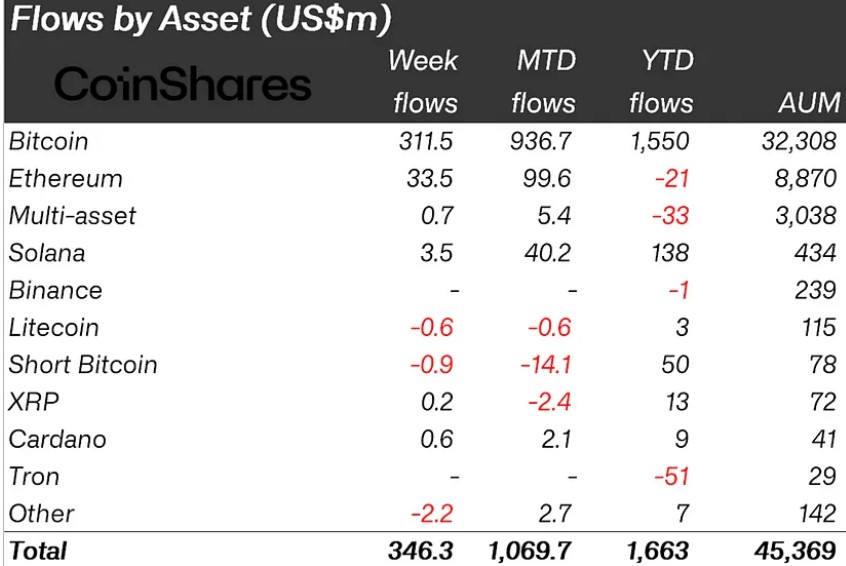

2020-11-25 21:00 |

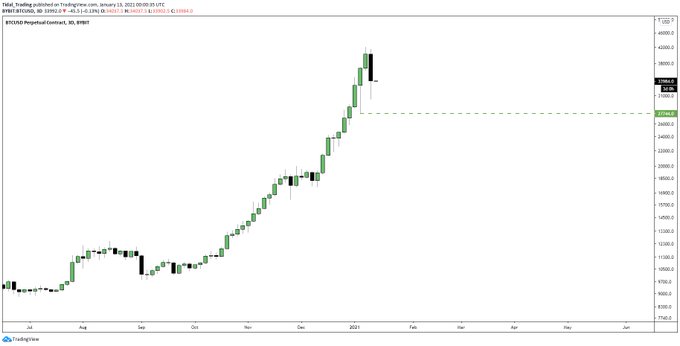

Bitcoin and the entire cryptocurrency market have been caught in the throes of an intense uptrend throughout the past few days Bulls have been aggressively propelling the cryptocurrency higher, with BTC now pushing past its key $19,000 resistance level The selling pressure here has proven to be quite intense, making the firm break above this level technically significant If the cryptocurrency can hold above $19,000 for an extended period of time, it could be a sign that upside is imminent for the token One trader is now noting that there is one reason for concern, with one key level potentially acting as a magnate that will spark a 30%+ dip

Bitcoin and the aggregated crypto market are in a clear and firm bull market. Sellers have been unable to control its recent trend, with it only facing a few fleeting pullbacks.

The fact that each dip is met with such aggressive buying pressure signifies that serious upside could be imminent in the near-term.

Although BTC will surely face some resistance around its all-time highs, there’s a strong possibility that it will plow through the sell orders here once retail “FOMO” kicks in.

One trader is noting that it may first need to retest one key technical level before posting any significant rally higher.

Bitcoin Rallies Past $19,000 as Uptrend Continues StrongAt the time of writing, Bitcoin is trading up just over 4% at its current price of $19,200. This is around where it has been trading throughout the past few hours.

It does appear to be fairly stable above this price level, as sellers have yet to spark any intense selloff.

This could be a positive sign that indicates further upside is imminent, although the selling pressure around its all-time highs in the upper-$19,000 region may be what causes it to see a firm rejection.

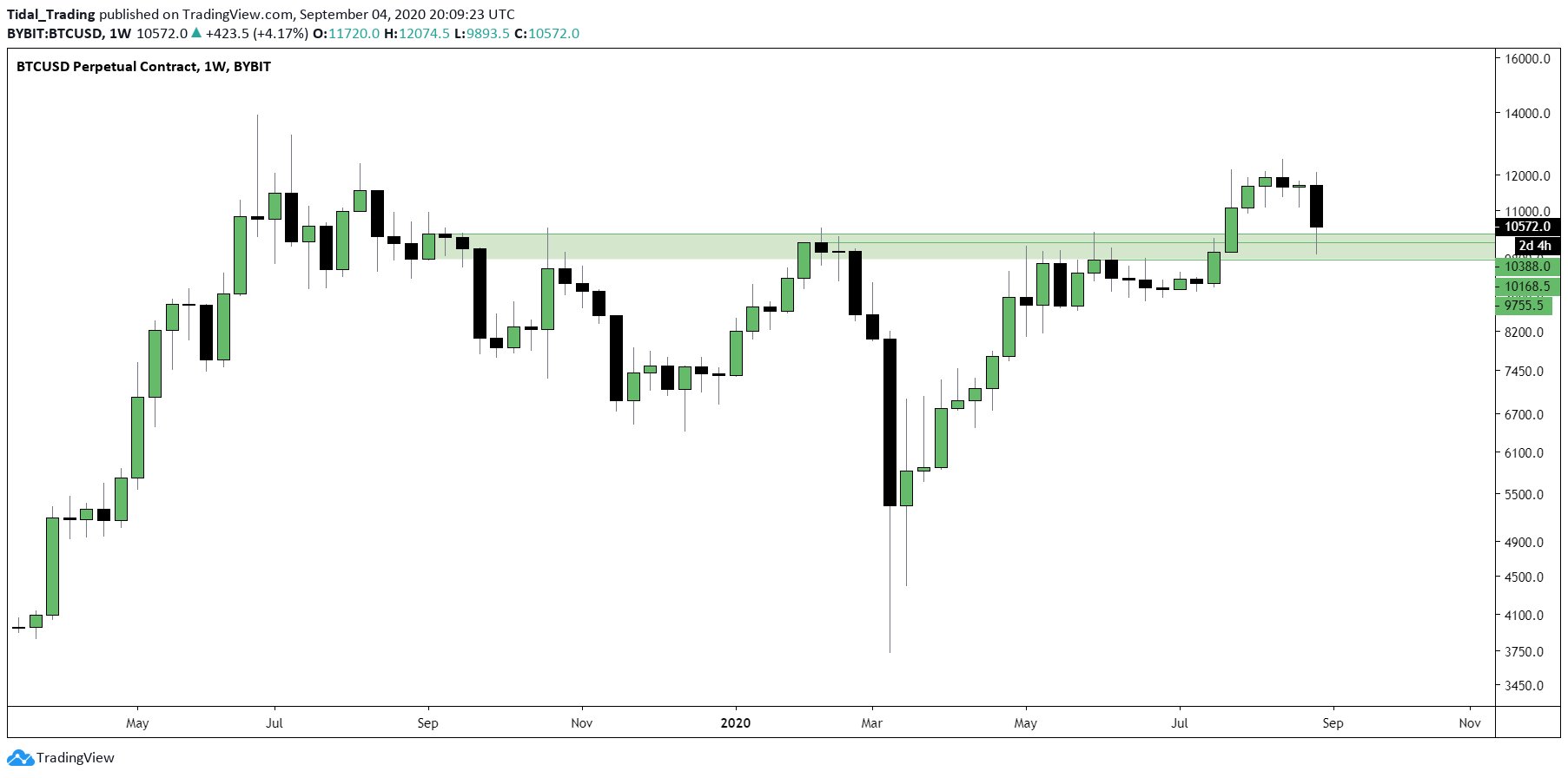

Analyst: BTC Could See a Strong Pullback Before Pushing HigherOne trader believes that Bitcoin may need to test its 200-day MA before breaking above its all-time highs.

This could mean that a dip as low as $13,000-15,000 could be imminent in the days and weeks ahead.

“BTC: Something to be aware of: In 2017, the 200dMA underpinned the entire trend. We haven’t retested it in a while – wouldn’t be surprised to see a 30-35% dip in late Dec/early Jan to retest it as support for the next leg higher to $21k+.”

Image Courtesy of Nik Patel. Source: BTCUSD on TradingView.The coming couple of days should provide insight into whether this pullback will occur or if BTC will continue its parabolic advance higher.

Featured image from Unsplash. Charts from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|