2021-5-20 14:41 |

The recent crypto market crash has seen even the largest coins drop from their high levels by as much as 30%, or even more in some cases. Meanwhile, the crypto industry started delving deep into speculation, trying to determine what exactly was the cause of the price drop.

The initial blame fell on Elon Musk and Tesla, as the crash started right after Tesla announced that it will no longer accept crypto payments for its electric cars. However, those claims were quickly disproven by experts.

Another theory was that China’s newest crypto crackdown may be the reason, but Okcoin’s CEO, Hong Fang, said that the crypto ban was nothing new, and certainly not something that could have surprised people.

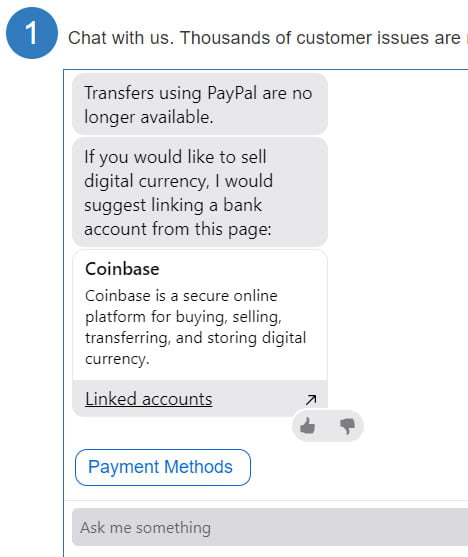

How does the crash affect crypto businesses?Dan Dolev, Mizuho Securities analyst, was asked in a recent interview with CNBC whether Coinbase can be viewed apart from cryptos, or if it is going to spend its life as a prisoner of what happens to crypto markets. Dolev said that 80% of Coinbase revenue is tied to retain trading fees. He also pointed out that the yields on the trading fees are expected to come down, or rather — to keep going down.

The yields have already seen a dramatic decline between Q4 2020 and Q1 2021, going from 1.4% to 1.2%. Meanwhile, as competition continues to heat up, this decline is expected to keep going. Meanwhile, Coinbase is earning as much as it could earn, although its future revenue might be endangered by the current events.

The post Market speculation goes through the roof due to the recent crypto sell-off appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|