2026-1-17 02:00 |

A few days ago, the price of Bitcoin experienced a bounce after weeks of trading below the $91,000 mark. However, this renewed momentum appears to be gradually fading as the crypto market slowly shifts toward a bearish state, with large and retail BTC investors moving in a distinct direction.

What’s Happening Behind The Bitcoin’s RiseBitcoin may have slightly pulled back from its most recent bounce, but the price is still holding strong above the $95,000 level. Meanwhile, the latest jump has attracted significant attention in the broader cryptocurrency market, with the move being increasingly viewed as well-justified rather than speculative.

Currently, on-chain and market data are showing a clear divergence in who is driving the ongoing move. Santiment, a leading market intelligence and on-chain data analytics platform, disclosed that itcoin’s surge to a high of $97,800 on Wednesday seemed more than warranted due to the behavior of large and retail investors.

Institutions, long-term investors, and big wallets, together referred to as smart money, have been discreetly accumulating while retail traders have been gradually lowering their exposure and selling into strength. With the rotation of supply from weaker hands to more conviction-driven investors reducing selling pressure, the rally’s foundation is being strengthened.

When whales are buying more BTC, and retail investors are dumping, it reflects a very bullish market outlook. Since January 10, whales and sharks, particularly wallets holding between 10 and 10,000 BTC, have been amassing BTC, collectively scooping up more than 32,693 BTC. This massive purchase represents a +0.24% rise to their collective holdings.

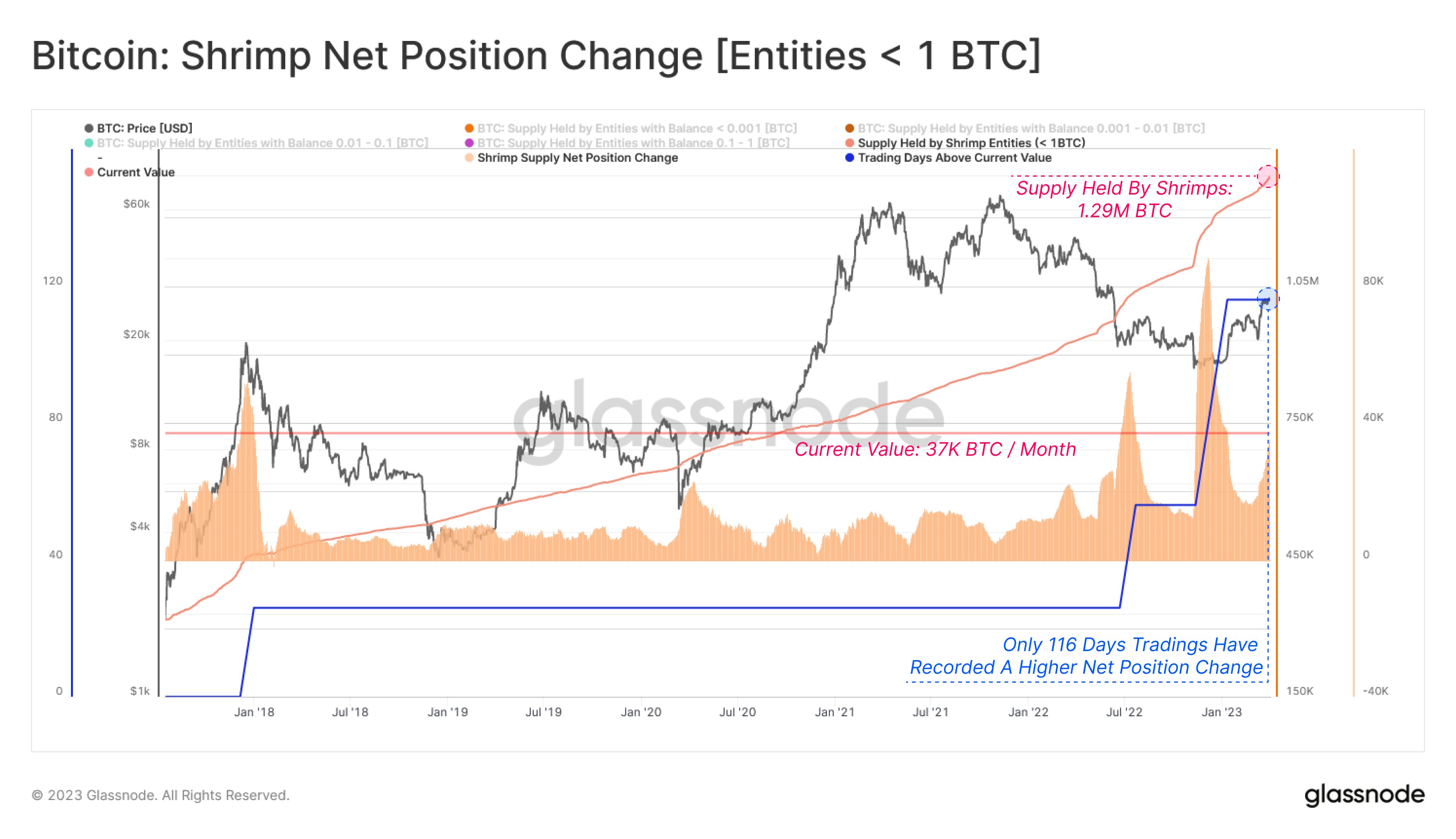

On the other hand, retail or shrimp holders, those holding less than 0.01 BTC, have collectively offloaded over 149 BTC since January 10. Data shows that the dump represents a 30% decline in their holdings altogether.

Santiment highlighted that the key signal underneath the action is that smart money is finally buying consistently, while micro money bows out. Furthermore, it is considered an ideal setup for a bull run. However, how long retail doubts the formed tiny rally will determine how long it lasts, and the “Very Bullish” green zone is still in place for the time being.

Ongoing FUD In The Market Set To Propel BTC’s PriceEven with the recent recovery, Bitcoin is seeing negative interactions from crypto enthusiasts and analysts on social media platforms. This behavior implies that the crowd is not entirely confident in the BTC rally that occurred on Wednesday. Although the development may seem present itself as negative, it is actually a good sign that the rally might extend.

Social data reveals that commentary toward BTC across social media platforms has sharply leaned to a bearish outlook as prices have bounced this week. With markets often moving in the opposite direction of retail sentiment, Santiment noted that the most FUD in 10 days is likely to propel BTC to its first return above the $100,000 mark, which was last seen on November 13, 2025.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|