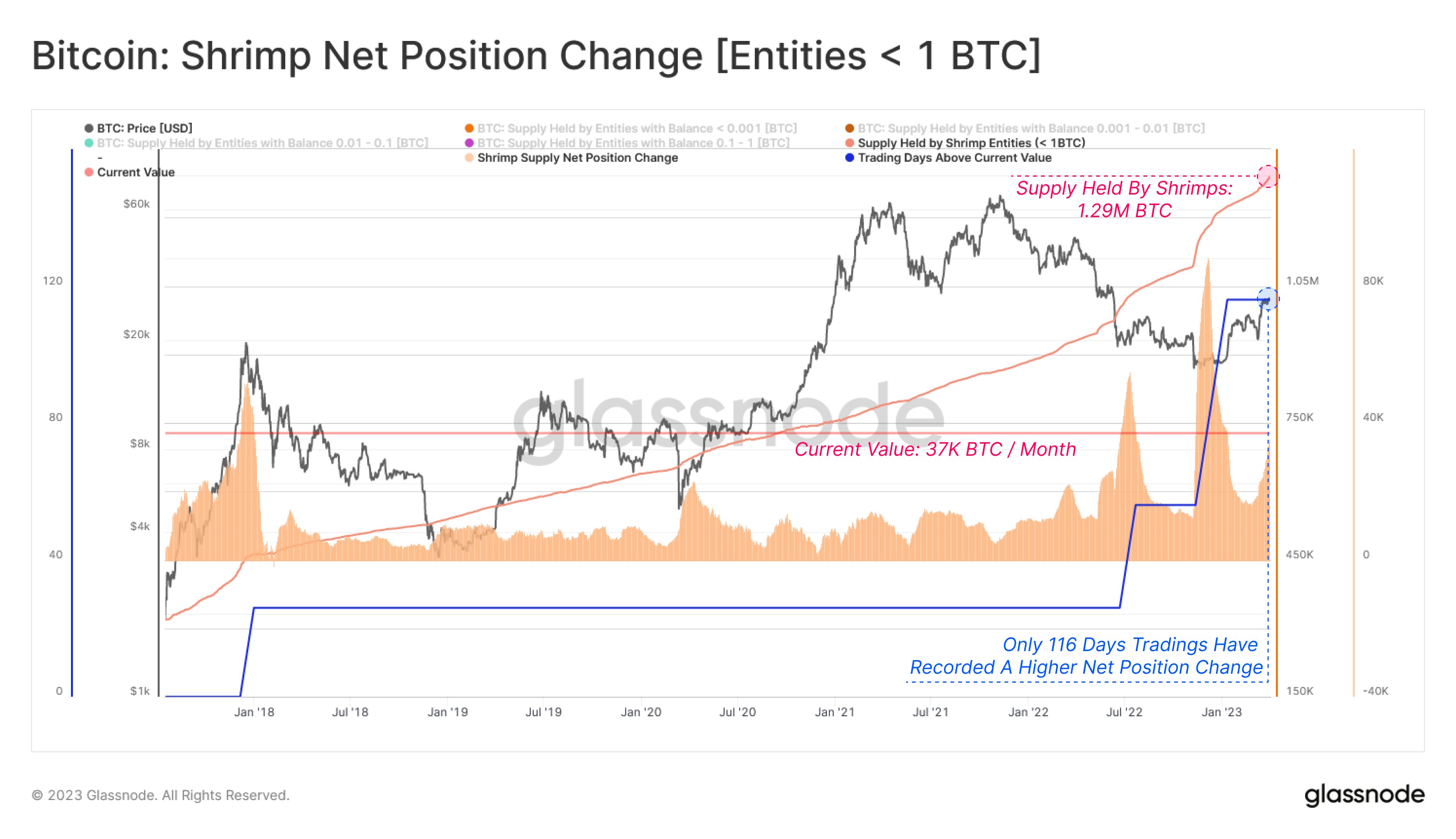

The number of addresses holding 1k and 10k BTC, institution-sized amounts, have increased significantly since late 2020, so much so, they now hold about 30% of the total BTC supply, as per Coin Metrics.

Source: CoinMetrics

At the same time, addresses holding between 10 and 1,000 BTC have been losing their share. But much like large holders, small-holders which are retail-sized investors are also busty accumulating with those addresses holding between 0 and 10 BTC gaining the supply share since mid-2020.

Bitcoin/USD BTCUSD 45,532.6995 -$18.21 -0.04% Volume 88.75 b Change -$18.21 Open$45,532.6995 Circulating 18.63 m Market Cap 848.05 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Retail & Institutional Investors Continue to Gobble More and More of Bitcoin’s Supply first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|