2021-3-17 14:36 |

Research strategists at JPMorgan Chase, a top U.S investment bank, revealed that there are more retail traders investing in Bitcoin than there are institutional traders.

The report reveals that retail investors have bought over 187,000 Bitcoin using Square and PayPal this quarter. However, institutional investors bought 173,000 BTC, which means retail investors have bought higher.

When Bitcoin initiated its bull run in October last year, it was mainly engineered by institutional investors. But presently, retail traders have increased their activities in the Bitcoin market. They are gradually wielding more power, as shown during Reddit’s WallStreetBets community.

After massive Bitcoin investments from top companies like MassMutual, Tesla, and MicroStrategy, Bitcoin’s price was appreciated massively.

The massive price increase also catches the attention of the average everyday trader. According to the JPMorgan report, retail has started gaining higher portions of Bitcoin since the beginning of the first quarter of the year.

Several factors contributing to increased retail influenceEd Moya, a senior market analyst at Oanda, stated that the sudden rise of retail interest is a result of stimulus payouts, the current NFT craze, and social media influence. He reiterated that the stimulus payout has given some traders extra cash to add to their investment, and many of them chose Bitcoin.

More recently, the Reddit-fueled meme stock trend has also contributed to the massive investment by retail traders.

He added that many retail traders suffered losses from trading “meme-stocks”. But Bitcoin has become their lifesaver as it has remained bullish during the pandemic.

Brian Vendig, president of JPMorgan Wealth Advisors, opined that the fear of missing out on high-yielding investment has driven retail investments. As institutional investors are busy grabbing any piece of Bitcoin they can get, retail investors do not want to be left out.

Retail investors growing in influenceOver the weekend, Bitcoin reached as far as $62,000 per coin. But it has since fallen to $56,000. This is still high, considering the price of the top crypto asset at the beginning of the year.

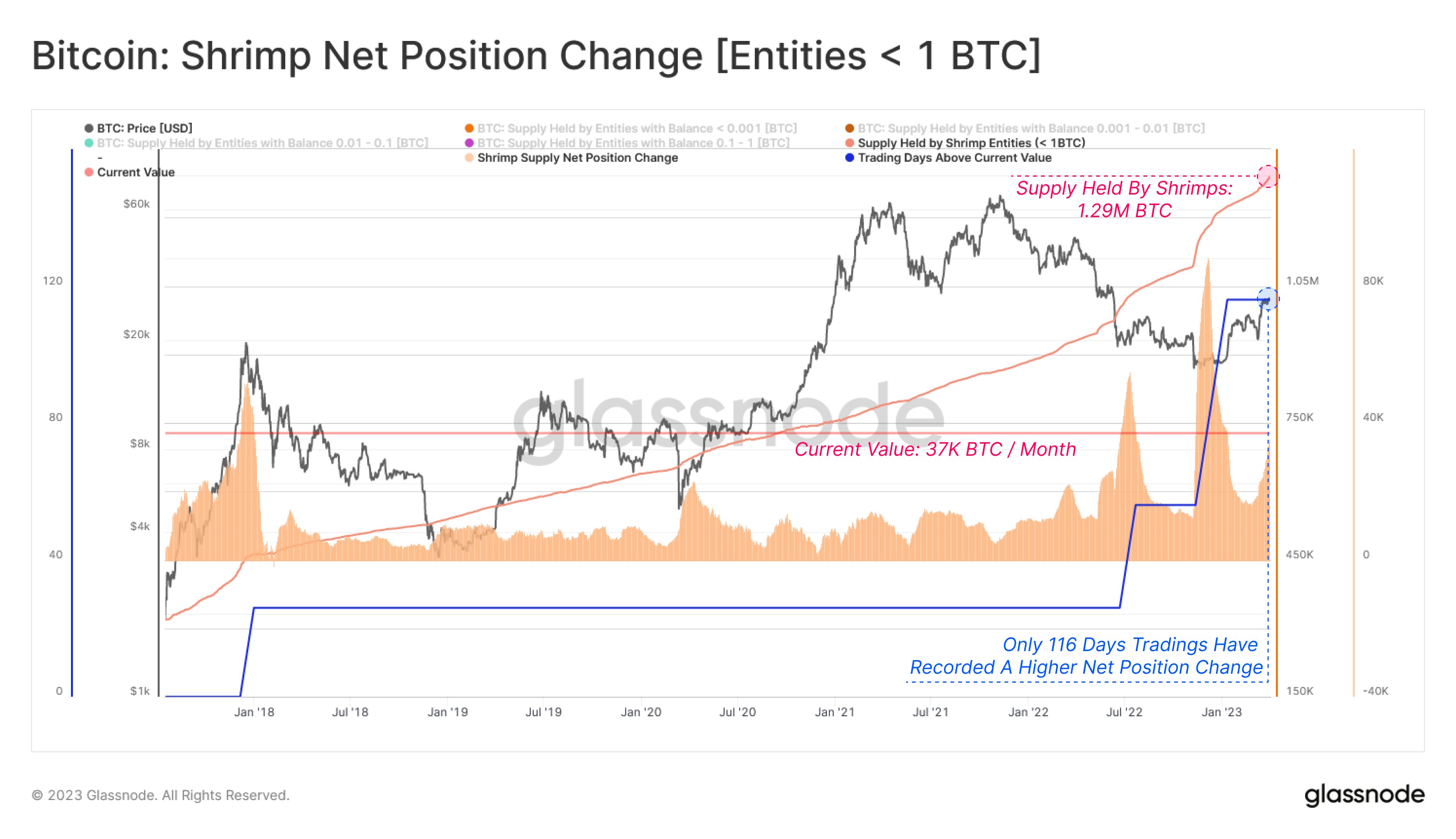

While institutional investors were responsible for Bitcoin’s push at the beginning of the year, the price of the coin in the past few weeks have been influenced by retail investors. According to data aggregator Glassnode, retail investors are doing extremely well in the market and are growing massively in influence.

The post JPMorgan says retail Bitcoin investors are now out-buying institutions appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|