2020-12-12 23:00 |

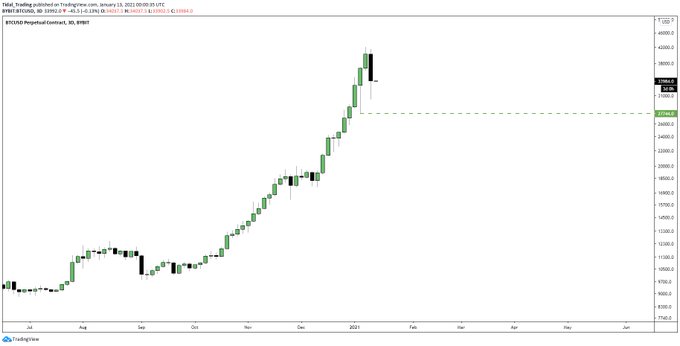

Bitcoin is currently experiencing a small correction by cryptocurrency standards. The last time the top cryptocurrency corrected from below $20,000, it touched under $6,000 weeks later. But the normally notoriously volatile crypto asset isn’t swinging quite as wildly as the peak of the 2017 bull run.

So while this isn’t likely the peak that causes another bear market, there are at least five technical reasons for the current correction that suggest Bitcoin is taking a quick breather before the final bullish impulse begins.

Bitcoin Bullish Impulse Reachs Exhaustion, Short-Term Reversal ProbableThe gloves are on, and bear whales with large supplies of BTC are slugging it out with institutional buyers accumulating the cryptocurrency at whatever price they can get their hands on it.

Retail FOMO recently jumped in at the end just as the asset set a new all-time high. But “OG whales” are currently showing why they are the reigning heavyweight champs of the crypto space.

Related Reading | “Cyclical Nature Of Bitcoin” Could Provide Clues On Continuation Or Correction

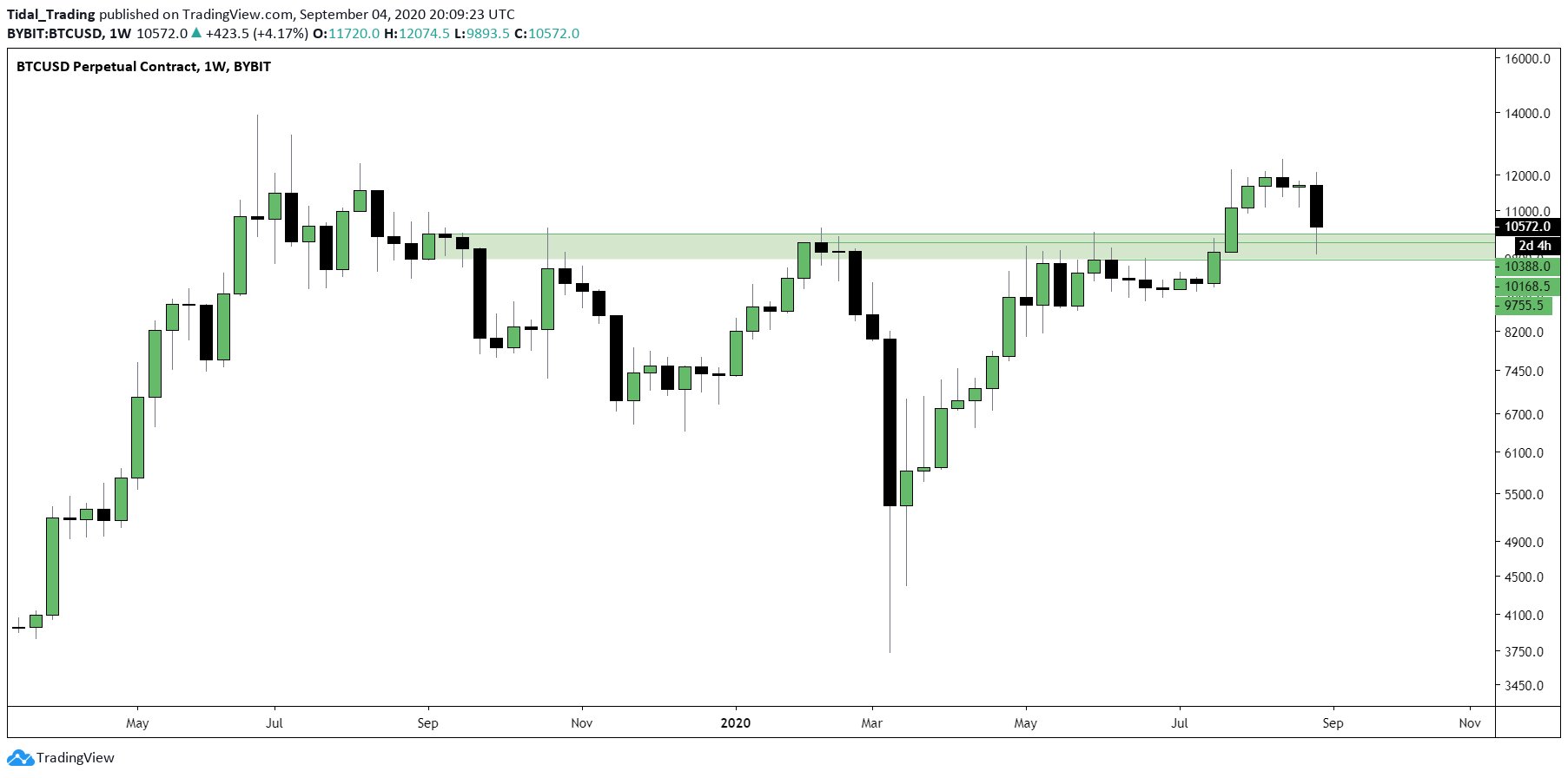

The tides are turning, and the recent bull trend is beginning to wane. Technicals show extreme exhaustion was reached days ago, and now the momentum is fading as prices begin to fall. Five different technical indicators are all giving strong bearish signals on daily timeframes, but because the higher timeframes remain bullish, any downside is likely only a breather for Bitcoin.

Five Technical Indicators Forewarning Of A Needed Crypto Market CorrectionThe first technical indicator we’ll examine is called the Bollinger Bands and has a variety of features. It can be used to measure volatility through the width between each band, acts as support or resistance, and can be used for buy or sell signals.

The tool’s creator has even called for a potential top pattern in Bitcoin, but as an experienced trader was waiting for confirmation. That confirmation has potentially arrived with the bands beginning to “lift” downward, after passing through and failing to reclaim the middle-BB.

Bitcoin "rode the bands" at the first major close outside the top band | Source: BTCUSD on TradingView.comPreviously when the cryptocurrency fell to the middle-line, there was a bounce to another high. This time, however, failed to reproduce the same results.

A similar type of retest failed to break back above the Tenkan-Sen on the Ichimoku indicator. If the Tenkan-Sen (in blue) crosses below the Kijun-Sen (in red), the sell signal is confirmed.

Bitcoin has traded above both lines throughout most of Q4, supporting the entire rally. Losing the lines should result in a retest of the cloud below.

Things could get cloudy for crypto in the days ahead | Source: BTCUSD on TradingView.comAs mentioned, the high timeframe bull trend is still intact, and each daily timeframe reversal is only a short breather in the cryptocurrency’s climb to the next major peak.

The chart below depicting the Relative Strength Index and Stochastic demonstrate how many turning points like this there have been in 2020 and suggest that this is more of the same low timeframe price action.

But they also show that this latest just swing just started, indicating a correction or consolidation is about to take place for at least a couple of weeks. Each of the below arrows depicting the direction of the trend change, and also acts as a trendline that when broken marks where momentum began to shift.

The RSI and Stoch show where Bitcoin reached overbought or oversold conditions | Source: BTCUSD on TradingView.comFinally, the Average Directional Index – a trend measuring tool – is both showing that the trend is ending, but that there could be one last blow-off top left in the crypto asset.

Related Reading | Christmas Day Derivatives Expiry Could Deliver The Gift Of Dangerous Bitcoin Volatility

Each checkered flag in the chart below signifies the finish line for each trend. The white flag outlined in blue, however, resulted in a fakeout and one more high to let out any remaining bullish energy. Doing so, however, made the resulting downtrend worse.

Has the trend ended completely, or is there a blow-off top coming? | Source: BTCUSD on TradingView.comInstances where the checked flag was waived and the correction was more quickly over with have been much healthier for Bitcoin and allowed it to recover and run more sustainably.

So while FOMO is fun to watch, and prices soaring is always nice, the cryptocurrency becoming too overheated too quickly doesn’t always yield consistently positive results.

Wishing for a quick, and even a sharp correction or this point is the best thing for the asset, as Black Thursday has clearly demonstrated. And getting the downside over with sooner than later will allow the bull run to blossom earlier as well.

Featured image from Deposit Photos, Charts from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|