2021-10-19 16:51 |

Grayscale Investments, announced today that NYSE Arca has filed Form 19b-4 with the Securities and Exchange Commission (SEC) to convert Grayscale’s flagship product, Grayscale Bitcoin Trust (OTCQX: GBTC), into a Bitcoin Spot ETF.

We have long been committed to transforming $GBTC and our other investment products into ETFs, and we’re proud to deliver on that long-standing commitment by submitting our 19B4 filing today to transform GBTC into a #Bitcoin Spot ETF. THREAD (1/4) pic.twitter.com/H9GdFbSSgp

— Grayscale (@Grayscale) October 19, 2021

ETFs are regulated financial products traded on the open market that tracks the price of an underlying asset. A Bitcoin ETF has long been sought by US players but have been famously shunned by the SEC, the country’s regulatory watchdog. But such rejections may not last long.

“Since 2013, the Grayscale team has worked tirelessly to build the world’s largest, most transparent Bitcoin investment vehicle, GBTC, while partnering with policymakers and regulators to build familiarity and trust in Bitcoin, blockchain, and the underlying Bitcoin market,” explained Michael Sonnenshein, CEO of Grayscale Investments.

He added, “In becoming the first crypto SEC reporting investment vehicle, GBTC has helped move the entire digital currency ecosystem forward. As we file to convert GBTC into an ETF, the natural next step in the product’s evolution, we recognize this as an important moment for our investors, our industry partners, and all those who realize the potential of digital currencies to transform our future.”

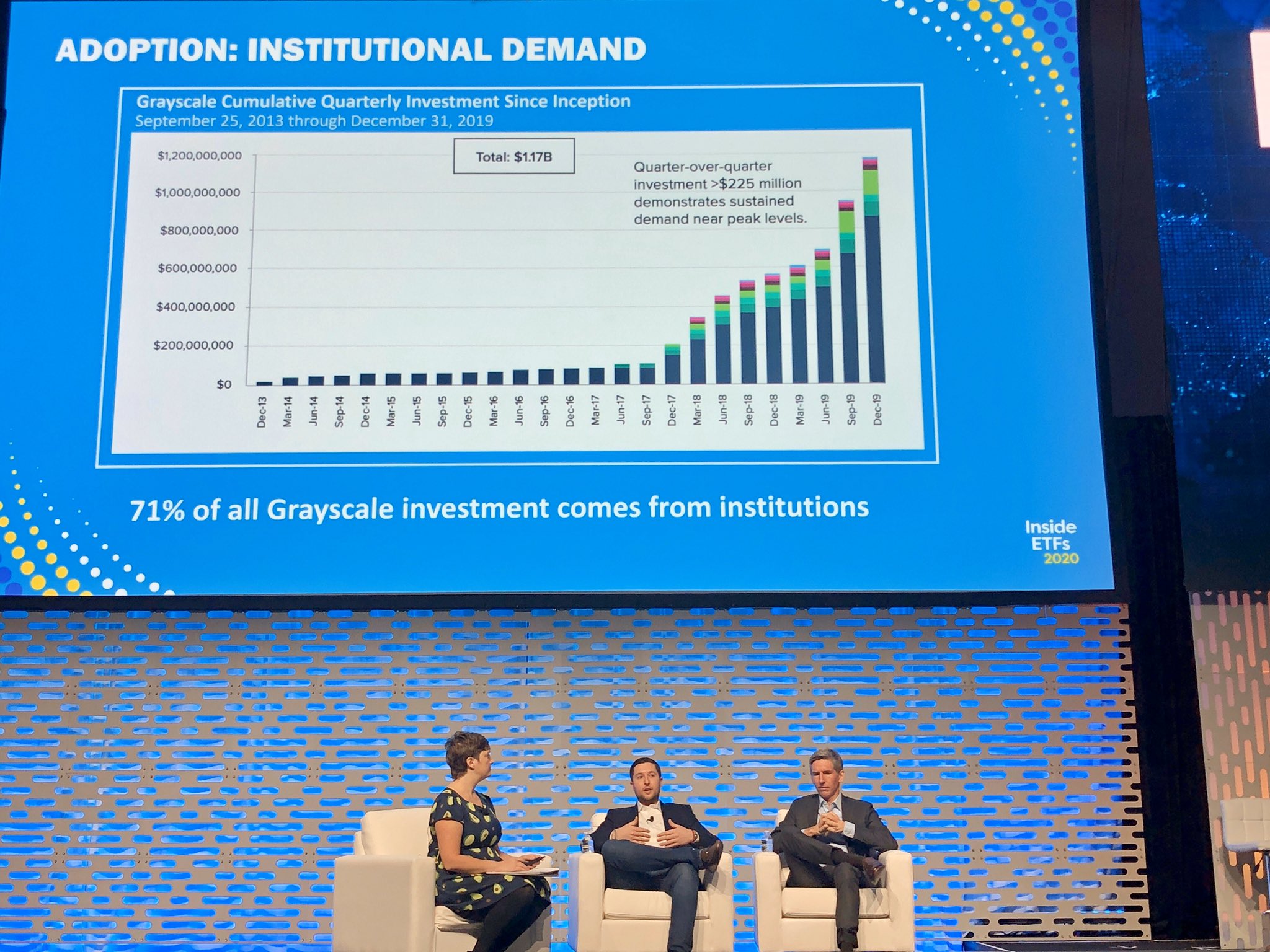

More crypto ETFs are on the way apart from BitcoinGrayscale has publicly committed the firm’s intent to convert GBTC as well as its other 14 investment products into ETFs. Grayscale Bitcoin Trust launched in 2013, received a public quotation in May 2015, and became an SEC reporting company in January 2020. Today, the Trust is the largest Bitcoin investment vehicle in the world, holding approximately 3.44% of all Bitcoin in circulation.

“At Grayscale, we believe that if regulators are comfortable with ETFs that hold futures of a given asset, they should also be comfortable with ETFs that offer exposure to the spot price of that same asset,” said Dave LaValle, Global Head of ETFs at Grayscale Investments.

Today, GBTC’s assets under management amount to nearly $40billion, representing investment from individuals and institutions across all 50 states. And these are only set to bulge further.

The post NYSE Arca files form 19b-4 to convert Grayscale Bitcoin Trust (GBTC) into an ETF appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|