2021-7-25 17:20 |

The debacle of the GameStop situation has sparked arguments in favor of decentralized finance (DeFi) protocols recently.

Proponents of DeFi protocols have said that the information asymmetry and censorship that resulted in investors losing their investments would have not occurred on DeFi platforms.

Ethereum maximalist and founder of Mythos Capital, Ryan Adams, took to Twitter to state that Ethereum based DeFi platform, Uniswap, solves the GameStop problem. His position has sparked arguments as he alleges that neither Bitcoin, Dogecoin, or cryptocurrency exchange, Binance, can be said to solve the problem.

What played out in the GameStop situation was that the company was publicized as the next big thing on a Reddit community, r/Wallstreetbets. In the next few weeks, the stock of the company grew phenomenally as retail investors flocked into the market. Unknown at the time was the fact that a group of hedge funds had also placed short orders on the stock, betting on the demise of the company. When the information got out, retail investors stopped selling their acquired stocks leading the hedge funds to lose around $19 billion. This turnout led centralized corporations to intervene on behalf of the hedge funds, stopping trading of the shares on key exchanges and giving the hedge funds a chance to regain some of their losses.

The current argument is that apart from the Ethereum blockchain which offers decentralized finance solutions, no other prominent blockchain, including Bitcoin, solves the problem of regulation, market manipulation, and censorship.

Bitcoin proponents have countered Adams’ take on the issue. Alex Gladstein in response to the claim stated that while Bitcoin does not actually ‘fix’ the GameStop problem, it is wrong to say Bitcoin can be stopped by any centralized body or government. “Bitcoin by the way doesn’t “fix” GME either but does provide an asset that the government can’t stop you from trading,” he said in the tweet.

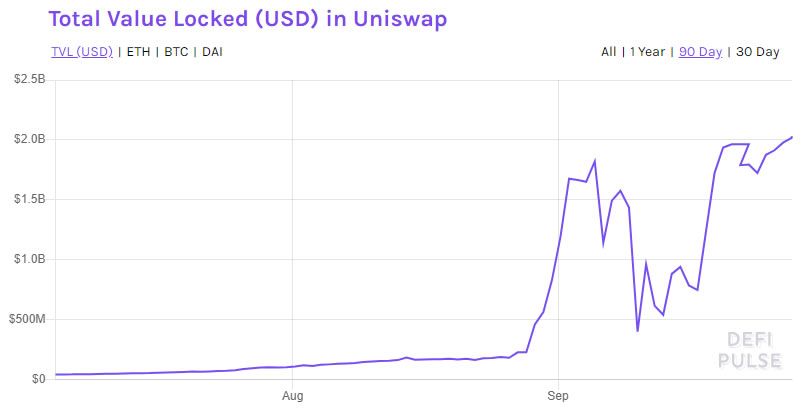

Still pushing his argument, Adams stated that Bitcoin can be regulated if governments stop liquidity from flowing into cryptocurrencies exchanges. “The government can stop Bitcoin from trading by choking out liquidity on a few exchanges. Uniswap on Ethereum is unstoppable. If you’re a friend of democracy and civil liberties, why aren’t you a friend of DeFi?”

His argument seems to have holes in it as in a similar fashion, governments can also “chock out liquidity” from exchanges offering Ethereum. Also as has been evident in cases where this has been attempted, such as Nigeria, traders just diverted to using peer-to-peer trades to circumvent the ban.

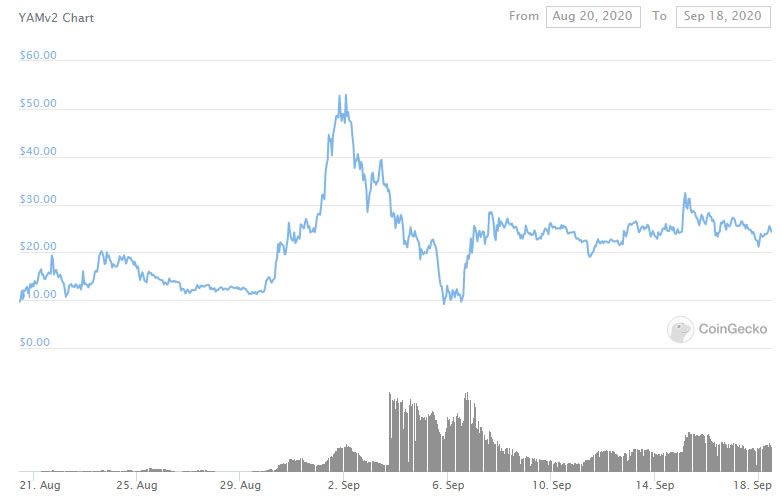

Notably, DeFi offers a way to solve the GameStop problem as a key characteristic of blockchains is the open ledger where all transactions are recorded and are open for scrutiny. Every position in a market – both long and short – can be known in DeFi protocols leading to less information asymmetry. Add to that the uncensorable nature of decentralized blockchains and you have a strong tool to combat manipulation by external forces in the market.

origin »Defi (DEFI) на Currencies.ru

|

|