2020-4-30 01:09 |

The COVID-19 induced cryptocurrency crash last month had a severe impact on exchanges like BitMEX. Some have yet to fully recover despite a revival in Bitcoin and altcoin prices.

The cryptocurrency world labeled it ‘Black Thursday,’ the day that digital asset markets lost almost 50% (over $100 billion) in less than 24 hours.

Since then, the total market capitalization has nearly made a full recovery, touching a seven-week high today of $225 billion. The move has resulted in Bitcoin and many altcoins returning to their pre-crash prices.

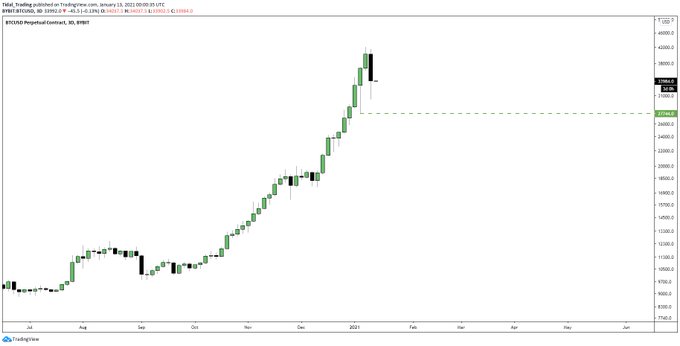

BitMEX Liquidity UnrecoveredAccording to Unfolded, a market insights platform, the liquidity on the BitMEX futures exchange has yet to return to normal levels.

BitMEX liquidity – UnfoldedLiquidity and volumes spiked at the end of that fateful week as long positions were liquidated en masse and the selloff accelerated below major support levels.

According to Datamish, volumes on BitMEX have been lower than usual, despite a steady uptrend in prices over the past month or so. The analytics platform also reports that there have been over $11 million shorts liquidated in the past day as Bitcoin prices creep higher.

The BitMEX volume trend may continue as it has recently restricted access to users in Japan. The move came in response to amendments to the Japan Financial Instruments and Exchange Act, and Japan Payment Services Act, which are set to go into effect on May 1.

The amendments will require crypto exchanges to register with Japanese regulatory agencies and comply with regulations regarding the management of user transaction records and other provisions.

Bitcoin Fundamentals Screaming ‘Buy’Fundamentally, Bitcoin has continued to strengthen over the past couple of weeks. The asset recently overtook a heavy resistance just above the $7,800 price level.

Capriole Digital Asset Manager, Charles Edwards, recently tweeted a chart showing several indicators for BTC.

Looking at pure Bitcoin fundamentals only. Basically everything screams ‘buy.’

The chart has included hash ribbons, which are strong indicators that provide powerful buy signals based on hash rate and difficulty moving averages. It’s worth noting that a buy signal using this particular indicator does not come often. The last recent instances were in the depths of the ‘crypto winter’ of 2018, and the market dump at the end of 2019.

Bitcoin Energy Value, which hypothesizes that BTC fair value is a function of energy input, is also showing that prices are ‘at a discount.’ The Dynamic Range NVT signal, which can be used to identify when BTC is expensive (overbought) or cheap (oversold), is showing the latter.

The post Bitcoin Fundamentals Strengthen While BitMEX Liquidity Struggles to Recover appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|