2020-7-3 20:54 |

The latest study titled, “Retail Investors Steady in Physical Bitcoin Snatch-Up” talks about how the remaining 10% of bitcoin supply will take 120 years to come to market, reflecting just how scarce the leading digital asset is already and “looks to displace gold as the global store-of-value.”

Bitcoin’s limited supply is what makes this digital asset so attractive, especially during the current unprecedented money printing by governments around the world.

The Supply & Demand of itWhen the first block of the digital asset was solved, the miner was rewarded with 50 Bitcoin, which in May 2020 was reduced to 6.25 BTC.

The creator of the cryptocurrency, pseudonymous Satoshi Nakamoto designed its inflation rate to “emulate the new supply of gold coming to the market,” as such every four years it goes through halving that decreases the miners’ rewards by half until 21 million BTC are created. At that point, there won’t be any new supply.

Currently, 900 BTC is generated per day, and before this decade is over, only 225 new BTC will enter the market as fresh supply. “This means a near 90% loss in new supply – within the next eight years alone.”

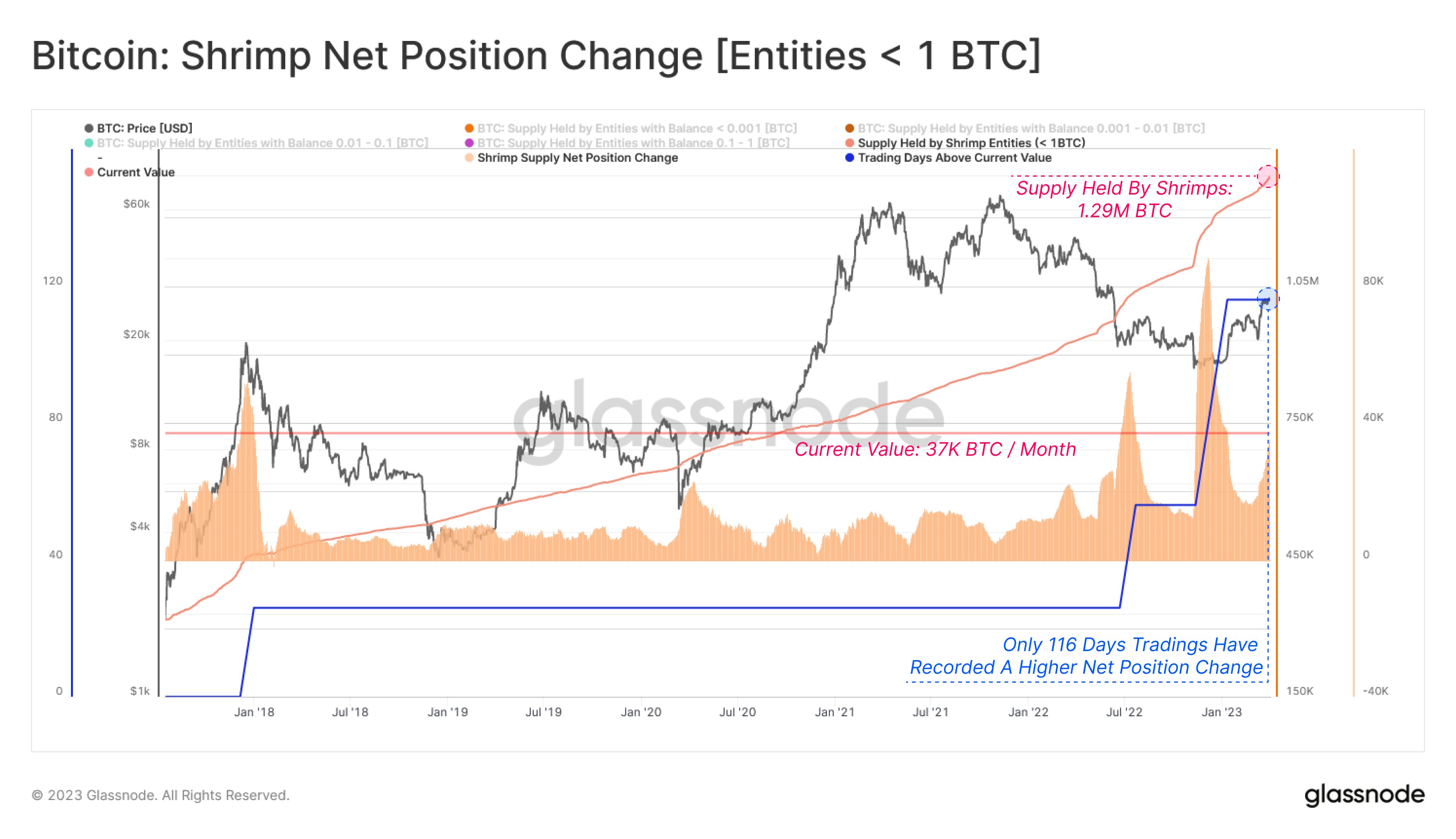

Now, if we look at the demand side, as Chainalysis data states, there's a continuous growth in bitcoin investment regardless of its price.

Interestingly, even during the global market sell-off when BTC also crashed, addresses/entities with rounded bitcoins, 1, 2 up to 10, increased and have grown by 11% since the start of the year and have “yet to see a single month in decline” since April 2019.

Source: Zubr via Chainalysis DataIn April 2020, addresses holding exactly 1, 2, 3 all the way to 10 BTC have surpassed 500,000 and have been growing every month since the start of the 2018 bear market except for a single month.

“The value of these on-chain holdings at the start of June 2020 breached the $5bn mark for the third time ever.”

Zubr extrapolates future demand at this pace which points to a “very dramatic shift in 2028” when these retail addresses begin to eat up all the new supply alone, which means in about 2024, they will be gobbling up more than 50% of the physical supply.

Source: Zubr via Chainalysis Data Replacing GoldThe traditional safe-haven asset gold is a valuable commodity because of one of its main attributes that is a limited supply – “an attribute that Bitcoin is designed to mimic in electronic format.”

But while technology helps bitcoin remains truly limited in supply, it has done the opposite to the bullion.

The new quantity of gold entering the market has been actually increasing, in 2019 gold production rose by 11% over 2010, as per the World Gold Council. On the other hand, there has been a decline in demand.

However during the coronavirus pandemic, both gold and bitcoin saw “strong demand.” But gold faced supply interruption due to lockdown which resulted in price dislocation so much so the spread between London's spot market and COMEX gold futures rose by 700% which usually is just a few US Dollars.

Such production supply disruptions are unlikely to be a problem with bitcoin, an electronically transferable commodity but “physical Bitcoin supply-constraints could have the same effect regardless and in turn, as seen with gold, push prices further higher.”

But the critical difference is these supply constraints will be the result of the “permanent perpetual nature of the store-of-value cryptocurrency that is designed to cut off new supply,” which might come sooner if the demand from small investors remains as steady as it has been all these years.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,106.5015 change ~ -1.53%Coin Market Cap

$167.76 Billion24 Hour Volume

$4.03 Billion24 Hour VWAP

$9.11 K24 Hour Change

$-139.7101 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|