2024-8-27 15:01 |

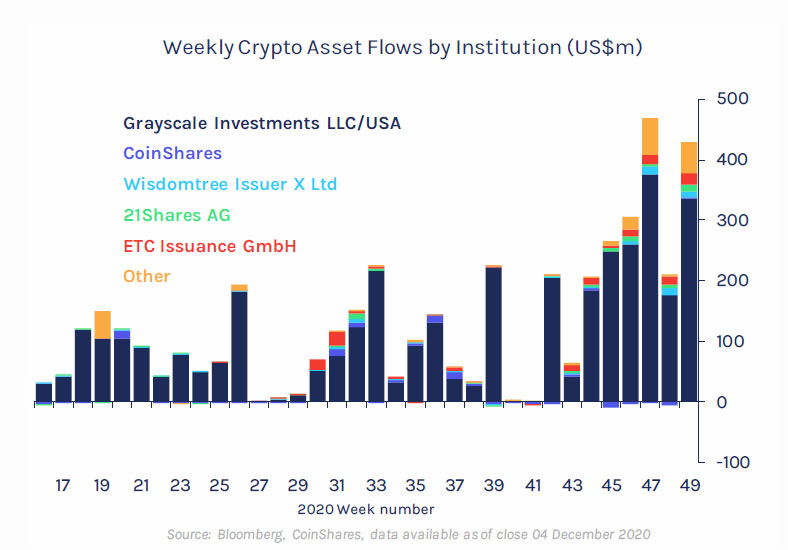

Digital asset investment products experienced a significant surge in inflows last week, totaling $533 million, the largest in five weeks, according to CoinShares.

This influx was largely driven by Bitcoin, which saw inflows of $543 million, while Ethereum faced outflows of $36 million.

According to CoinShares, digital asset investment products saw inflows totaling $533 million last week, the largest inflow in five weeks. The surge came after Powell's speech. Bitcoin saw inflows of $543 million. Ethereum saw outflows of $36 million.https://t.co/zWwgUiGZtI

— Wu Blockchain (@WuBlockchain) August 26, 2024

However, a closer look at Ethereum’s ecosystem reveals a fascinating trend. The percentage of ETH held on centralized exchanges has hit an all-time low, sparking concerns of a potential supply shock. In response, Ethereum whales have aggressively accumulated over 200,000 ETH in the past 96 hours, adding approximately $540 million to their holdings.

#Ethereum whales have accumulated over 200,000 $ETH in the last 96 hours, adding approximately $540 million to their holdings! pic.twitter.com/is9LqpQAS9

— Ali (@ali_charts) August 26, 2024

Ethereum Spot ETFs Saw Notable Net Outflow Of $44.54 Million Last WeekMeanwhile, Ethereum spot ETFs saw a net outflow of $44.54 million last week, with Grayscale’s ETHE experiencing a significant outflow of $118 million. In contrast, BlackRock’s ETHA and Fidelity’s FETH saw inflows of $26.77 million and $22.94 million, respectively. The total net asset value of Ethereum spot ETFs now stands at $7.652 billion.

Last week (August 19 to August 23, EST), Ethereum spot ETFs had a net outflow of $44.54 million. Grayscale ETF ETHE had an outflow of $118 million, BlackRock ETF ETHA had an inflow of $26.77 million, and Fidelity ETF FETH had an inflow of $22.94 million. The total net asset value…

— Wu Blockchain (@WuBlockchain) August 26, 2024

As Ethereum’s supply dynamics continue to shift, investors are closely watching the potential implications of a supply shock. Will this trend continue, and what does it mean for Ethereum’s future prospects? Only time will tell, but one thing is certain – Ethereum whales are making their move.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!Image Source: ximagination/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|