2022-5-7 23:00 |

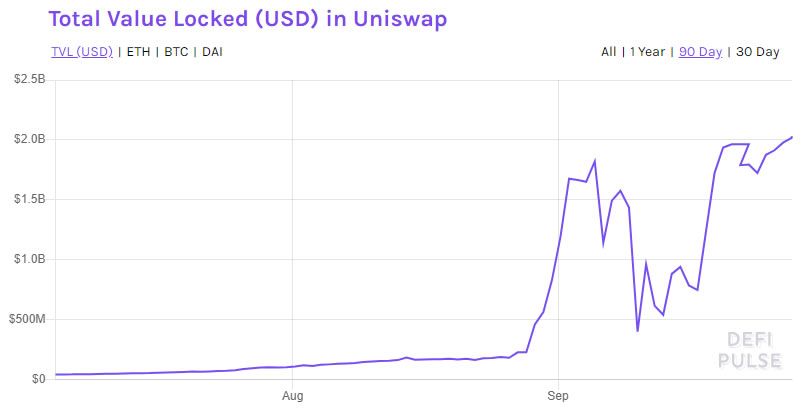

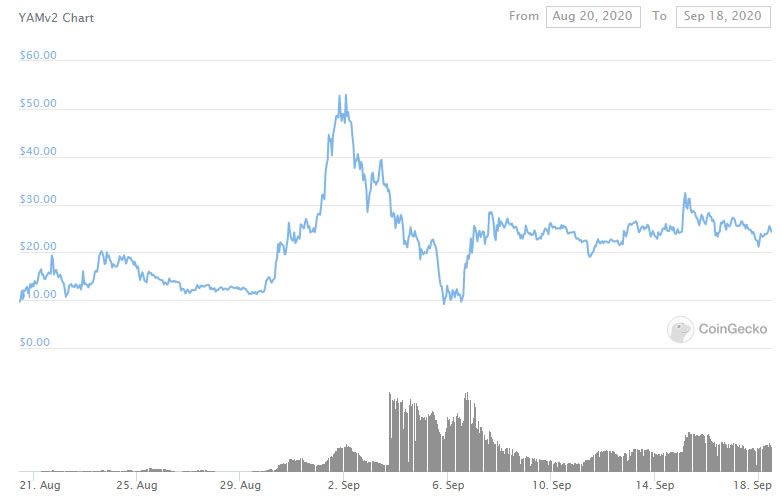

The week in DeFi saw European lawmakers write a new chapter on DeFi, a Virginia county plan to put its pension fund in a DeFi yield, DeFi protocols lose $1.6 billion to exploits, and more origin »

Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|