2024-4-12 15:29 |

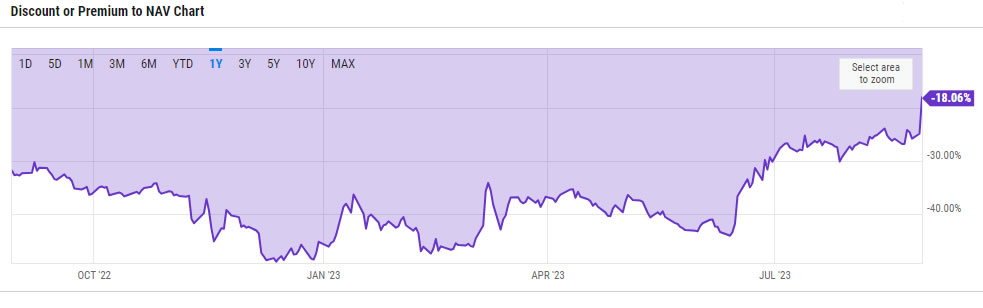

After moving markets with its shuffling of Bitcoin holdings, it appears that the worst may be over for BTC now that Grayscale has dramatically reduced the pace of its sales. Outflows from the Grayscale Bitcoin Trust (GBTC) ETF hit a new record low figure since its conversion from an essentially closed-end fund to a proper spot ETF in January.

Only $17 Million Left Grayscale TrustIs the end in sight for Grayscale’s nightmare?

The daily net outflow from Grayscale Investments’ spot Bitcoin exchange-traded fund (ETF) hit a new record low of $17.5 million on April 10, according to data provided by SosoValue. This marked a considerable decrease compared to the $154.9 million outflows recorded on April 9. The previous low was on February 26, when GBTC saw $22.4 million outflows.

Since its launch in mid-January, the GBTC ETF has been shedding capital as investors rush for the door so fast that the product has registered the largest outflows of any ETF since March 2009 at around $16 billion as of Wednesday. The bleeding out appeared to subject the price of the world’s largest cryptocurrency to take a beating.

The decreased GBTC outflows came a day after Grayscale CEO Michael Sonnenshein said the company’s fund has started to reach an equilibrium with its outflows. Sonnenshein told Reuters that the huge outflows were mostly due to selling activity related to settlements of bankrupt crypto firms like FTX and switch trade strategies utilized by some market participants.

BlackRock’s ETF Closes In On GBTCTo offset the outflows, Grayscale is readying to offer a “mini” Bitcoin ETF with lower sponsor fees to compete in the market better. But as it awaits regulatory approval, other ETFs — like BlackRock’s largely popular iShares Bitcoin Trust (IBTC) — are recording gargantuan inflows.

Since going live, the BlackRock fund has attracted over $18 billion in new money, and it appears to be on pace to flip GBTC, which currently holds approximately $23.2 billion.

As Grayscale’s GBTC fund, which charges a higher fee than IBTC, has consistently haemorrhaged BTC, BlackRock has been steadily narrowing the gap in terms of assets under management.

It seems inevitable that IBIT will soon overtake GBTC as the biggest Bitcoin ETF issuer in AUM.

origin »Bitcoin price in Telegram @btc_price_every_hour

HitChain (HIT) на Currencies.ru

|

|