2022-10-27 19:05 |

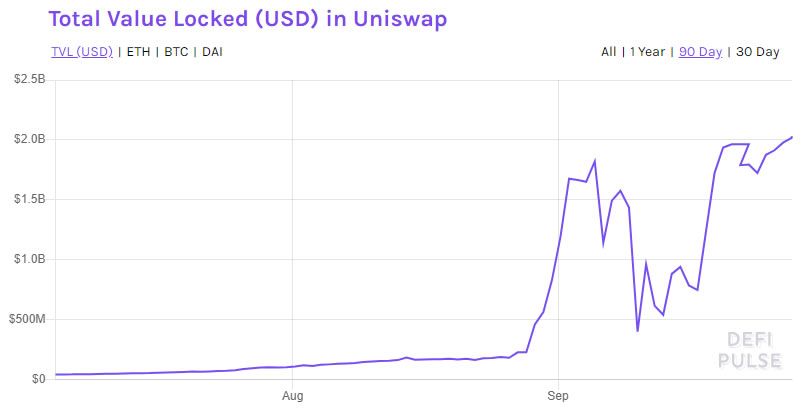

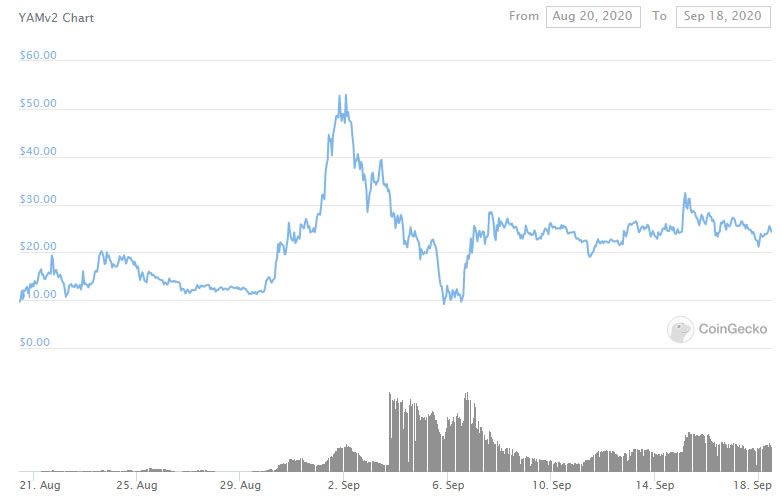

DeFi’s permissionless and trustless nature mandates liquidity from investors. This method of bootstrapping liquidity has proved incredibly successful for protocols and investors.

Finding solid protocols early on is the trick to making significant returns within DeFi. A new protocol Oryen (ORY), pays out a fixed 90% APY to all investors who help its early expansion. Putting it leagues ahead of Binance Coin (BNB), Solana (SOL), and Avalanche (AVAX).

Oryen (ORY)

Oryen leads the DeFi APY race. Oryen’s sophisticated solution to creating wealth divides itself into three steps: buy, hold, and earn. The OAT (Oryen Autostaking Technic) system powers this APY by leveraging the power of compound interest and auto-compounding investors’ yields to maximize returns. Additionally, as the name suggests, the Oryen protocol automatically stakes ORY from investors’ wallets, meaning the earning process begins the minute they buy.

Oryen’s ecosystem is taking its fledgling steps and has already announced a risk-free wallet for ORY holders. The value proposition of Oryen is fantastic but coupled with its relatively unknown status and a small market cap; this is a bona fide gem that can easily 20X.

Binance Coin (BNB)

Investors can stake Binance Coin on Binance to generate yield or can explore the yields of the Binance Smart Chain ecosystem if they want to generate more attractive returns. A class destination among investors is PancakeSwap- the leading decentralized exchange within the Binance Smart Chain ecosystem- where the token can be paired with CAKE for an APY of over 40%. However, this opens investors up to the possibility of impermanent loss, a risk ORY holders do not face.

Solana (SOL)

Investors can stake SOL directly from their Phantom wallet or use the decentralized lending protocol Solend to earn yield. Solana’s ecosystem continues to grow, and many of the investors that initially migrated, enticed by the network’s low fees and rapid transactions, have remained. Solana powers millions of transactions a day. Therefore SOL remains in demand. However, persistent network outages have cracked investors’ faith in this blockchain.

Avalanche (AVAX)

Avalanche enjoyed enormous success as DeFi exploded. Avalanche was one of the first alternative layer projects to gain significant traction. With decentralized exchanges like TraderJoe launching on the network, it quickly devoured DeFi liquidity and established itself as a major DeFi chain. But with increased competition from faster and cheaper alternative layer ones, Avalanche’s future looks more uncertain.

Closing Thoughts

DeFi evolves rapidly, and investors must move fast if they want to secure early adopter gains. Early investors in BNB, SOL, and AVAX made a king’s ransom. Now the opportunity swings in the direction of ORY.

Find Out More Here:

Join Presale: https://presale.oryennetwork.io/register

Website: https://oryennetwork.io/

Disclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

The post High APY Defi: Oryen With Fixed 90% Ahead Of Binance Coin, Solana And Avalanche appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|