2024-12-18 07:41 |

Key Takeaways

Ohio lawmakers seem particularly passionate about cryptocurrency. In today’s turbulent global economy, their willingness to test new financial solutions like Bitcoin is both bold and refreshing. Texas and Pennsylvania have joined the race, showing a broader trend of states starting to view Bitcoin as a viable reserve asset. Ohio’s Bold Step Toward Bitcoin The “Ohio Bitcoin Reserve Act”Leading the charge is the “Ohio Bitcoin Reserve Act,” proposed by Ohio House Republican Leader Derek Merrin. The goal is simple yet bold: purchase Bitcoin and integrate it into the state’s reserve asset portfolio.

Merrin has openly expressed his concerns about the devaluation of the U.S. dollar. With a solid background in finance, he believes Bitcoin can act as a hedge, protecting Ohio’s tax revenues from inflation. After all, no one wants their hard-earned money to lose value without reason.

Taking a Balanced ApproachThe bill doesn’t mandate Bitcoin purchases; instead, it gives Ohio’s Treasurer the authority to invest in Bitcoin if it aligns with the state’s financial goals. This approach demonstrates Ohio’s readiness to explore opportunities while managing risks responsibly.

Merrin’s support for cryptocurrency is notable. He has received an “A” rating from a pro-cryptocurrency lobbying group, underscoring his belief in Bitcoin’s potential to reshape financial systems.

Ohio Is Not Alone: A Growing Trend Across StatesOhio isn’t the only state exploring the possibilities of Bitcoin. Both Texas and Pennsylvania are also taking steps to integrate cryptocurrency into their financial strategies, reflecting a larger trend across the U.S.

These states appear to be aligning their efforts to modernize financial systems. It’s clear no one wants to sit idle while inflation erodes the value of traditional reserves.

More News: FSOC urges Congress to pass stablecoin legislation to stabilize global finance

Going Further: Paying Taxes with BitcoinOhio lawmakers are going a step beyond Bitcoin reserves. They aim to legalize tax payments in cryptocurrency. Senator Niraj Antani has proposed a bill allowing Ohio residents to use Bitcoin and other cryptocurrencies to pay taxes and state fees.

Moreover, the bill would enable state universities and public pension funds to invest in cryptocurrency, signaling Ohio’s commitment to integrating innovative financial tools and preparing for the future.

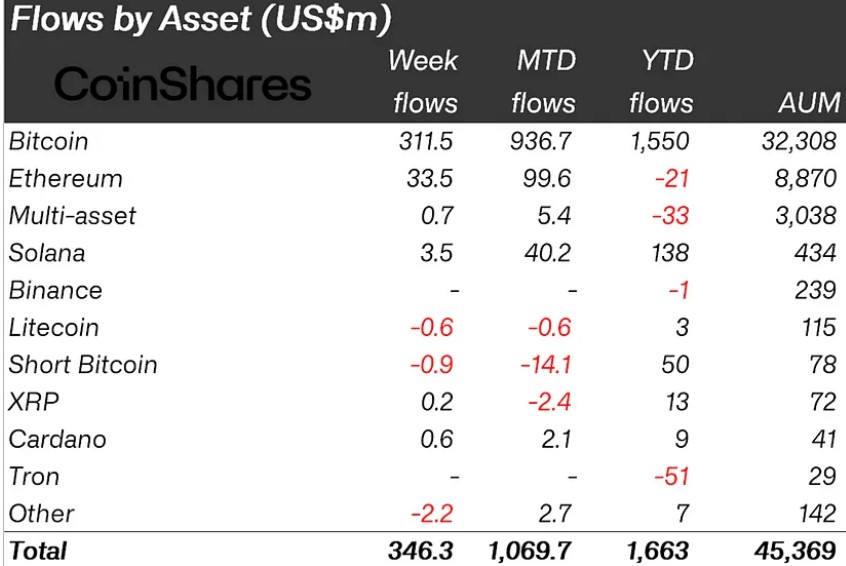

Summary of State Cryptocurrency Legislation State Bill Key Details Ohio “Ohio Bitcoin Reserve Act” (HB 703) Grants the Treasurer authority to purchase Bitcoin as a reserve asset (optional). Ohio Cryptocurrency Tax Payment Bill Allows tax and fee payments in Bitcoin; permits state universities and pension funds to invest in cryptocurrency. Texas “Texas Strategic Bitcoin Reserve Act” Proposes holding Bitcoin in the treasury for a minimum of five years. Pennsylvania Bitcoin Reserve Bill Permits the treasury to allocate up to 10% of its assets in Bitcoin.

The post Ohio Takes the Lead in the Cryptocurrency Race: Is Bitcoin Becoming a State Reserve Asset? appeared first on CryptoNinjas.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|