2021-9-28 15:20 |

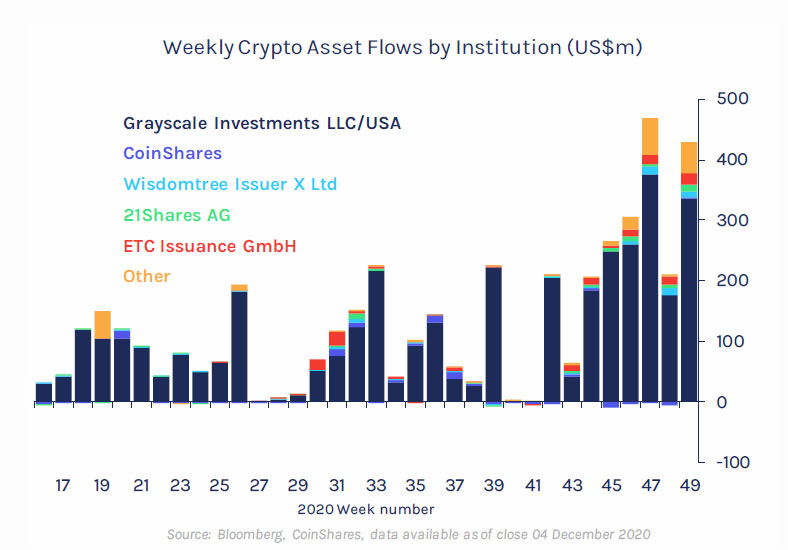

For the sixth consecutive week, cryptocurrency investment products and funds posted inflows as investors took the recent dip due to the China ban as a buying opportunity, said the digital asset manager CoinShares in its report on Monday.

$95 million of inflows were recorded into the sector for the week ending Sept 24, bringing the inflows over the last six weeks to $320 million. For 2021, inflows so far are $6 billion.

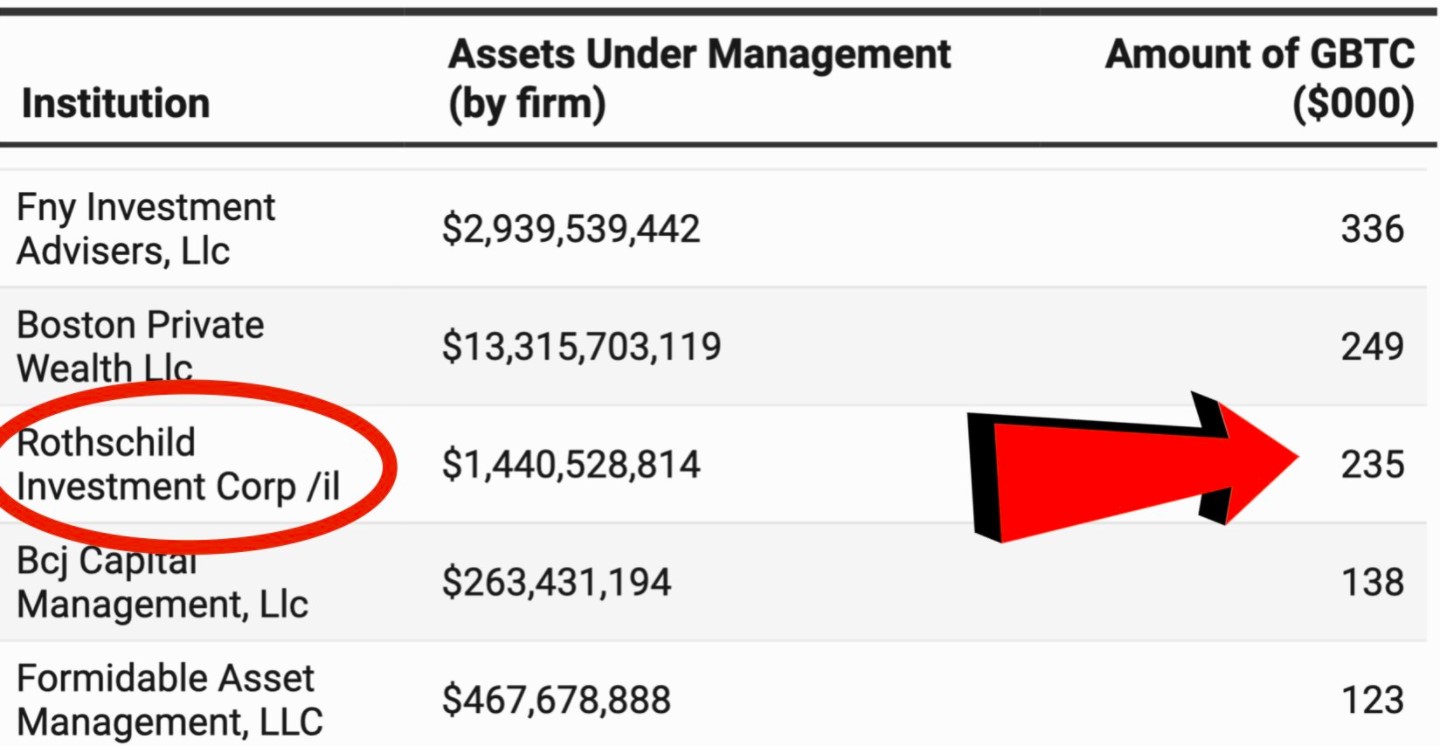

However, SkyBridge Capital founder Anthony Scaramucci says the vast majority of money managers remain hesitant about cryptocurrencies and blockchain technology. According to him, the new asset class is dominated by an estimated 10% of the financial-service community, which he called a “feeding frenzy” that reminded him of the 1990s dot-com boom.

“The establishments aren’t there,” Scaramucci said in an interview.

“Anyone who’s telling you there’s institutional adoption into this area isn’t being completely truthful — or they’re seeing one thing that I’m now not seeing.”

Both A Bearish And Bullish SignalMeanwhile, after bearing the brunt of negative investor sentiments for the last two quarters, Bitcoin has finally started seeing positive momentum. Last week, Bitcoin led the investments at $50.2 million — the fourth week of inflows out of the last 17. Bitcoin’s inflows so far, however, this year remain robust at $4.3 billion.

Last week, China’s crackdown sent the crypto market crashing yet again, which had the BTC price tumbling to $40,700. After shrugging off the news and recovering to $44,400 on Monday, bitcoin is trading around $42k as of writing.

“Once again, we're seeing some real resilience in bitcoin, which at one stage was pushing $40,000,” said Craig Erlam, senior market analyst at OANDA.

According to data provider Glassnode, the “relatively low utilization” of the bitcoin block-space – as seen in the number of transactions at 175k-200k per day, the same as the 2018 bear market, could be both a bearish and bullish signal.

Ether, SOL, and DOT Attracting InflowsAfter Bitcoin, Ether saw the second most inflows at $29 million as sentiments remain buoyant for the second-largest network as amounts staked to ETH 2.0 progresses, as per the report.

An estimated 6.6% of Ether is staked to ETH 2.0, and growth in staking is essential for investor sentiment as “investors see it as a potential environmentally alternative to other proof-of-stake digital assets.”

Besides Ether, Solana and Polkadot continue to see “outsized inflows” at $3.9 million and $2.4 million, representing 4.5% and 3.2% of AuM respectively.

SOL -8.88%

Solana / USD

SOLUSD

$ 133.46

-$11.85

-8.88%

Volume 2.53 b

Change -$11.85

Open $133.46

Circulating 297.42 m

Market Cap 39.69 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=SOL&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

1 h

Bitcoin’s Monthly Inflow Crosses $100 Million, Solana and Polkadot See “Outsized Inflows”

3 d

Solana-Based DAO Developer, Grape Network, Raises $1.2 Million in Funding

4 d

Wormhole Launches Solana-Ethereum Bridge to Move NFTs Cross-Chain

DOT -4.71%

Polkadot / USD

DOTUSD

$ 27.53

-$1.30

-4.71%

Volume 1.54 b

Change -$1.30

Open $27.53

Circulating 987.58 m

Market Cap 27.19 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=DOT&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

1 h

Bitcoin’s Monthly Inflow Crosses $100 Million, Solana and Polkadot See “Outsized Inflows”

1 d

South Korea’s Largest Crypto Exchange Operator Raises $85 Million at an $8.65 Billion Valuation

6 d

Deutsche Boerse Expand Crypto Offering to Include Polkadot (DOT), Solana (SOL), and Tron (TRX) ETNs

Due to the pressure on crypto prices following China's regulations news, assets under management at the two largest digital asset managers, Grayscale and CoinShares, dipped to $38.016 billion and $3.671 billion, respectively.

Bitcoin BTC $ 41,640.13 -0.78% -4.43% -2.42% baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); See Details Ethereum ETH $ 2,895.18 -0.43% -5.95% -3.70% baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=ETH&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); See Details The post Bitcoin’s Monthly Inflow Crosses 0 Million, Solana and Polkadot See “Outsized Inflows” first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

TOOKTOOK (TOOK) íà Currencies.ru

|

|