2018-8-7 11:30 |

LedgerX July Statistics Reveal Massive Bitcoin Options Spike

LedgerX remains one of the most famous among the companies offering Bitcoin futures and options trading. The trade of Bitcoin options is, by itself, a major change to the status quo of cryptocurrency trading. Before the introduction of options of Bitcoin and other cryptos, it was only possible to profit from the rise or fall in cryptocurrency pricing by holding the currency themselves, which is something that many hopeful investors simply don’t have the technical knowledge to successfully do.

But with Bitcoin options, investors can invest their fiat money in the ups and downs of the cryptocurrency market without ever having to physically hold stock of a particular coin. This eliminates some of the insecurity of the cryptocurrency market that turns many investors off, and it gives these same investors the opportunity to capitalize on a quickly-changing market with significant profit to be had.

Despite the introduction of this massive new market to the trade sector of cryptocurrencies and blockchain technology, the cryptocurrency markets are still in ruins following the collapse early last month. With the price of Bitcoin continuing to fall and the altcoins in complete devastation across the board, many of the most optimistic consumers have considered pulling their money from the market.

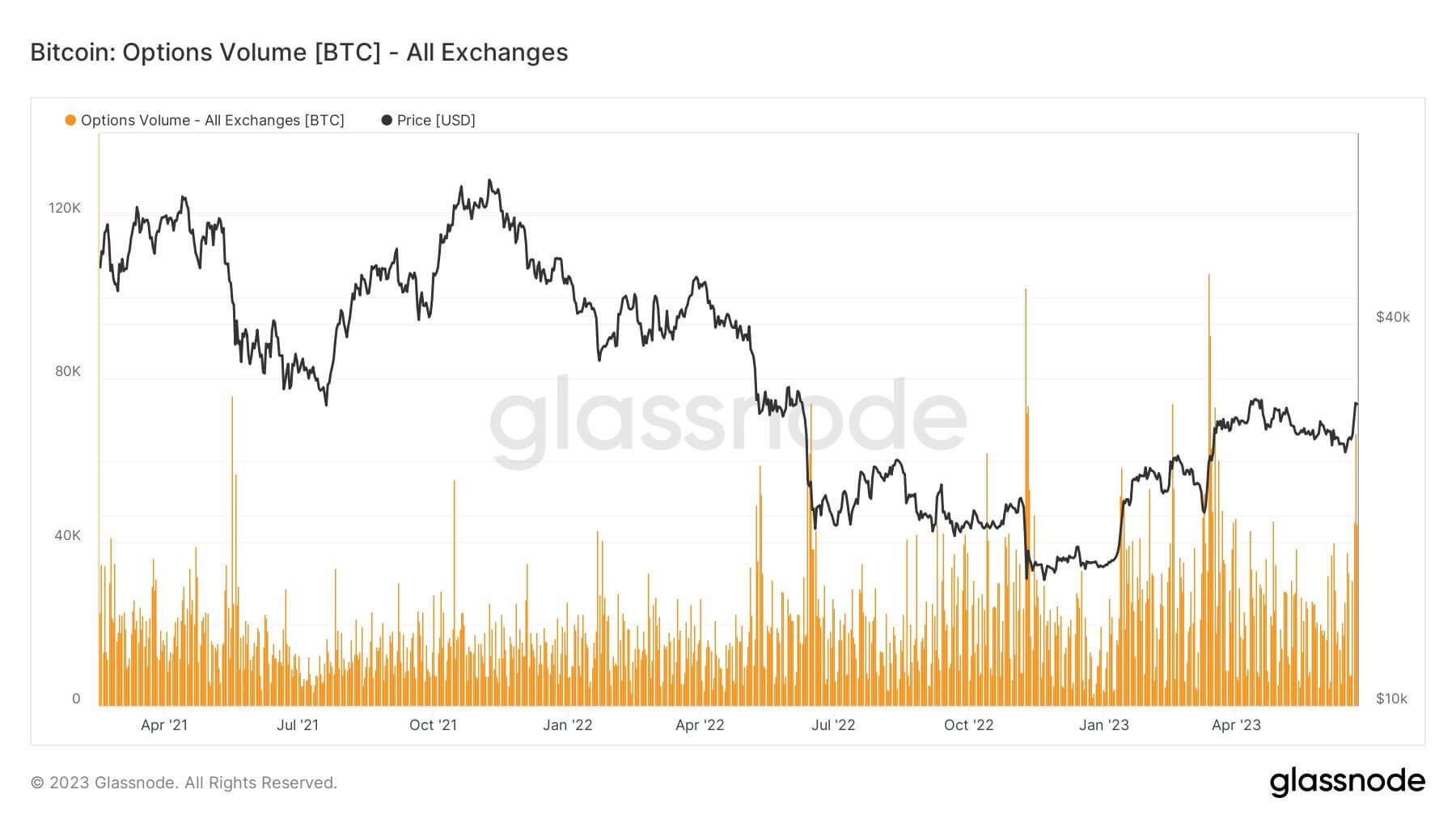

According to LedgerX, however, the past two months have been record-setting, especially in terms of overall volume of Bitcoin trade. Clearing over fifty million U.S. Dollars in derivatives in just July, the numbers support the company’s theory that the last quarter has been revolutionary and signifies increase interest in the bustling market.

Massive July NumbersIn addition to seeing the highest trade volume in the history of the Bitcoin institutional market, the trade organization also saw their largest deal on a single trade, one totaling up to $15,000 on a strike call. In response to the increased numbers, the company released a new purchasing system, referred to as “one-click bitcoin.

The new trading system will provide high-worth clients and institutional purchasers with a “one-stop shop” to buy Bitcoin and Bitcoin stock. The trading platform is also federally-backed, which is a major boon within a community that constantly struggles with federal regulatory compliance. The organization’s newest trade offerings are backed on the existing LedgerSavings platform, which came out in May of this year.

Though LedgerX doesn’t quite have the institutional backing that other crypto investment organizations might have, the company does have several important institutional clients, as well as clients with very high net worth. With over 130 institutional clients contributing to their massive trading numbers, the company is appealing to a significant portion of their clientele with their newest trading platform.

The Future of the IndustryLedgerX has also provided some insight this past month into the future of their cryptocurrency trade opportunities on the esteemed platform. In the future, the firm hopes to gain approval from key U.S. regulators to offer other cryptocurrencies, including mainly Ethereum. As the industry continues to develop and cooperate with important developers, the introduction of new cryptocurrencies will become more mainstream.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|