2021-10-20 16:44 |

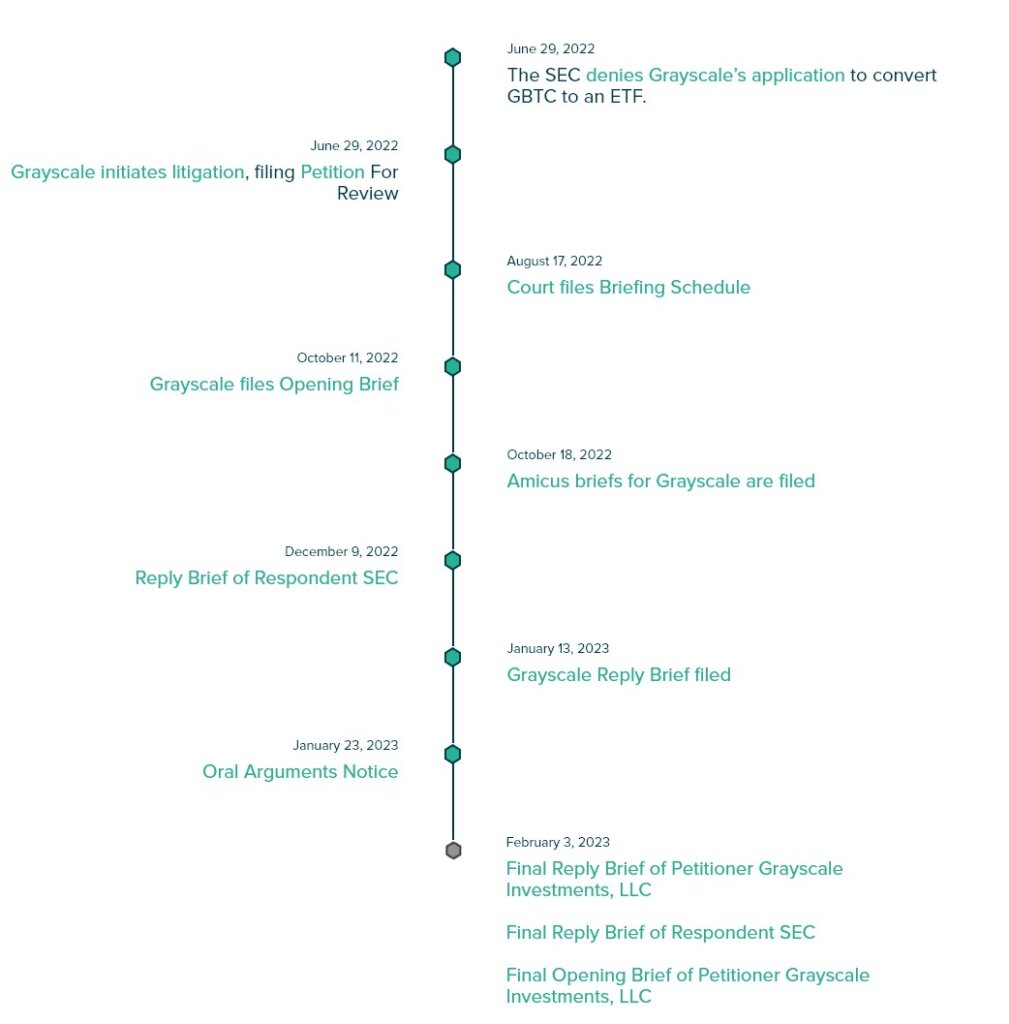

The day the first Bitcoin ETF launched in the US, the largest digital asset manager Grayscale Investments announced that it had filed to convert the world’s biggest Bitcoin fund into a spot ETF.

The Grayscale Bitcoin Trust will trade under the ticker symbol ‘BTC.’

Unlike the ProShares Bitcoin Strategy ETF (BITO), whose debut was the second most traded ETF with more than $1 billion worth changing hands, Grayscale’s ETF will be backed by actual units of the leading cryptocurrency.

The filing by Grayscale along with the NYSE Arca has kickstarted a window for the Securities and Exchange Commission (SEC) to reject or delay the GBTC conversion application. The SEC has 75 days to review the application.

While the SEC has allowed the derivatives-based product to launch, Chair Gary Gensler has emphasized that it offered more investor protection. Physically-backed Bitcoin ETF was first filed by Winklevoss twins in 2013, and in the past eight years, the agency has rejected every single one of them.

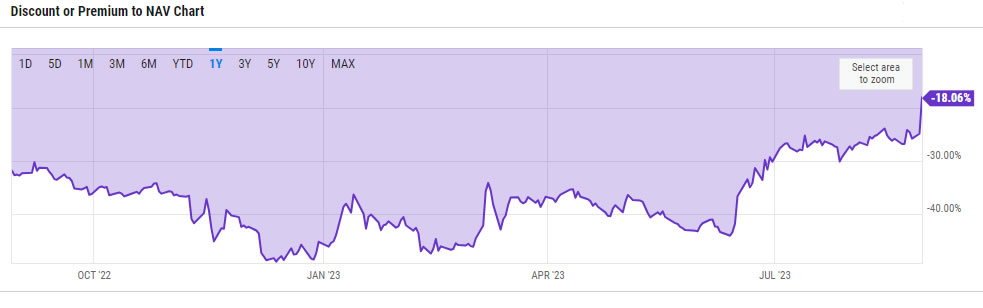

Launched in 2013, Grayscale Bitcoin Trust has $41.7 billion assets under management and is currently trading at a steep 16.56% discount. GBTC holds roughly 3.44% of all Bitcoin in circulation. Michael Sonnenshein, chief executive officer, said,

“As we file to convert GBTC into an ETF, the natural next step in the product’s evolution, we recognize this as an important moment for our investors, our industry partners, and all those who realize the potential of digital currencies to transform our future.”

Thank you for being a part of this journey with us. We’re just getting started. $GBTC pic.twitter.com/NjAI8eXHdD

— Michael Sonnenshein (@Sonnenshein) October 19, 2021

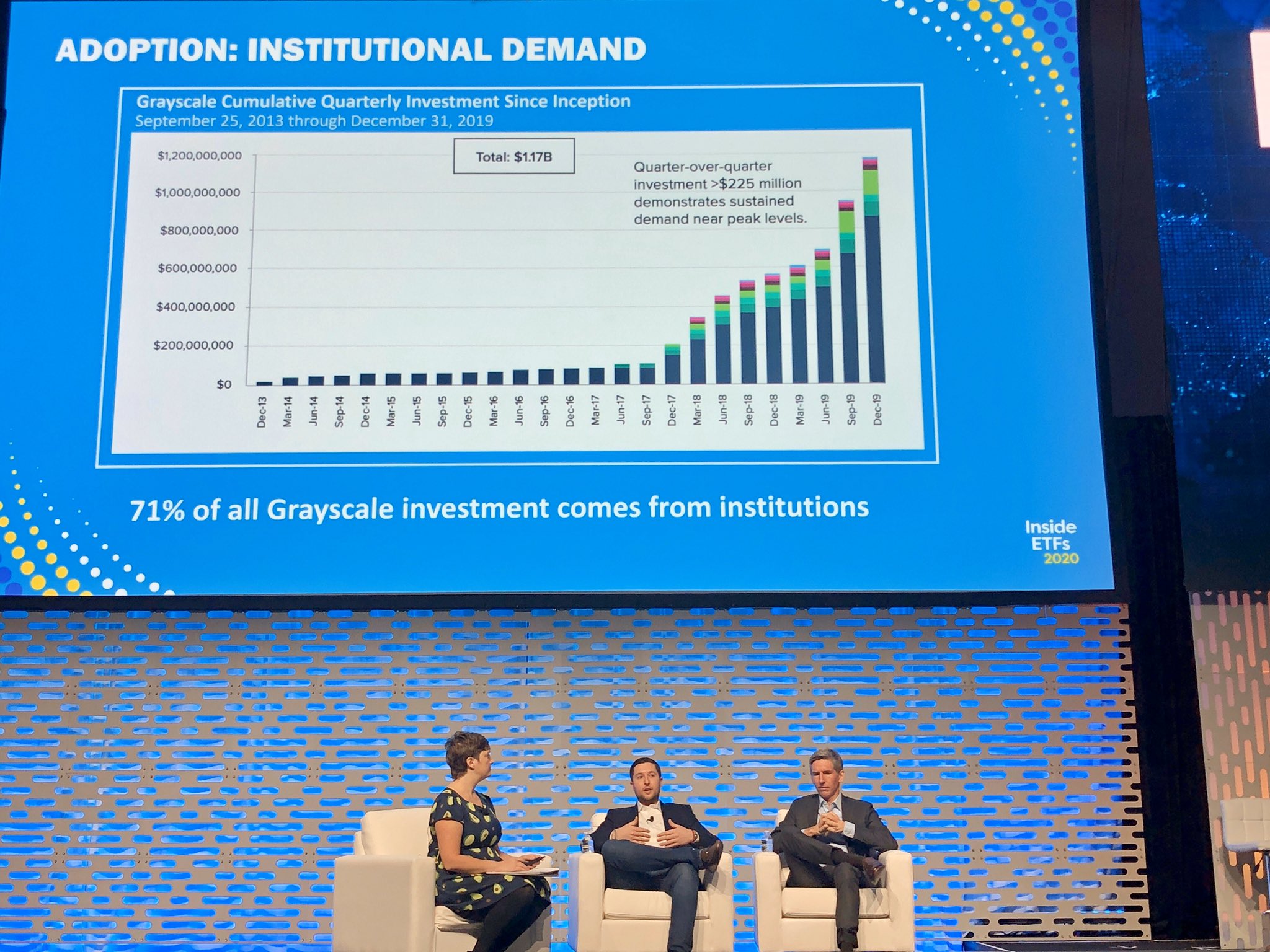

Sonnenshein shared on Twitter that GBTC is owned by investors in all 50 states, representing over 700K retail and institutional accounts. GBTC shares are locked up for six months; this means the holders are unable to trade in reaction to market movements.

Grayscale is committed to converting not only GBTC but also other 14 investment products into ETFs, he added.

Dave LaValle, Global Head of ETFs at Grayscale Investments, said,

“At Grayscale, we believe that if regulators are comfortable with ETFs that hold futures of a given asset, they should also be comfortable with ETFs that offer exposure to the spot price of that same asset.”

Bitcoin/USD BTCUSD 66,441.7412 $3,262.29 4.91% Volume 42.05 b Change $3,262.29 Open$66,441.7412 Circulating 18.85 m Market Cap 1.25 t baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Grayscale Kickstarts SEC Review of its Spot Bitcoin ETF (‘BTC’) Application first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|