2018-12-5 00:24 |

The words “death spiral” have been tossed around the crypto mining community in recent weeks. Is bitcoin really going into a miner-induced death spiral? Is this the end of bitcoin as we know it? Or is this just an over-hyped source of FUD?

The team at The Block recently addressed the issue of the bitcoin mining death spiral. In The Block’s article, they discussed why crypto fund managers and crypto users alike are talking about a miner-induced death spiral.

Bitcoin is Not Going Into a Miner-Induced Death SpiralFirst, let’s address the rumors: the rumors argue that bitcoin is going into a miner-induced death spiral.

It’s true: there’s a possibility for a miner-induced death spiral to take place in the bitcoin community. However, as analysts like Ari Paul have pointed out, there are economic incentives to prevent that from happening:

“Had a short debate on crypto twitter about realities of a Bitcoin hashpower “death spiral” and what assumptions go into dismissing it as a risk. The TDLR: holders of BTC or equity in key service providers probably have incentive to mine uneconomically to prevent it.”

Had a short debate on crypto twitter about realities of a Bitcoin hashpower "death spiral" and what assumptions go into dismissing it as a risk. The TDLR: holders of BTC or equity in key service providers probably have incentive to mine uneconomically to prevent it.

— Ari Paul (@AriDavidPaul) December 3, 2018

In the extremely unlikely scenario that bitcoin hashrate drops significantly, miners can continue running by increasing fees. If the increased fees aren’t sufficient, then there could be an emergency bitcoin fork to manually lower difficulty on the bitcoin network.

Both of these systems are built into bitcoin specifically to prevent a bitcoin mining death spiral.

How Does a Bitcoin Mining Death Spiral Start?It seems unlikely that a bitcoin mining death spiral will ever occur. However, if it does occur, here’s what would take place:

Bitcoin prices drop by a significant amount in a short period of time Marginally-profitable bitcoin miners shut down due to the declining price More and more bitcoin miners continue shutting down At some point, all of the miners are gone and nobody mines bitcoin, at which point bitcoin is deadThe argument sounds legit. What’s to prevent such a situation from taking place? However, the argument hinges on a few assumptions.

What Needs to Happen for a Bitcoin Death Spiral to Occur?For a bitcoin death spiral to start, the following conditions need to take place:

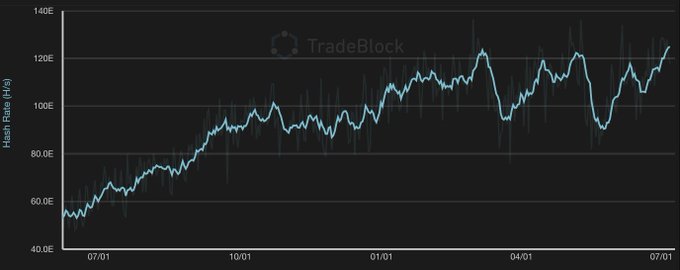

The price of bitcoin needs to drop below $1,000 Hashrate needs to dramatically drop off before the difficulty adjustment, which is the variable representing the difficulty of mining a new bitcoin block Miners who act rationally in the short-term need to shut off all of their bitcoin miners or mine altcoins instead of mining bitcoin at a lossThe crux of the bitcoin mining death spiral argument has to do with difficulty adjustments. The difficulty of the bitcoin network continuously adjusts to the hashrate. Difficulty adjustments occur every 2016 blocks, which works out to one difficulty adjustment every two weeks. If the price drops to $1,000 in between a difficulty adjustment and there’s a mass exodus of bitcoin miners, then it’s possible we could see the start of a bitcoin mining death spiral.

We’ve Seen Mining Death Spiral Discussions BeforeBack in 2011, the bitcoin community was rattled with discussions of a bitcoin mining death spiral.

During that time, the same arguments were discussed. Some thought it was the end of bitcoin as we knew it. Others thought a mining death spiral seemed unlikely.

Check out this post from the Bitcointalk forums in 2011, for example, as spotted by The Block. That post by Kano talks about the exact situation mentioned above:

“…a short time frame drop in the network capacity by 50% would mean that the number of days remaining of the 2 weeks, would double thus extending out the slow down of the transaction confirmation in the network and thus having all the roll on effects that this would lead to including the possible self perpetuating spiral down that it could cause.”

The issue was brought up again in 2015 when ASICs were starting to hit the bitcoin scene. Messari CTO Dan McArdle tweeted in January 2015, for example,

“What happened to everyone arguing that price-drop -> miners leaving -> systemic incentive fail spiral? Did it not happen after all? #duh”

The Game Theory Behind Bitcoin Remains the SameIt’s true that bitcoin mining has changed significantly since 2009. We’ve gone from Satoshi mining the first bitcoin block with (presumably) a basic desktop computer to hobby miners, GPU miners, ASIC miners, and massive bitcoin mining farms.

Despite these massive changes, the game theory behind bitcoin remains the same. It’s this game theory that has kept the bitcoin network running since January 2009.

Bitcoin’s game theory ensures the following occurs to prevent a death spiral:

The price of bitcoin falls, causing bitcoin’s hash power to drop either a little or a lot If bitcoin’s hashpower drops a lot (which is very unlikely), then bitcoin will be faced with a chain halt for the first time in its history, at which point the community will hard fork to a new, lower difficulty, after which block production will resume as normal If bitcoin’s hashpower drops a little bit (which is much more likely), then block production will temporarily slow down for a maximum of 2016 blocks until the difficulty is adjusted; difficulty will be reduced to accommodate the lower hashrate, at which point block production will resume as normalIn both of these scenarios, block production eventually resumes as normal.

Myths About the Bitcoin Death SpiralThe Block also clarified some of the myths regarding the bitcoin death spiral, including misconceptions users seem to have about how bitcoin mining works.

Mining Isn’t As Expensive As You ThinkThe break-even cost of mining is lower for many miners than what is often quoted by analysts. The costs you see online, for example, are often the costs for an average miner. Half of bitcoin miners can mine bitcoin more cheaply than that average cost. As The Block explains,

“many of the most profitable miners have a “cost per bitcoin” (opex + capex) that asymptotically approaches 0.”

The largest miners can access specially discounted rates of electricity, for example, and enjoy bulk discounts on ASICs. This gives larger miners a significant advantage over smaller miners.

Miners Don’t Instantly Stop Mining When the Price Drops; Miners Have an Incentive to Continue Mining at a LossThe bitcoin death spiral theory is based on the idea that bitcoin miners will act rationally in the short-term. When the price of bitcoin drops, these miners will leave the market. However, this doesn’t necessarily take place.

Just like traditional commodity producers, bitcoin miners have an incentive to mine at a loss. They have things like long-term purchase agreements, hardware purchase agreements, and facility leases. When these constraints are taken into account, combined with strategically-planned cash reserves, it’s easy to see why miners can mine at a loss for an extended period of time.

The Faster Bitcoin is Mined, the Sooner the Next Difficulty Adjustment is ReachedIn traditional commodity markets, commodity producers who mine at a loss will add supply to the market, which will continue to supress the price. In bitcoin, there’s no such effect. Rational miners want to mine bitcoin in order to accelerate the time to the next difficulty adjustment. Miners that endure a crypto bear market have a massive competitive advantage. There was massive miner consolidation in the last market cycle.

Ultimately, bitcoin’s game theory has ensured smooth operation of the network since January 4, 2009. Bitcoin has run uninterrupted since that date. Theoretically, a bitcoin miner death spiral could take place – but it’s extremely unlikely due to game theory and the economic incentives of the bitcoin network.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|