2019-2-15 20:00 |

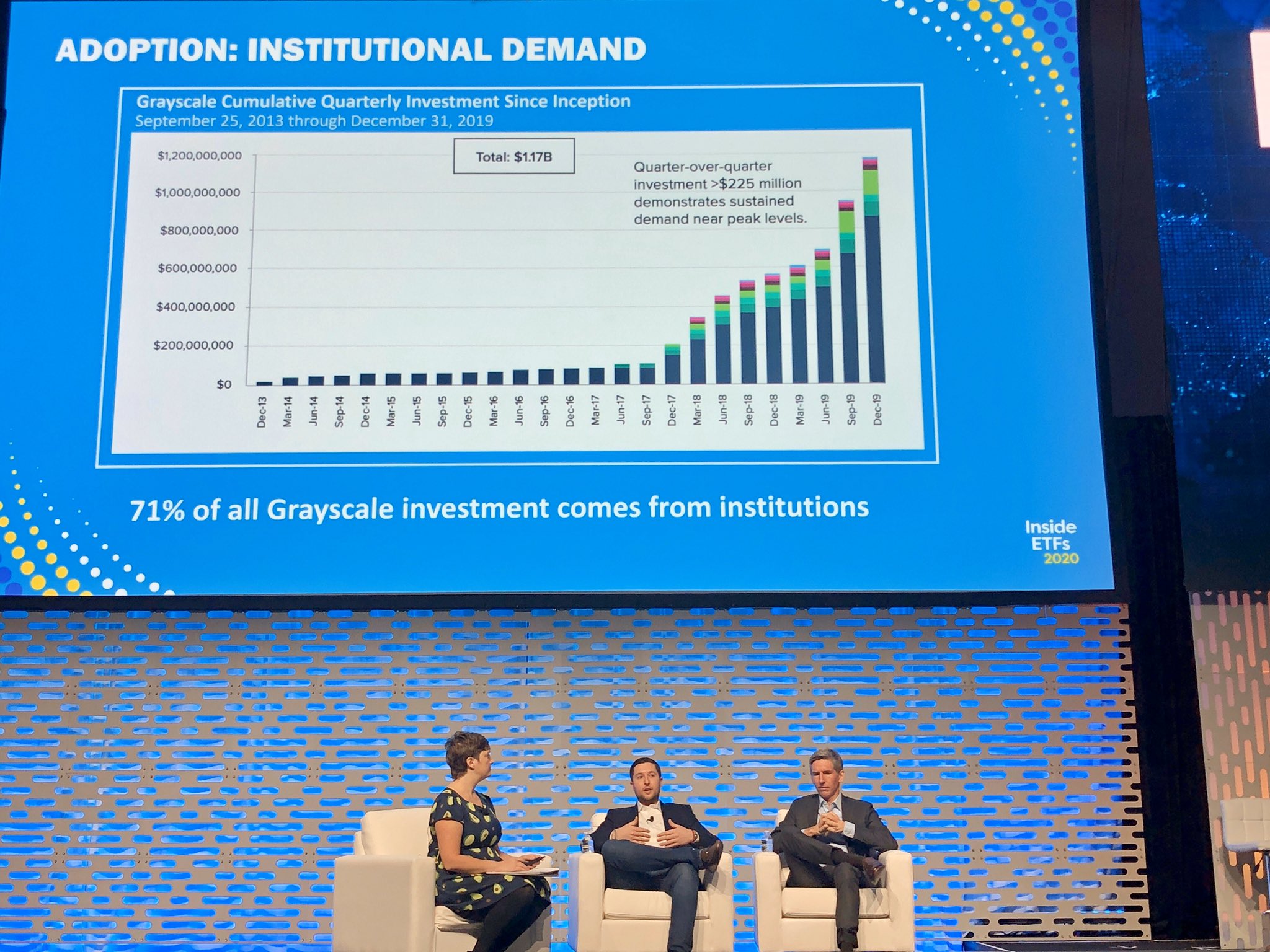

Digital Currency Asset Manager, Grayscale Investments, had a record year in 2018, with institutions and retirement accounts comprising the lion’s share. What’s more, they are increasingly opting for Bitcoin over other altcoin offerings as the cryptocurrency market flatlines.

A Challenging, Yet Record YearAccording to Grayscale’s Q4 report, 2018 saw new investment at Grayscale hit a record high of $359.5 million; almost triple that of 2017’s bull-run. However, quarter on quarter, inflows reduced over 60 percent on average to only $31.1 million in Q4.

The breakdown of this figure shows that price falls and the general market slowdown, are changing the average investor profile. As Grayscale Managing Director, Michael Sonnenshein, explained:

It was by no means our best quarter, but it’s certainly important to recognize that despite the price declines investors were actively engaged.

‘Return of the Bitcoin Maximalist’Of this inflow, 88 percent came from bitcoin investment, and 12 percent from non-bitcoin investment.

This is compared to 67 percent and 33 percent bitcoin to alts through 2018, suggesting that investors are increasingly going for Bitcoin as the bear market continues.

Grayscale notes that a key takeaway from their Q4 data is that there is increasing appetite for their bitcoin product compared to other altcoins.

Return of the Bitcoin Maximalist. Grayscale Bitcoin Trust (f/k/a Bitcoin Investment Trust) stood out this quarter, attracting the most capital within the Grayscale family of products despite further price declines in the digital asset market. In the fourth quarter, 88% of inflows were into Grayscale Bitcoin Trust, while 12% were into products tied to other digital assets.

Saving For The Grey DollarIndividual investors can buy and hold Grayscale’s flagship Bitcoin Trust (GBTC) product via brokerage retirement accounts. This gives investors exposure to bitcoin price 00 movements without actually buying any, which is almost impossible through retirement vehicles normally.

While such investors made up 15 percent of Grayscale’s total inflows for 2018 ($53.9 million), this leapt to 40% when considering only Q4 (around $12 million).

Institutional investors accounted for 50 percent of Q4 investment (66% over the whole of 2018), and family offices and accredited investors made up the rest.

This indicates that average investors are using the bear market to invest for retirement, taking a long-term view on the prospects of BTC.

Institutional HoldingsThe other indication from these results is that larger institutions are gradually building up their core strategic positions in the market.

This is certainly echoed by Grayscale Founder, and CEO of (Grayscale parent company) Digital Currency Group, Barry Silbert. As Bitcoinist reported yesterday, Silbert is expecting 2019 to be a tipping point for institutional investment, and expects prices to “snap back hard” as soon as this happens.

Grayscale is the largest cryptocurrency asset manager in the world, holding $793.6 million of client funds.

Meanwhile, earlier this week saw the first investment into cryptocurrency of US public pension funds. Two funds representing public servants from Fairfax County, anchored a $40 million fund launched by Morgan Creek Digital.

Why do you think retirement funds are tapping into Bitcoin? Share your thoughts below!

Images courtesy of Shutterstock, grayscale.co

The post Grayscale Q4 Report Finds Institutional Investors Returning to ‘Bitcoin Maximalism’ appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|